Markets | NGI All News Access | NGI Data

Weekly Natural Gas Prices Post Solid Gains as Summer Temperatures Soar

Spot prices surged over the course of the week as robust heat stretched across the country, with highs reaching into the triple-digits over swaths of Texas and the Southwest.

Strong cooling demand propelled weekly spot gas prices for the July 6-10 period. NGI’s Weekly Spot Gas National Avg. advanced 22.0 cents to $1.730.

Though forecasts pulled back moderately late in the week, expectations remain elevated for continued heat waves. Bespoke Weather Services said the week ending July 17 had shown gas-weighted degree day totals as high as 105-106 at one point in the week, but that figure was down to 97.5 as of early Friday.

However, this is “still quite hot and well above normal levels,” Bespoke said. Additionally, “above normal days continue rolling into the back of the forecast, which we think continues into late month and into August.

“At the end of the day, this keeps us on pace to edge out July 2011 for the hottest month on record,” the firm added, “though the risk is that models could wind up being too hot in the week ending July 24 now, given what we have been seeing as the forecast rolls forward.”

As the trading week came to an end, spot price gains were widespread and pronounced, with double-digit advances found in every region of the Lower 48.

PNGTS spiked 65.0 cents to $2.740, while Dominion Energy Cove Point jumped 23.0 cents to $1.815, and Columbia Gas rose 20.5 cents to $1.665.

Bumpy Ride for Futures

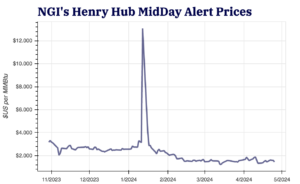

August natural gas futures started the week on solid ground, pushing ahead alongside the forecasts for strong summer heat and advancing both Monday and Tuesday to mark a three-day winning streak dating to the prior week.

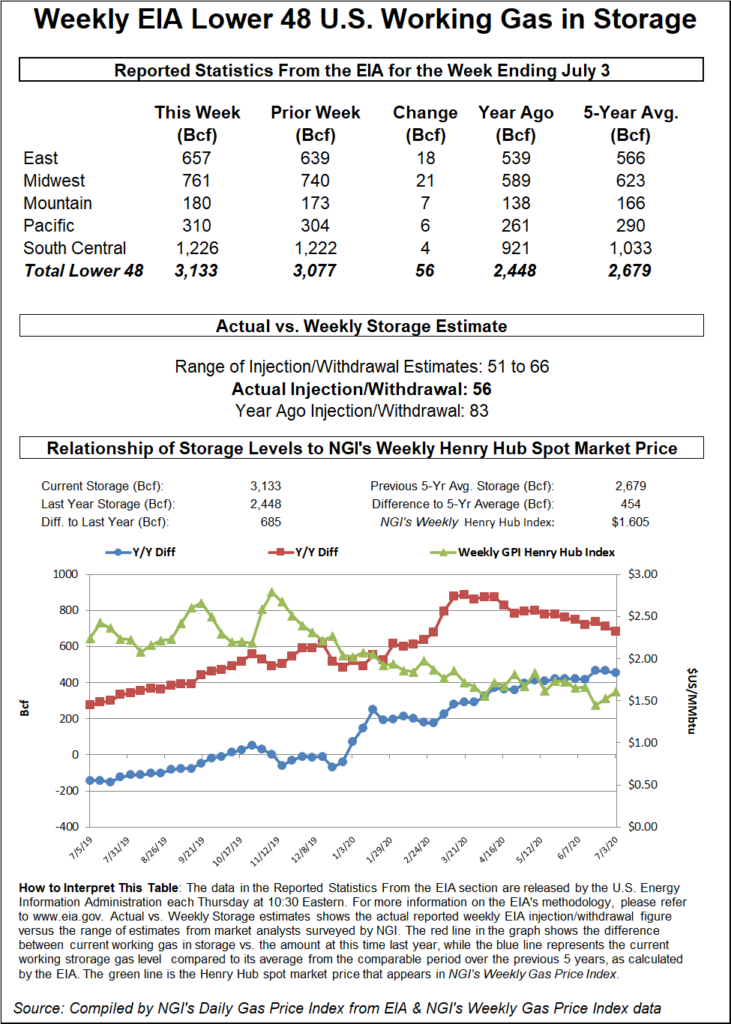

But profit-taking slowed momentum Wednesday and, despite a modestly bullish storage print on Thursday, futures dipped for a second consecutive day, largely on concerns about still robust stockpiles and export weakness.

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 56 Bcf natural gas storage for the week ending July 3. The topline figure was below the average expectations of major polls. But the build lifted inventories to 3,133 Bcf, well above the year-earlier level of 2,448 Bcf and above the five-year average of 2,679 Bcf.

Both export and storage challenges are woven into the fabric of the coronavirus pandemic, which has hampered economic activity and energy demand in Europe and Asia – key U.S. liquefied natural gas export destinations prior to virus outbreaks. With export levels anemic in recent months, and with the outlook muddied by a resurgence of the virus in June and early July, worries linger that summer heat may not prove enough to address supply/demand imbalance.

“Rising storage surpluses and record low prices in Europe and Asia…have turned the economics upside down for U.S. exports and led to widespread cancellations of contracted cargoes” in recent weeks, said RBN Energy LLC analyst Sheetal Nasta. “Feed gas deliveries and cargo liftings at Lower 48 terminals both have plummeted to the lowest levels since early 2019, despite domestic liquefaction capacity climbing by more than 4 Bcf/d since then.”

Moreover, she added, “the dynamics that led to the current predicament are likely to persist at least through injection season and potentially even beyond that.”

If the scenario Nasta describes bears out, containment challenges could emerge in the fall. That possibility continues to play a prominent role in cutting off natural gas rallies this summer.

At the same time, however, scorching summer heat continues to pervade the country, galvanizing air conditioner use and driving power burns. The consistency of the hot weather has functioned as a repeated driver of bullish sentiment. That appeared to be the case again Friday, as the August Nymex contract rebounded 2.6 cents day/day and settled at $1.805/MMBtu to close out the week.

As mid-summer nears, meanwhile, analysts are starting to look farther into the second half of the year – and with some optimism.

“While natural gas demand losses due to COVID-19 were higher than production declines, upcoming peak demand for winter is expected to produce an impressive bump for the price of natural gas,” Enverus analysts said.

With prices averaging under $2/MMBtu in 2020, the Enverus analysts envision prices increasing above $3.50/MMBtu as soon as the coming winter, with the bulk of production growth generated in the Marcellus/Utica, Haynesville, and Permian Basins.

That is, of course, dependent on notable long-term improvement on the pandemic front and seasonally solid demand.

“We’re cautiously optimistic, but not ready to label this a comeback,” said Bernadette Johnson, vice president of Strategy and Analytics at Enverus. “We anticipate some operators to carry that same theme, too. A lot of the pain should be behind them now.”

Cash Clunks Late

Spot prices posted losses throughout the Lower 48 on Friday, after the modest cooling shift in forecasts and several days of gains earlier in the week.

Though not as hot as forecasts earlier in the week, NatGasWeather said, “upper high pressure will rule” much of the country over the next several days.

“Cooler exceptions are expected from a weak tropical system bringing squalls to the Mid-Atlantic Coast” on Friday, the firm added. But cooling demand is expected to surge for the week ahead “across the southern United States as highs reach the 100s from California to Texas, with mid-90s across the South and Southeast.”

Notable decliners on Friday included SoCal Citygate, which lost 13.5 cents to $2.110, and Algonquin Citygate, which shed 14.0 cents to $1.525.

Elsewhere, Defiance gave up 10.0 cents to $1.655, while Chicago Citygate fell 8.5 cents to $1.705, and El Paso Permian declined 8.5 cents to $1.590.

On the pipeline front, Vector Pipeline said it would begin early this week scheduled maintenance at the interstate interconnect with Alliance Pipeline in Will County, IL, that would restrict up to 225 MMcf/d of receipts onto Vector from Alliance. The restriction is expected to apply from Sunday through July 19, and all receipts from Alliance are not to be accepted for the duration of the maintenance event, according to Genscape. Over the past 30 days, the firm said, receipts from Alliance onto Vector have averaged 134 MMcf/d and maxed at 225 MMcf/d.

“However, two other interstate interconnects with Northern Border and Guardian, also located in Will County, will be fully available and operational,” Genscape added. “These interconnects typically have over 1 Bcf/d of available capacity combined, leaving ample capacity to compensate for the lack of receipts from Alliance.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |