E&P | NGI All News Access | NGI The Weekly Gas Market Report

Whiting Focused on Williston, Possibly Monetizing DJ Assets

Denver-based Whiting Petroleum Corp. said it plans to deploy a fifth drilling rig in the Williston Basin and is moving forward with a possible sale of some assets in the Denver-Julesburg (DJ) Basin in Colorado.

During an earnings call Tuesday to discuss 1Q2018, CEO Brad Holly said Whiting had undertaken a “very robust process” as it explores monetizing assets from its Redtail development program, which targets the A, B and C intervals of the Niobrara formation and the Codell/Fort Hays formations.

Although bids were originally due this week, Holly said that “due to interest and activity, we delayed that slightly. But bids are due next week, and we expect to complete the process late in the second quarter or early in the third quarter.”

When asked what Whiting would do with any proceeds from a Redtail sale, Holly said the company “will likely do a combination of both paying down debt and potentially reinvesting for growth. We’re not ruling out…potentially looking at buying back shares if that makes the most sense.”

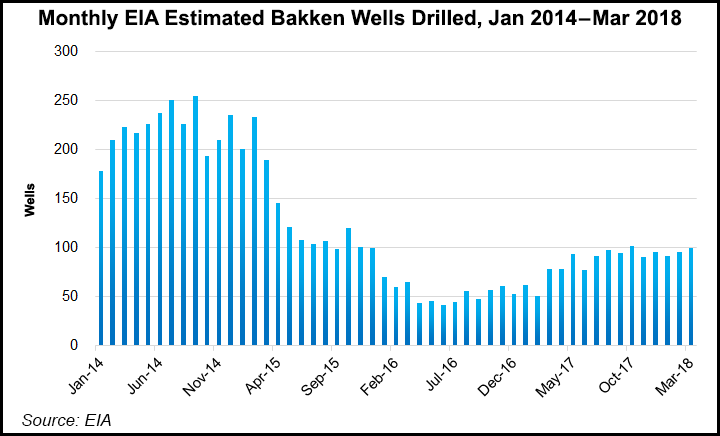

A sale would also increase the company’s focus on the Williston and the Bakken Shale.

“We really like the basin,” Holly said of possible bolt-on opportunities in the Williston. “We think there’s more to do out there. We think we have substantial opportunities in all of our areas,” and could “potentially increase the geographic footprint” to economically drill in the Bakken.

Whiting executives said it was unlikely any of its nonoperated acreage in the Bakken would be sold, in part because the company is “enjoying the additional insight” from other operators working in the area, especially with regard to drilling and completions. Whiting holds 409,593 net acres in the Williston.

Production averaged 127,050 boe/d in 1Q2018, up 8.3% from 1Q2017 (117,360 boe/d) and above the midpoint of guidance for the quarter (11.1-11.6 million boe). Broken down by play, production averaged 103,115 boe/d in the Bakken and 23,300 boe/d in the DJ Basin.

Using a capital budget of $750 million in 2018, Whiting plans to drill 120 Bakken/Three Forks wells this year. It also plans to place 145 wells into production in 2018: 123 in the Williston and 22 in the Redtail area. Some $600 million, or 80%, of the capital budget is to be devoted to the Williston.

Whiting was planning to add a fifth drilling rig to its Williston drilling program at the end of April, according to an investor presentation. It is currently running up to four completion crews in the Williston.

Whiting reported net income of $15 million (16 cents/share) in 1Q2018, compared with a net loss of $87 million (minus 96 cents) in the year-ago quarter. Operating revenues from the sale of crude oil, natural gas and natural gas liquids totaled $515.1 million in 1Q2018, compared with $371.3 million in 1Q2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |