Williams, building its natural gas portfolio to move more supply to the Gulf Coast and beyond, has snapped up NorTex Midstream Partners LP in a $423 million deal that expands Texas opportunities.

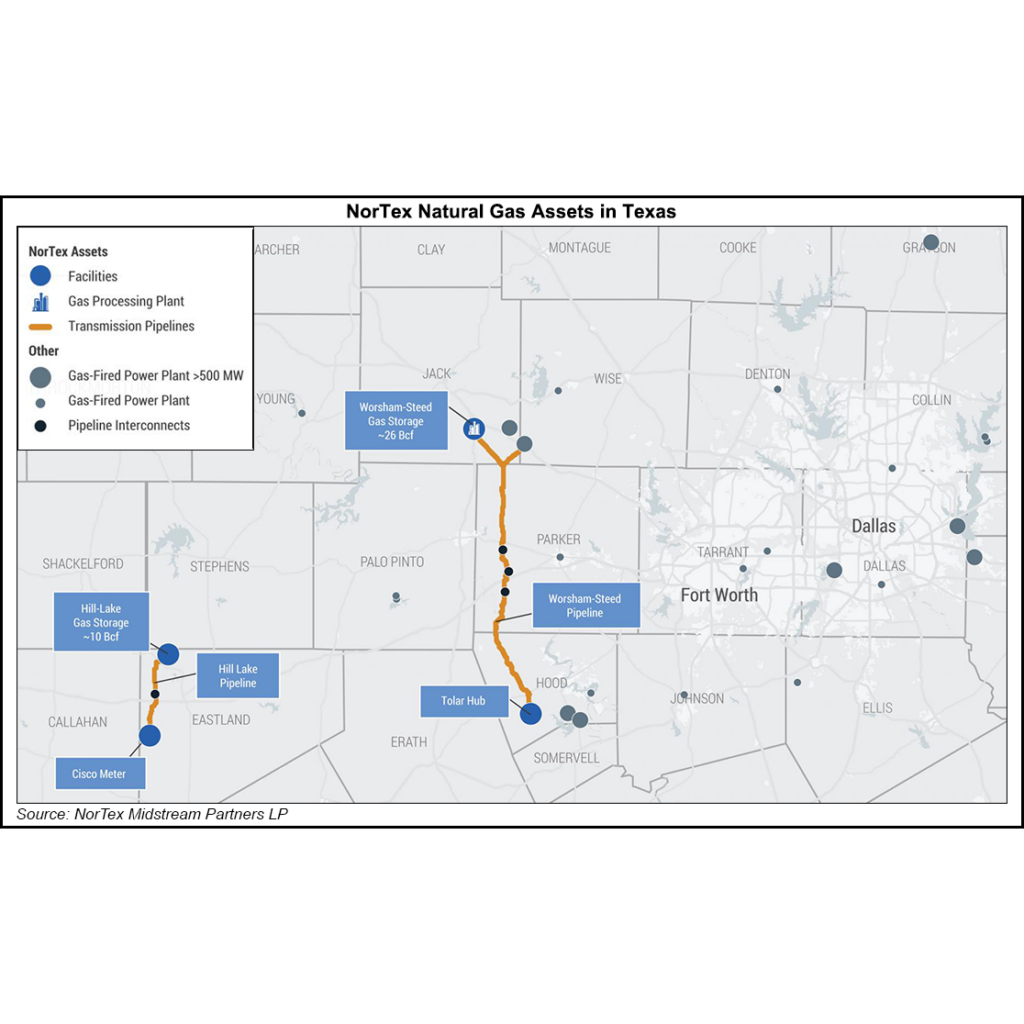

The NorTex purchase, from an affiliate of private equity firm Tailwater Capital, includes 80 miles of gas transportation pipelines, 36 Bcf of storage and the Tolar Hub, the largest in the Dallas-Fort Worth region. It also provides service to about 4 GW of gas-fired power generation for the area.

“Serving one of the fastest growing population centers in the United States, this irreplaceable natural gas infrastructure is critical to bridging the gap between limited supplies and periods of peak demand, while supporting the viability of intermittent renewables like solar and wind,” CEO...