Bakken Shale independents Whiting Petroleum Corp. and Oasis Petroleum Inc. have agreed to join forces in a “merger of equals” transaction, the companies said Monday.

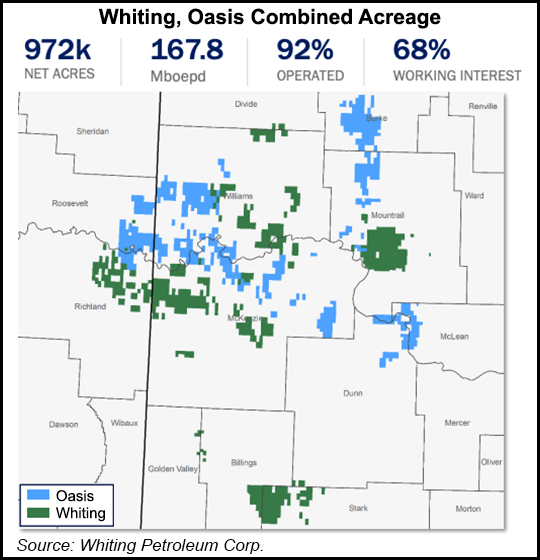

“The combined company will have a premier Williston Basin position with top tier assets across approximately 972,000 net acres, combined production of 167,800 boe/d, significant scale and enhanced free cash flow generation to return capital to shareholders,” the companies said.

Whiting CEO Lynn Peterson will serve as executive chair of the new company’s board, while Oasis CEO Danny Brown will be its CEO.

“The combination will bring together two excellent operators with complementary and high-quality assets to create a leader in the Williston Basin, poised for significant and resilient cash flow...