NGI Weekly Gas Price Index | Markets | NGI All News Access

Weekly Spot Gas Prices Rise on Strong Power Burns, Brush Off Bearish EIA Data

Temperatures across the United States may be pleasant, but that hasn’t stopped power burns from coming in strong and boosting NGI’s Weekly Spot Gas National Avg. up by 4.5 cents to $1.660 for the May 25-28 period.

The June Nymex gas futures contract expired 7.1 cents lower at $1.722 on Wednesday. On Thursday, the July Nymex contract fell another 5.9 cents to $1.827/MMBtu but then some late buying during Friday’s session pushed the prompt month back up to $1.849.

Although most cash market points across the Lower 48 picked up less than a dime week/week, West Coast markets posted notably larger gains as temperatures in the region rose to near-record levels. The heat was seen persisting through Friday, with daily records expected in California, the Great Basin and the Southwest as temperatures exceed 100 degrees in many cities, according to the National Weather Service (NWS).

“The West Coast should start to cool down by Saturday as a potent upper-level low approaches, but hot temperatures will remain over interior parts of the West,” NWS said.

SoCal Citygate spot gas averaged $2.265 for the May 26-28 period, up 45.0 cents week/week. That massive gain dwarfed those seen farther north in California, where PG&E Citygate bumped up only 4.5 cents on the week to $2.580.

Over in the Desert Southwest, El Paso S. Mainline/N. Baja cash picked up 16.0 cents week/week to average $1.795, while markets over in the Rockies were up around a nickel or so.

The modest increases spilled over into the producing regions, where Permian Basin prices climbed less than 5.0 cents on average and Midcontinent prices were up by an even smaller amount.

Over on the East Coast, double-digit gains were the norm as the cheap gas price environment incentivized power burns. Tenn Zone 6 200L spot gas prices averaged 10.0 cents higher week/week at $1.615. Transco Zone 6 NY, meanwhile, edged up only 3.5 cents on the week to $1.435.

News was in abundance in a week shortened by the Memorial Day holiday on Monday, but against a backdrop of conflicting factors, flagging liquefied natural gas (LNG) demand proved to be too much for Nymex futures to overcome.

June futures returned from the holiday weekend with some optimism on increasing demand as more economies reopened amid the coronavirus pandemic and as weather models pointed to summer heat. The June Nymex gas futures contract climbed 6.2 cents to settle at $1.793 on Tuesday.

But prices reversed course the following day and fell further Thursday, despite power burns coming in stronger than expected as pandemic restrictions eased. Gas prices on Wednesday fell along with oil prices as U.S./China tensions intensified amid renewed apprehension about Russia’s commitment to production cuts. Usual volatility ahead of contract expiration likely also factored into the gas price midweek decline.

Expectations for the Energy Information Administration (EIA) to report another large injection in the next storage inventory report weighed on the market as well — and those expectations proved correct.

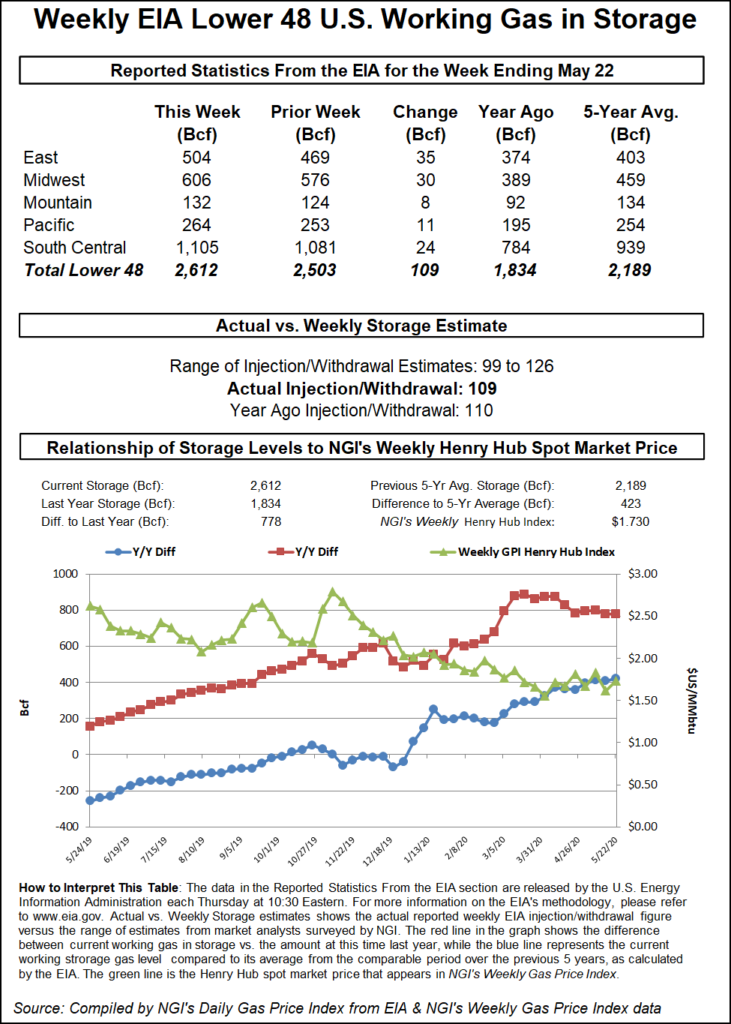

The EIA on Thursday reported an injection of 109 Bcf in natural gas storage inventories for the week ending May 22, coming in slightly ahead of market estimates. A Bloomberg survey conducted before the report had injection forecasts ranging from 99 Bcf to 126 Bcf, with a median of 104 Bcf. The average of a Reuters poll was 106 Bcf. NGI projected 110 Bcf.

The latest injection maintained inventories at far above-average levels, raising concerns among market observers that supply is higher than demand from the critical commercial and industrial sectors, where energy use is recovering only gradually.

“Excluding weather-related demand,” the latest report “implies that market demand was flat versus the same week last year and has averaged 0.3 Bcf/d looser over the past four weeks,” Raymond James analysts said.

Additionally, falling European gas prices fomented concern about U.S. LNG exports, which have become an increasingly important source of U.S. natural gas demand.

RBN Energy LLC said a hoped-for second wave of U.S. LNG export hangs in limbo. RBN analyst Sheetal Nasta said momentum started to stall in the latter half of 2019 as global gas oversupply mounted further, largely reflecting project completions and export increases from the United States and Australia.

“Any remaining optimism has since been squashed by the Covid crisis, which crushed global demand after lockdowns began in February 2020, and the oil price collapse, which has made oil-indexed LNG prices overseas much more competitive against U.S. LNG, almost all of which is priced off the Henry Hub gas benchmark price,” Nasta said.

Ultimately, summer heat remains a bit out of reach to move the needle much. Overall, NatGasWeather said it views weather forecasts through the first week of June as unfavorable for gas demand.

“Upper high pressure will strengthen over the central United States, Texas, the South and Southeast as next week progresses with very warm highs of upper 80s to lower 90s,” NatGasWeather said. “However, the northern and eastern U.S. will be quite comfortable to counter with highs of 70s to 80s, including the important” areas from Chicago to New York City.

“The pattern is close to hot enough June 4-12, but might need a little hotter trends to be considered bullish.”

Cash markets across the Lower 48, which traded Thursday for delivery through Sunday (May 31), declined as most areas were expected to see a continuation of mild weather in the coming days. The only exception to the pleasant weather outlook was in the West, where forecasters are calling for hot high pressure to continue across California and the Southwest, lifting daytime temperatures to near-record highs in the 90s and 100s.

Even with the extreme early season heat, prices across California and the Southwest fell Thursday. The most significant declines were seen in the Southwest, while prices in the Rockies fell between 5.0 cents and 10.0 cents, averaging in the $1.50s range.

The decreases spilled over into producing regions farther upstream, with prices in both the Permian Basin and Midcontinent coming off about 10.0 cents.

Most other markets across the country were down anywhere from a few pennies to around a dime, though some slightly steeper declines were seen on the East Coast.

Cash prices continued to decline on Friday as well, even as a sharp surge of cool air was set to push out the recent unseasonable heat in the Northeast, according to Genscape. The firm’s meteorologists were predicting the cold spell to bring a boost in demand between Sunday and Wednesday, though milder temperatures are expected toward the end of next week.

The most notable spot gas decreases were in New England, where Iroquois Zone 2 gas for Monday’s delivery plunged 27.0 cents to $1.300. Farther upstream, the biggest mover in Appalachia was Tenn Zone 4 200L, which tumbled 15.5 cents to average $1.350 for Monday’s gas day.

In fact, steep, double-digit losses even extended into California, where SoCal Citygate plummeted 41.0 cents to $1.805 for Monday’s gas delivery despite the scorching weather and a maintenance event getting underway on Southern California Gas that is expected to disrupt about 150 MMcf/d of flowing supply at the California-Arizona border.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |