NGI The Weekly Gas Market Report | E&P | M&A | NGI All News Access

Williams, Brazos Midstream Eye Permian Natural Gas, Oil Expansion

Tulsa-based pipeline giant Williams is teaming up with Permian Basin pure-play Brazos Midstream to expand their natural gas and crude oil footprint in West Texas.

Under terms of the joint venture (JV) announced late Thursday, Williams is contributing the muscle, including its existing Delaware sub-basin assets in exchange for a 15% minority position in the Brazos system. Brazos, which is providing most of the assets, would own an 85% stake in the JV and operate the systems.

Financial details were not disclosed.

“This transaction is another example of high-grading our portfolio by leveraging an existing asset into a larger integrated system with better growth, in a manner that improves our credit metrics over time,” Williams CEO Alan Armstrong said.

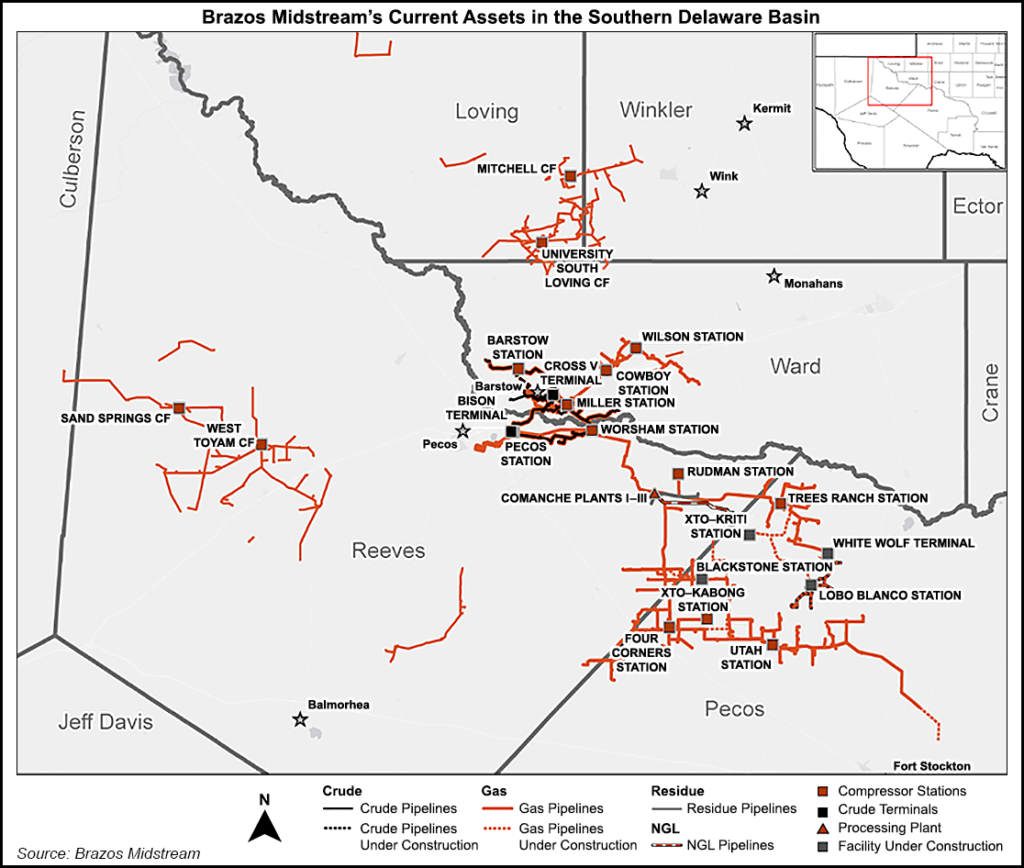

Brazos, which would operate the JV with an 85% stake, is contributing West Texas assets in Reeves, Ward and Pecos counties, which include 520 miles of natural gas and crude oil gathering pipelines, a gas processing complex with 260 MMcf/d of processing capacity in operation with an additional 200 MMcf/d of capacity under construction, and about 75,000 bbl of crude oil storage. It has long-term dedications from more than 400,000 acres.

When combined with Williams assets, Brazos would manage 725 miles of gas gathering pipelines, 460 MMcf/d of total processing, 75 miles of oil gathering pipelines and 75,000 bbl of oil storage in the West Texas counties of Reeves, Loving, Ward, Winkler, Pecos and Culberson.

Brazos’ 200 MMcf/d Comanche III gas processing plant, is scheduled to be fully operational in early 2019.

In total, the JV would be supported by 500,000-plus acres of long-term dedications now being developed by oil and gas producers.

Williams and Brazos also agreed to jointly develop gas residue solutions to benefit Delaware operators.

“This joint venture increases our scale in the Delaware Basin, including a much larger footprint, new processing capabilities, and greater exposure to an impressive customer base,” said Williams Senior Vice President Chad Zamarin, who runs corporate strategic development. The Brazos assets “are an excellent match for the gathering systems and additional capabilities that Williams is contributing as part of this transaction.

“With the residue gas position that we will establish together with Brazos, we unlock additional opportunities for value, as growing Permian natural gas supply increasingly needs access to high-value demand markets, including premium Gulf Coast markets” served by Williams’ Transcontinental Gas Pipe Line, i.e. Transco, the nation’s largest gas system by volume.

Brazos CEO Brad Iles noted how quickly demand for Permian production services has grown. Earlier this year the Fort Worth, TX-based operator gained Morgan Stanley Infrastructure Partners as a sponsor to help with expansion plans.

“We are excited to form this joint venture with Williams and greatly appreciate the confidence they have in Brazos to entrust us with operatorship of their assets and stewardship of their customers,” Iles said. The partnership “will greatly enhance both companies’ efforts to develop top-tier assets in the Permian Basin.”

The plan to consider gas residue solutions potentially could revitalize Williams’ previously proposed Bluebonnet Market Express pipeline, analysts with Tudor, Pickering, Holt & Co. said Friday.

Bluebonnet, a potential 2 Bcf/d project, as designed would source Permian natural gas for delivery to Transco Zone 2 in Katy, near Houston, with southbound connectivity to the South Texas hub at Agua Dulce or northbound to the Gulf Coast, analysts said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |