NGI Weekly Gas Price Index | Markets | NGI All News Access

Weekly Prices Mixed as Major Pipeline Work Impacts Some Markets Despite Light Demand

With daytime temperatures reaching the 60s to 80s across key demand regions during the April 20-24 week, prices moved lower throughout much of the country. There were some stark exceptions, however, as stout gains on the West Coast that spilled over into West Texas led to a modest bump for the NGI Spot Gas Weekly Avg., which rose 2 cents to $2.055.

Pipeline maintenance on Gas Transmission Northwest (GTN) began severely limiting cross-border gas flows into the Pacific Northwest, driving up weekly prices at Northwest S. of Green River nearly $1 to $1.70. Several other pricing hubs in the region posted dramatic increases of more than 50 cents.

GTN’s previously announced 18-day maintenance was upgraded to a force majeure event, restricting 513 MMcf/d of flows compared to pre-maintenance 30-day flows, according to Genscape Inc.

“The pipeline anticipates that this work will further affect primary firm volumes through Kingsgate,” Genscape natural gas analyst Matthew McDowell said.

It is unclear as to whether incremental operational capacity at Kingsgate will be restored as the work is completed, or if these further constraints will last for the duration of the maintenance, which is scheduled to end May 10, according to Genscape.

With neighboring markets on the West Coast having to compete with the Rockies to attract molecules, Malin climbed more than 20 cents to $1.83.

Permian Basin prices also benefited from the cut to Canadian imports. Waha rose 27.5 cents to 55 cents.

Meanwhile, NOVA/AECO C in Western Canada plunged nearly 85 cents to just C50.5 cents/GJ due to the stranded supplies.

The slew of other pipeline maintenance events going on across the country appeared to have little impact on other markets. Appalachia prices were down more than 10 cents at most pricing hubs, as were Northeast prices.

Smaller losses of less than a dime were seen throughout the Southeast and Louisiana, while the Midwest posted decreases of about 15 cents or so despite an approaching snowstorm.

In the futures market, swings in projected demand and production cuts put prices on a wild ride during the April 20-24 week. Even with storage inventories quickly improving to a year/year surplus, the May Nymex gas futures contract rolled off the board at $2.566, after sinking as low as $2.455 earlier in the week. June settled Friday at $2.58, up from a $2.499 low.

Much of the overall gains occurred late in the week, with the May contract surging some 10-plus cents between Wednesday and Friday. The increase was largely due to colder trends in weather models that had actually shown up in forecasts right after the Easter holiday, but didn’t have much sway with traders until Thursday.

Another small upward revision to weather demand was seen early Friday, as models showed slightly higher heating degree day (HDD) levels in the upcoming week due to the colder push into the northern United States, according to Bespoke Weather Services. The firm also noted the late-season snowstorm that was forecast to hit the Upper Midwest this weekend. Next week also has some noteworthy heat in parts of the South, with numerous highs set to reach the upper 80s to low 90s in the Southeast.

“Highs reaching that level would be close to records for this time of the year in many locations,” Bespoke chief meteorologist Brian Lovern said.

The midday Global Forecast System wasn’t quite as cool across the northern United States compared to Thursday night’s run, losing around 7 heating degree days, but was still solidly cooler overall compared to what it showed to start of the week, according to NatGasWeather. The firm maintained its bearish weather sentiment, “although just not as bearish as once advertised due to cooler trends across the northern United States.”

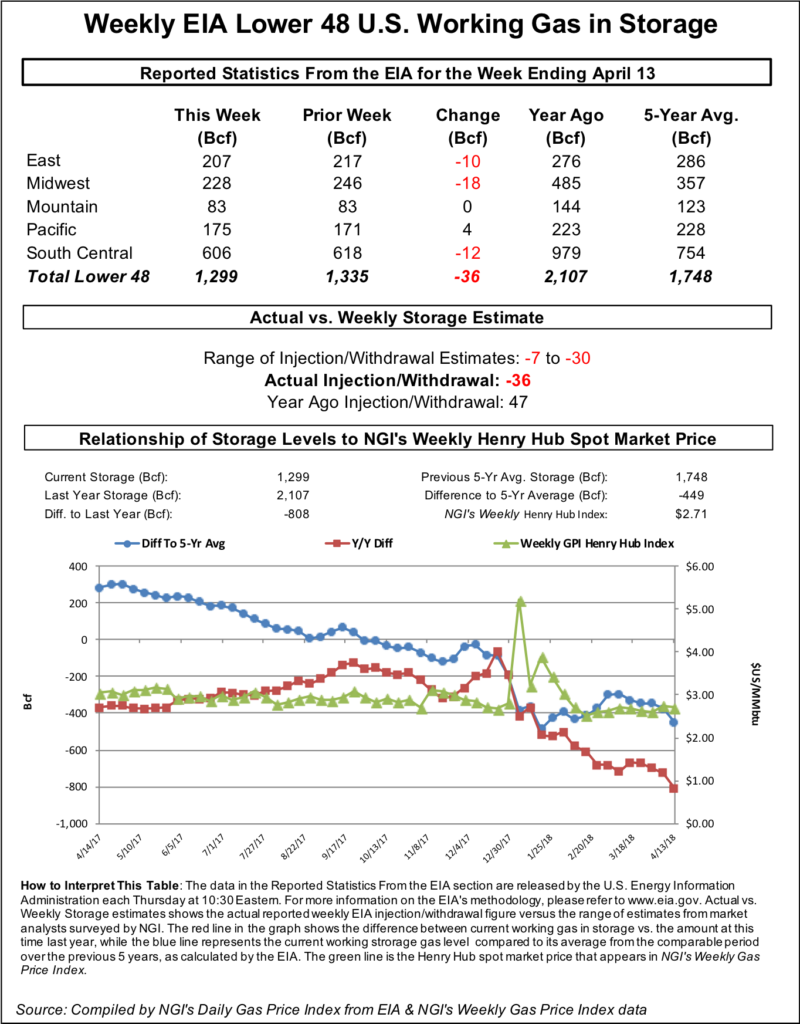

Nevertheless, the generally comfortable weather pattern was seen further improving the storage picture in the coming weeks. The Energy Information Administration (EIA) reported a 92 Bcf injection into storage inventories for the week ending April 19, lifting stocks to a 55 Bcf surplus over year-ago levels and trimming the deficit to the five-year average to 369 Bcf.

Next week’s storage report is expected to reflect a build near 120 Bcf, which would improve deficits by around 50 Bcf to 319 Bcf. The following week’s EIA data, however, is where earlier injection estimates of around 125 Bcf were now seen closer to 80 Bcf given this week’s demand additions to forecasts.

Meanwhile, production data continues to suggest robust growth ahead, despite some temporary cuts to output during the spring maintenance season, according to Raymond James & Associates. Lower 48 production in January averaged 98.12 Bcf/d, down 0.16 Bcf/d sequentially. However, total production was up 12.67 Bcf/d year/year.

The firm modeled a modest slowdown in Lower 48 wet gas production as operators pursuing slower growth in 2019 threatens associated gas production. Dry gas production is expected to average 87.91 Bcf/d in 1Q2019, which is 1.56 Bcf/d higher than 4Q2018.

“Our outlook for gas has trended bearish,” Raymond James analysts said. “Fundamentally speaking, our natural gas outlook is modestly supported by our expectations for strong natural gas demand and export trends.”

Although project delays are affecting some near-term gas demand from liquefied natural gas (LNG) and Mexican exports, “the fact remains that U.S. gas demand growth is very stout from coal-to-gas switching, petrochemical expansions, LNG exports and Mexican exports,” analysts said.

Regardless, the upcoming gas supply surge, particularly from associated gas production, should more than offset robust demand growth, Raymond James said.

Spot gas prices across much of the United States strengthened Friday as cooler weather was set to arrive in the East beginning over the weekend and lasting through the early part of the week.

The fresh chill was expected to arrive behind a storm responsible for soaking the region with rain and locally severe thunderstorms into Friday night, according to AccuWeather. Just enough cold air may catch up with moisture to produce some wet snow or a rain and wet snow mix across portions of northern Pennsylvania and central and northern New York state for a time Saturday morning and midday.

“Rain will linger across northern New England to start the weekend as strong winds whip and temperatures tumble in the balance of the Northeast,” AccuWeather meteorologist Renee Duff said.

Despite strong winds whipping, conditions will not be that harsh for late April across the lower mid-Atlantic, according to the forecaster. The fresh chill over interior areas was expected to lay the groundwork for wintry weather to arrive as a new storm was set to arrive into Sunday.

“This is the same storm that will first lay a swath of snow from the northern Plains to the Great Lakes early in the weekend,” Duff said.

While temperatures associated with this first storm were expected to bottom out on Sunday, the northeastern states were due for more storms through midweek, although most precipitation with these events is likely to fall in the form of rain, according to AccuWeather.

The line of weather systems on tap for the Northeast sent spot gas prices up by the double digits at several pricing hubs, although Transco Zone 6 NY managed to slip 2.5 cents to $2.28.

Most Appalachia markets posted mostly small increases of less than a dime, although both Millennium East Pool and Tennessee Zone 4 Marcellus jumped significantly more as prices recouped the previous day’s steep losses.

Pipeline work in Appalachia is set to continue. Nexus Gas Transmission was scheduled to begin conducting in-line inspection tool runs in eastern Ohio on Monday. Although the event is not expected to create any flow disruptions, Nexus did warn of the possibility.

The tool run is taking place in Market Zone 1, from Hanoverton Station to Wadsworth Station. Nexus indicated that if isolation of this section of pipe is necessary, the worst-case scenario would be to cut all deliveries onto Nexus from Texas Eastern Transmission (Tetco), leading to an impact of up to 366 MMcf/d.

“However, this worst-case scenario seems unlikely based upon the wording of the notice provided by Nexus,” Genscape Inc. natural gas analyst Anthony Ferrara said. “Enbridge Inc., the pipeline operator of both Nexus and Tetco, has a reputation of usually providing more notice if an event will be more impactful than initially expected.” No end date has been provided for the event.

In addition to the Nexus maintenance, Columbia Gas Transmission (TCO) was scheduled to perform compressor work on the Lost River compressor station in northern Virginia beginning Monday through May 9, which could limit up to 207 MMcf/d of deliveries. During the maintenance, there is a high potential impact to firm and non-firm services at the Warren County location (meter 842564).

“Over the past 30 days, deliveries to Warren County have averaged 154 MMcf/d and maxed at 207 MMcf/d,” Ferrara said. However, over the five days leading up to Friday, deliveries had only averaged 13 MMcf/d and maxed at 38 MMcf/d.

Further east, gains of 5-10 cents were common throughout the Southeast and Louisiana, while cash prices in the Midwest were stronger amid the snowstorm forecast to hit the region over the weekend. Chicago Citygate jumped 13.5 cents to $2.345.

Meanwhile, planned maintenance on ANR Pipeline’s Michigan Leg South could create constrained conditions and possibly flow cuts. From gas days April 29-May 4, ANR plans to reduce capacity at the St. John Compressor Station in the Northern Area (Zone 7) by 500 MMcf/d, leaving 767 MMcf/d available.

Over the past 30 days, flows through St. John Eastbound have averaged 602 MMcf/d, including a single-day high of 1,154 MMcf/d, according to Genscape. The pipe work, therefore, raises the potential for “some constraints or even flow cuts during the event,” Ferrara said.

For all the upside in Friday’s cash markets, West Texas prices tumbled back down after closing in on $1 Thursday. Waha plunged 45.5 cents to average below 35 cents, a decline likely tied to overall weakness in downstream West Coast markets.

SoCal Citygate dropped more than 70 cents to $1.79, while other California points fell a quarter or more. Rockies spot prices were down 15-30 cents at most market hubs.

In Western Canada, system maintenance and price volatility “are the name of the game during injection season and NOVA/AECO C is following the playbook,” according to TPH. Cash prices shed more than $1 over the past week to sit at 57 cents on Thursday. Friday, however, brought about a modest rebound that lifted NOVA/AECO C prices back to C60.5 cents/Gj.

Western Canadian storage deficits sit at 14%, having narrowed from 17% a month ago. TPH is projecting a 5 Bcf build in storage for the week ending Friday (April 26), which would be in line with the five-year average.

Eastern Canada saw its first injection year to date at 2 Bcf, which also marks the first time Eastern Canada storage caverns were above 2018 levels since this past February, according to TPH. Stocks, however, remain around 44% lower than the five-year average.

“Canadian gas storage data provides interesting reference data points but until TransCanada Corp.’s NGTL system can function in a more normal manner, these storage data points don’t carry the price implications they once did,” TPH analysts said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |