LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Williams CEO Says U.S. LNG to Benefit from NS2 Suspension; Natural Gas Prices Move Higher

Europe’s dependence on U.S. natural gas is going to “grow even faster” if Nord Stream 2 (NS2) deliveries from Russia to Germany are delayed, Williams CEO Alan Armstrong said.

During a conference call Tuesday to discuss the natural gas pipeline giant’s fourth quarter and year-end results, Armstrong said the value of domestic supply will grow in light of the decision by Germany to delay NS2 certification.

President Biden and European allies also promised more sanctions against Russia regarding its incursion into Ukraine. As a part of the allied tranche approach, to divide and leverage the pressure on Russia, Biden said Wednesday the United States would levy sanctions on Nord Stream 2 AG, which operates and is majority owner of the pipeline. The company is a subsidiary of Gazprom PJSC.

The announcement of sanctions on NS2 was the closest Western allies have come to targeting energy industries in the response to Russian aggression. President Biden had emphasized on Tuesday that the administration meant to “shield” domestic consumers as much as possible.

The March New York Mercantile exchange natural gas futures contract, which expires on Thursday, settled at $4.623/MMBtu, up 12.5 cents on the day. April climbed 13.2 cents to $4.593. The West Texas Intermediate oil contract for April settled Wednesday at $92.10/bbl, up 19.0 cents.

‘Overwhelming Incentive’

“Through his actions, President Putin has provided the world with an overwhelming incentive to move away from Russian gas and to other forms of energy,” President Biden said.

During the Williams conference call, Armstrong said the value of U.S. liquefied natural gas (LNG) is expected to reap the benefit of suspending NS2.

“We are seeing the reality of energy economics come to light in the geopolitical factors,” he told analysts. “And again, it is really making it important here for North American natural gas and we are extremely well positioned to help around the globe through our infrastructure and our natural gas resources here in the U.S.

“Europe realized this winter how dependent it has become on intermittent power sources,” Armstrong said. “The lack of energy sources and the inadequate natural gas supplies that they had really showed up here recently.

“Europe’s dependency on imported LNG from the U.S. continues to grow and will grow even faster…if sanctions delay Nord Stream 2 deliveries.”

Euro Prices Rising

The delay in NS2 is further increasing the attractiveness of domestic exports despite lofty contract and spot prices for U.S. supplies abroad. Energy trading firm Energi Danmark said Wednesday that European gas prices rose sharply on the news of NS2’s suspension and could have ballooned higher under colder weather.

“As expected, gas prices rose sharply on the news, and had it not been for mild weather and an improving storage situation across Europe, the gains would have been even bigger,” Energi Danmark analysts wrote of Tuesday’s gains. “For how long the Nord Stream 2 project is put on hold is unclear, and this topic will remain on the gas market in the future.”

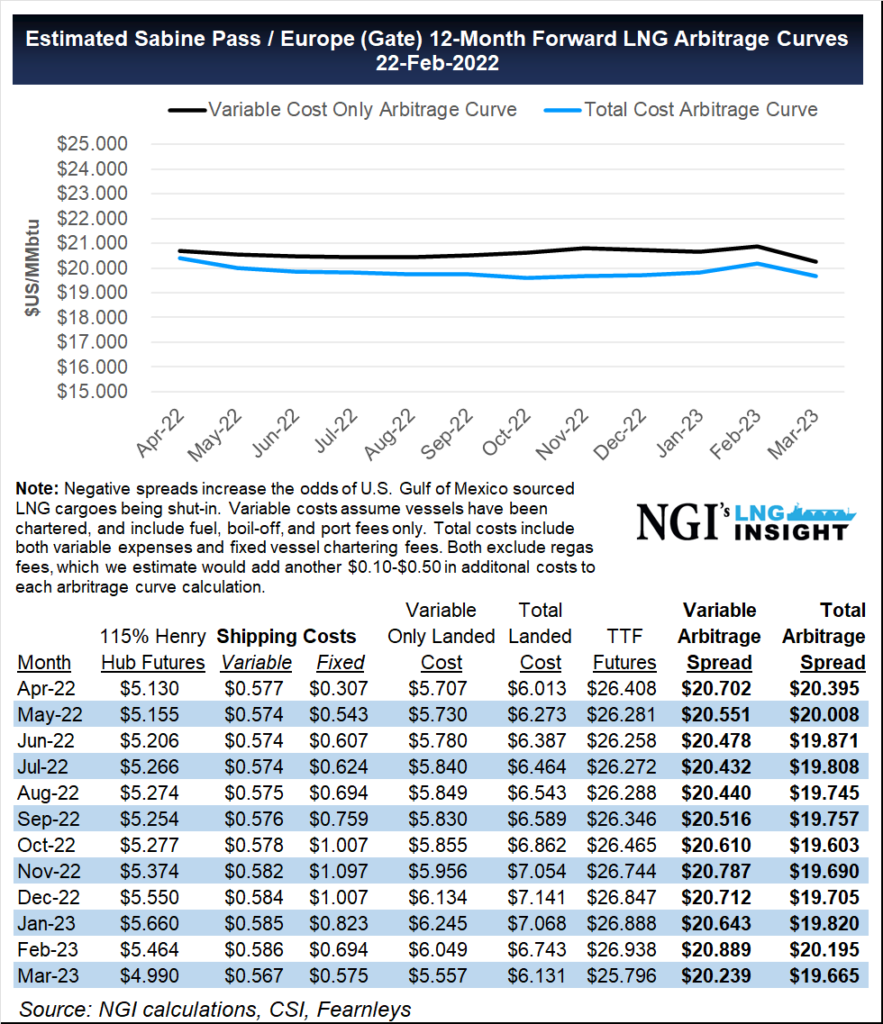

Prices in Europe climbed higher Wednesday across the curve. The prompt Dutch Title Transfer Facility contract finished near $30/MMBtu as the geopolitical tensions showed no signs of easing. Spot prices in Asia also ticked upward, while Brent crude was still trading near $100/bbl.

NGI’s Senior LNG Editor Jamison Cocklin on CGTN discussing the impacts of the Ukraine – Russia conflict with respect to LNG

LNG demand, in particular, is expected to soar in the coming years, Armstrong said. Europe has depended on Russian pipeline imports for about one-third of its gas imports in recent years.

Is Russian Gas In Demand?

The added reliance is because of an existing issue with Europe’s gas production. A continuous decline in Norway’s Groningen fields has led Europe to lean more on spot purchases of Russian gas to shore up capacity.

Once Russia began limiting spot deliveries in late 2021 from major entry points at Kondratki in Poland, Greifswald in Germany, and Velke Kapusany in Slovakia, the continent’s storage levels started an accelerated descent.

Pipeline receipts from Russia at its three main entry points averaged 10.7 Bcf/d in 2021, compared with 11.8 Bcf/d in 2020, according to the U.S. Energy Information Administration (EIA). Rising European hub prices spiked U.S. imports to 6.5 Bcf/d in January from 3.4 Bcf/d in November, EIA noted.

Demand for U.S. cargoes has remained high despite a mild winter. U.S. LNG feed gas volumes, boosted by European demand, have hovered around 13 Bcf most of February, or near record levels.

Weathering Suspension

Some energy analysts are predicting that Europe is in a position to weather the potential loss of NS2, at least in the short term. Wood Mackenzie on Wednesday predicted that Europe’s energy position has improved from earlier this winter.

From January through this month, imported LNG outnumbered Russian gas in the European system, putting storage levels with the five-year average again, according to Wood Mackenzie.

“Overall, the current supply and storage situation means Europe is in a better position both to navigate 2022 without Nord Stream 2 and to prepare for the next winter,” Wood Mackenzie principal analyst Kateryna Filippenko said. She stressed many beneficial factors are either coincidental or likely temporary.

High European prices have rerouted more LNG carriers to the continent, but it could have been a different story if Asia had begun the year with lower inventories or more extreme weather, Filippenko said.

Europe has mostly been winning in the tug-of-war over LNG cargoes during the start of the year, but Asian spot buyers recently started making large purchases. Market data firm Engie EnergyScan reported a 7.61% jump in the Japan Korea Marker, which helped swell European spot prices early Wednesday.

Wood Mackenzie predicted Europe could hit an 85% storage level by October, giving it a more comfortable stage for next winter than it had with its 74% storage level last October. However, without NS2 next winter, it could be tough for Euroope, according to the firm.

“If no additional gas is made available from Russia, Europe would be exposed to weather dynamics throughout next winter, similarly to this winter, with prices remaining high and volatile,” Filippenko said. “Only through increased flows from Russia the situation could ease – this is via existing spare capacity on transit routes through Ukraine and Poland – ensuring higher availability through winter 2023/24.”

Rystad Energy also weighed in on Europe’s outlook without NS2, noting the suspension “wipes out all hope” of balance returning to the gas market. Flows of Russian gas through NS2 were expected to make up 7% of the European gas market by the end of 2023, according to the firm. Rystad was more optimistic about immediate impacts to prices from the suspension, noting any spikes would likely be “limited.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |