NGI The Weekly Gas Market Report | Coronavirus | Markets | NGI All News Access

Williams Adopts Poison Pill to Fend off Speculators Amid Market Volatility

Tulsa-based Williams, one of the United States’ largest natural gas pipeline operators, has adopted a limited duration stockholder rights agreement, known commonly as a poison pill, in order to protect shareholders from the speculative acquisition of company shares for a bargain amid current market volatility.

“In light of the company’s strong position, the board wants to support the rights of shareholders and protect a fair value for their investment,” chairman Steve Bergstrom said Friday.

He added, “We are witnessing a unique dislocation in equity market valuations, with particular impact to Williams’ equity value. We do not believe the best interests of shareholders are served by allowing those seeking only short-term gains to take advantage of current market conditions at the expense of the company and its long-term investors.”

The board approved a dividend of one right for each common stock, effective March 30, and expiring on March 20, 2021.

The rights become exercisable if a person or group acquires beneficial ownership of 5% or more of Williams common stock in a transaction not approved by the Williams board.

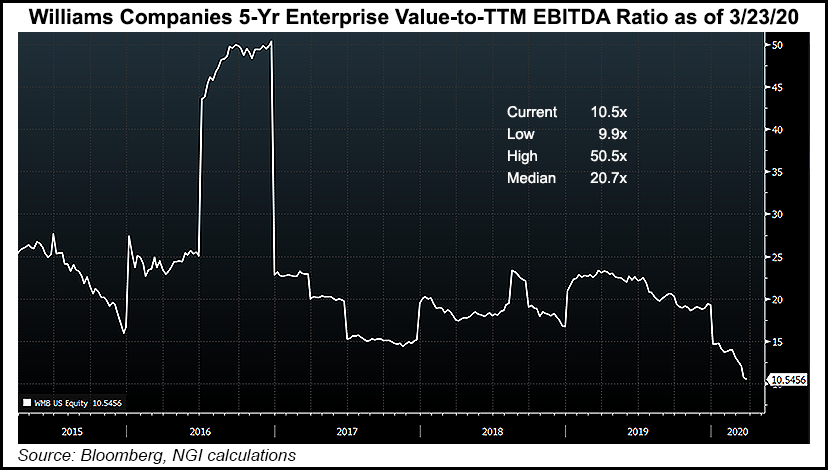

After falling to below $9 last Thursday as markets reacted to the evolving coronavirus pandemic, Williams shares were trading at $10.50 as of 10 a.m. ET Monday.

In the company’s Feb. 20 earnings call, management said that Williams, owner of the Transcontinental Gas Pipe Line (Transco) system, expected natural gas-directed drilling to remain the “bedrock” of domestic gas production despite dismal prices of late for the commodity, and that it remained confident in its core business of natural gas gathering and transportation services.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |