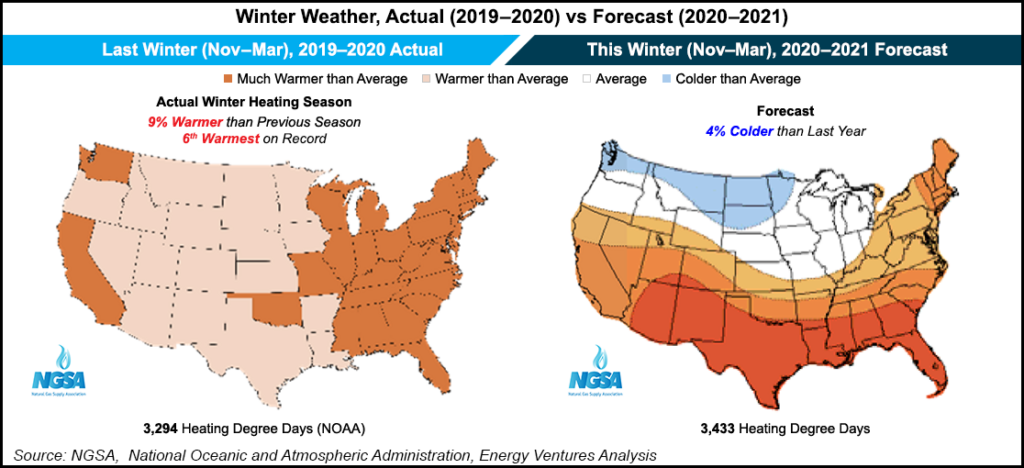

Shrinking production, growing exports and somewhat colder weather should see this winter’s natural gas prices trend upward compared with last winter, even as the Covid-19 pandemic threatens to hinder demand, according to new projections from the Natural Gas Supply Association (NGSA).

Total exports, both by way of liquefied natural gas (LNG) terminals and via pipeline to Mexico, should reach new highs this winter, growing to 14.8 Bcf/d in Winter 2020/21m compared with 13.6 Bcf/d in Winter 2019/20, the trade group said in its latest annual winter outlook, published Thursday.

Lower 48 production, meanwhile, is expected to fall to 86.0 Bcf/d on average this winter, down from 94.2 Bcf/d in the year-ago period, with the decrease driven by declines in associated gas production...