Williston Conference Speakers Mum on Price Predictions

While offering keynote remarks under the heading of “Uncertainty: Business as Usual,” ConocoPhillips’ Don Hrap, president for lower 48 states operations, reinforced an industry mantra that no one can offer concrete oil price predictions. However, he and the other speakers at this year’s Williston Basin Petroleum Conference (WBPC) on Wednesday generally offered bullish attitudes toward the Bakken’s future.

Hrap said he is very optimistic about the Bakken, adding that in this play and elsewhere the industry now is “stronger, smarter, better, and more efficient.” He reiterated other speakers’ contention that the “Bakken is a world class resource,” but he refused to get into the price prognostication game.

Like other speakers at WBPC, Hrap agreed that price cycles will continue for the oil/gas sector but responding from this crash should be smoother for surviving operators because their “ability to move forward is a lot better,” said Hrap, a Canadian who has experienced previous major price fluctuations.

“Business is easy at $100/bbl prices,” Hrap said. “It gets a lot harder at $30 or $40/bbl, but we should have learned that before.” He offered a lot of historical graphs emphasizing the extreme price fluctuations since early in the last century, noting the statistical average of oil prices since 1859 is about $35/bbl.

“That’s important to us because it points out you can’t count on $100/bbl oil,” Hrap said. “We’re moving to price recovery, but looking at the historical context, we know we can’t count on higher prices for long periods.”

With the technology advances and efficiencies that keep coming for the past 10 year, Hrap said that $60/bbl oil is the new $100/bbl price.

In a separate keynote address, Whiting Petroleum Corp. CEO Jim Volker said he was optimistic generally about the Bakken where his company is the major producer, but he was also bullish about prices based on Whiting’s recent experience hedging in the future markets for which the company is active for this year and next.

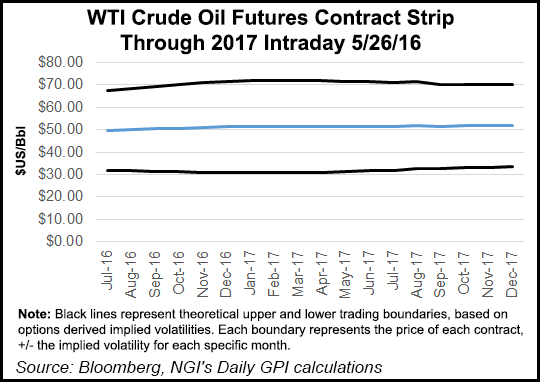

“We have a 22-bank coalition behind us with a $2.5 billion credit line, and right now we’re concentrating on reducing debt,” Volker said. “We’re about 50% hedged for this year and we’re going to hedge for 2017. Yesterday we did some hedging, and the futures market had a floor of $45/bbl for 2017 and a ceiling of $68/bbl on a three-way hedge. That means there are investors out there willing to bet that prices in 2017 will be higher than $68/bbl.

“This is quite a turnaround from where we were a few months ago.”

Another WBPC headline speaker, Neel Kashkari, president of the Federal Reserve Bank, Minneapolis, and a California Republican gubernatorial candidate two years ago who lost to incumbent Gov. Jerry Brown, was asked about where oil prices are going, and declined to make any predictions.

“We’re not very good at predicting where oil prices are going,” said Kashkari, while noting that the Fed has thousands of economists forecasting where the overall U.S. economy is going. “When you look at our forecast, we basically say where oil prices are today and the best we can do is project them out flat into the future.”

Kashkari was asked to elaborate on another speaker’s contention that a $1 move up and down in the value of the dollar globally has big impact on oil prices — $1 stronger can cause a $2/bbl oil price decline, and a $1 weakening of the dollar can mean a $4/bbl oil price increase? The Fed regional president was asked if he could explain this, and he could not.

“That is a really tough question, and the answer is we don’t know,” Kashkari said. “The economic profession knows a lot less than it pretends to know, and they like to pretend they know all these things and they don’t. We try to understand a lot of these correlations, but we don’t. We have to be more honest about what we know and what we don’t know, and operating in the uncertain [oil/gas] environment is really difficult for us.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |