NGI The Weekly Gas Market Report | E&P | Infrastructure | Markets | NGI All News Access

West Coast Natural Gas Hubs Seeing Winter Basis Rise from the Ashes of Oil’s Fall

A number of western U.S. demand hubs have experienced notable basis uplift over the past month as the collapse in oil prices has decimated drilling activity and scrambled the Lower 48 supply outlook for the 2020/21 winter, NGI pricing data show.

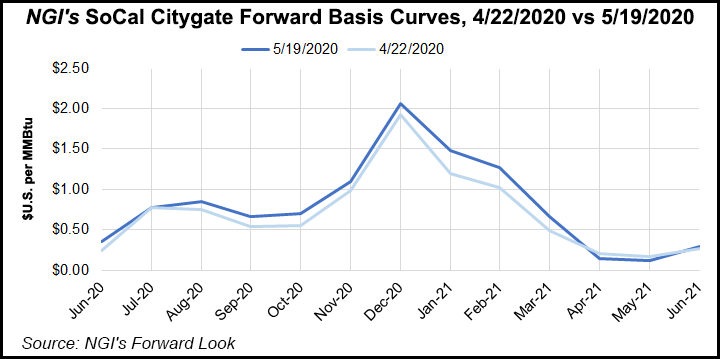

According to NGI’s Forward Look, from April 22 to May 19, basis pricing at West Coast locations like Northwest Sumas, Malin and SoCal Citygate has risen across the winter strip, including gains of around 25-30 cents or more for the January 2021 contract. Farther upstream, CIG (aka Colorado Interstate Gas) prices have also strengthened amid the shifting supply outlook, with January basis gaining around 15 cents over the same time frame.

[Plan for natural gas pricing 10 years out with NGI’s Forward Look data.]

The past month has seen U.S. onshore activity continue to collapse under the weight of unprecedented market conditions brought on by the coronavirus pandemic.

As of this past Friday, the U.S. rig count dropped to 318, down from slightly under 800 in early March. According to the Energy Information Administration (EIA), the recent declines have put the Baker Hughes Co. rig tally at its lowest level since the company began publishing rig count data back in 1987.

Most of the drilling declines have occurred in “oil-focused geologic plays, but natural gas-focused plays also saw significant decreases,” EIA analysts led by Nicholas Skarzynski said.

The extreme bearishness for the oil patch has brought some bullishness back to the natural gas price outlook, with the chronically glutted gas market now set to lose a significant source of supply as exploration and production (E&P) crude shut-ins curtail associated gas output.

According to recent forecasting from Genscape Inc., natural gas production out of the Permian, Rockies and Bakken regions is on track to fall 8% year/year for the upcoming winter season.

“Of these areas, we’re expecting to see the largest relative declines in the Rockies and the smallest relative declines in the Permian,” Genscape analyst Joe Bernardi told NGI.

However, in the current uncertain environment there are a lot of moving parts that could quickly shift the outlook.

“This forecast is very dynamic at the moment: the large shut-in volumes, frac holiday,” strategies surrounding drilled but uncompleted (DUC) wells “and uncertain oil macro outlook are all making producer behavior (which we are tracking) a much larger factor than normal,” Bernardi said.

The prospect of less associated gas production flowing out of these regions is “a logical driver” of the recent strengthening in winter basis at western U.S. hubs, according to the analyst.

“Interestingly, Pacific region storage inventories generally are trending in line with or above recent year averages for this time of year, but winter basis futures are running about as high as or higher than in previous years,” Bernardi said.

“It’s still early in the summer, and there’s a long time for things to play out under unprecedented market conditions, but production decreases are likely contributing to West basis futures running as high as they are given the way storage looks right now.”

After Covid-19 demand shocks helped to briefly drop crude oil futures into the negatives, West Texas Intermediate prices managed to claw their way back above the $30/bbl mark last week.

The Organization of the Petroleum of Exporting Countries, along with its allies, could prove to be a “victim of its own success” in efforts to curtail production, according to analysts at EBW Analytics Group.

“Several U.S. shale E&Ps have discussed resuming drilling with the WTI forward curve above $30/bbl,” they said in a recent note to clients. “It would not be surprising to see some Lower 48 producers restart shut-in wells to boost cash flow. Eventually, completion of DUCs and even modest drilling may take hold.

“That could slow the rate of decline of Lower 48 production and is likely to extend the length of the market rebalancing period — weakening physical support for futures prices.”

Shut-ins have helped to “temper concerns” that crude supply would overwhelm available storage capacity, and demand has shown signs of recovering in key markets, including the United States, China and India, the EBW analysts said.

“The demand recovery is likely to accelerate in the coming weeks as countries all over the world cautiously ratchet back their public health restrictions and unveil stimulus measures to strengthen their flagging economies,” they said.

Nonetheless, the recent rally is “likely overdone,” and a “downward retracement” could be in store for the crude market over the next several weeks, according to EBW.

“At a macro level, the world will be dealing with prolonged demand headwinds due to the unfolding Covid-related recession,” the EBW analysts said. “Recent rebound notwithstanding, crude and refined product demand remains well below year-ago and seasonal normal levels. Crack spreads are still remarkably thin or negative in some cases, limiting incentives for incremental crude throughputs.”

This comes as “the demand recovery is also very fragile. A secondary outbreak could force policymakers to rapidly reinstitute robust pandemic control measures, culling fuel demand again and sending prices through the floor again.”

Meanwhile, the drop-off in Bakken crude activity could be “creating an opening for long-suffering Canadian gas exports,” according to RBN Energy LLC analyst Martin King.

Major producers in the Bakken “have reacted swiftly” to the dramatic decline in oil prices by stopping operations and shutting in their wells, a trend reflected in the rig data, King wrote in a recent blog post. This has had a knock-on effect on associated gas supplies flowing out of the region.

“Flow data for the three interstate gas pipelines in the Bakken — Northern Border Pipeline (NBPL), WBI Energy Transmission and Alliance Pipeline — are showing that natural gas supplies have dropped considerably in the past 50 days,” King said. “The most pronounced drop can be seen for flows into WBI, with its receipts down in the range of 0.4 Bcf/d since late March, a time when oil well shut-ins and oil production declines began to accelerate in response to the oil price collapse.

“Other gas receipt declines, though not as obvious, have also been seen for NBPL and Alliance. The fall in receipts really began to accelerate from the middle of April to early May, with the combined drop being just over 0.8 Bcf/d, or more than one-third of all Bakken gas production receipts compared to the peak in early March.”

Western Canadian gas supplies have replaced some of the lost Bakken molecules, with imports on NBPL increasing from 0.4 Bcf/d at the start of April to average about 0.7 Bcf/d through the first half of May, according to King.

This has offset “some, but not all, of the decline in NBPL’s Bakken gas receipts,” the analyst said. “Why Canadian imports have not increased more to fully offset the decline in NBPL’s Bakken receipts is still not completely clear.

“However, the price spread between the Alberta gas price benchmark of AECO and the Chicago Citygate has tightened since late last year, suggesting the economics of moving larger quantities of gas from Canada has not improved enough to prompt an increase in export volumes.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |