Weekly NatGas Prices Ease As Traders Wrestle With Uncertainty

As the nation inaugurated its 45th President Friday, a new era of risk and uncertainty enveloped the electorate, with highly contentious if not polarized factions on either side of the major issues facing the new Trump presidency. The natural gas market faces its own set of challenges and uncertainties, with both bulls and bears armed with persuasive arguments.

As the industry passes the mid-point of the 2016-2017 heating season, prices have doubled from last winter’s $1.61 low, but bullish factors such as Mexican exports and the export of LNG contend with ample inventories and a weather dynamic that threatens to undermine any stronger pricing.

Weekly prices continue to hold above $3 and the NGI National Weekly Spot Gas Average fell 7 cents to $3.15. For the week ended Jan. 20, most points fell but only by a few cents. Conversely those that advanced also did so by only a few pennies.

The point showing the greatest gain was Tennessee Zone 4 Marcellus, with a rise of 8 cents to $2.86, and the week’s biggest loser was Tennessee Zone 6 200 L with a drop of $1.41 to $3.61.

Appalachia and California were the only regions to move into positive territory, with Appalachia rising 2 cents to $2.96 and California adding a penny to $3.37.

The Northeast fell the most, dropping 45 cents to $3.36, and the Midcontinent lost 9 cents to $3.07.

Rocky Mountain locations fell 6 cents to $3.10, the Midwest shed 5 cents to $3.19, and the Southeast was down 4 cents to $3.19.

South Louisiana inched lower by 3 cents to $3.15, and both South Texas and East Texas lost a penny, to $3.12 and $3.13, respectively.

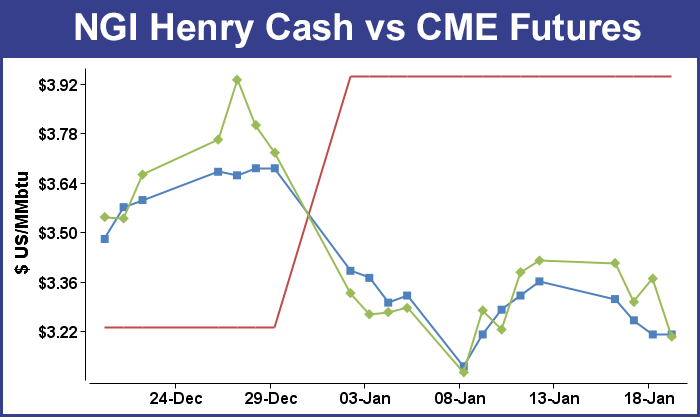

February futures on the week tumbled 21.5 cents to $3.204.

Thursday trading saw the futures hesitate following the release of storage data, which showed a withdrawal of 243 Bcf, about 12 Bcf greater than expected. But by the close February had added 6.6 cents to $3.368 and March was higher by 6.6 cents as well to $3.360.

Once the bullish EIA report rattled across trading desks natural gas futures tried to work higher. February futures reached a high of $3.336 immediately after the figures were released, and by 10:45 a.m. February was trading at $3.314, up 1.2 cents from Wednesday’s settlement.

“The market really didn’t do much, and struggled to get above resistance at $3.31,” said a New York floor trader. He added that additional market buying could take the market to the “next level” at $3.35 to $3.37.

“The 243 Bcf net withdrawal for last week was more than the final survey expectations, but not out of the range of estimates,” said Tim Evans of Citi Futures Perspective. “This was the largest draw of the season to date, exceeding the 237 Bcf decline in the week ended Dec. 23. It was also supportive relative to the 170 Bcf five-year average for the date, and so supportive on a seasonally adjusted basis.

“While this report was more supportive than anticipated and does go some way toward showing a somewhat tighter supply-demand balance, smaller and somewhat bearish storage withdrawals are still likely over the next two reports, limiting the upward price potential.”

Wells Fargo analyst David Tameron called the report “slightly bullish” and noted that the 243 Bcf pull “was 3 Bcf greater than consensus, 65 Bcf greater than last year’s mark and 59 Bcf greater than the five-year average withdrawal of 184 Bcf. Absolute storage levels are now 67 Bcf below the five-year average.”

Randy Ollenberger, an analyst with BMO, also had an upbeat take on the figures. “We believe the storage report will be viewed as positive. Storage has dropped to five-year average levels, and we believe that U.S. working gas in storage could trend toward five-year lows by the end of the 2017 winter withdrawal season, assuming normal weather,” he said in a report to clients.

Inventories now stand at 2,917 Bcf and are 431 Bcf less than last year and 77 Bcf less than the five-year average. In the East Region 59 Bcf was withdrawn and the Midwest Region saw inventories decrease by 70 Bcf. Stocks in the Mountain Region fell 14 Bcf, and the Pacific Region was down 15 Bcf. The South Central Region dropped 85 Bcf.

In Friday trading forecasts of mild temperatures were dotting the trading landscape, and buyers saw little reason to commit to three-day deals for weekend and Monday gas.

Losses were small but widespread, and a few points in Texas and the Midwest managed to scramble into the plus column. The greatest losses were seen in New England and Mid-Atlantic, where forecasts called for temperatures 15 degrees or more above normal.

The NGI National Spot Gas Average fell a penny to $3.10.

Futures were a different story, with the February contract taking the trajectory of a coyote falling off a cliff in a Saturday morning cartoon. February dropped 16.4 cents to $3.204, and March followed suit with a decline of 14.9 cents to $3.211. The expired February crude oil contract added $1.05 to $52.42/bbl.

Futures traders see solid near-term support not too far away. “On Jan. 9 and Jan. 10 we had two consecutive days with big ranges, big strong bars, and when you have something like that with a big down day [Jan. 9] followed by a big up day [Jan.10] it’s a good day for brokers but a bad day for traders,” said David Thompson, vice president at Powerhouse LLC, a Washington DC-based trading and risk management firm. “That did signify a bottom for the next five days. We have now given back much of that ensuing rally.

“That low from the 9th at $3.098 would be the key number for support right now. If we hold there, we have a double bottom within two weeks where the market made two attempts to go below $3.10 but couldn’t do it. If that holds, you will see some technical buying coming in, but if it breaks, the rally we had in November we are probably aiming for the low part of that at $2.55. All that opens up if we break $3.09. $3.09 is very important,” Thompson said.

Even though Thursday’s Energy Information Administration storage report had a decidedly bullish tone to it and suggested an overall tightening in the supply-demand balance, traders are focused on near-term weather.

“This market’s attempts to piece together a meaningful price advance continue to be thwarted by a lack of bullish weather guidance,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning report to clients. “Updates to the one- to two-week temperature forecasts are still being featured by above normal expectations within key consuming regions with extension now out to Feb. 3. Although below-normal temperatures are expected within the western half of the country and much of the South, the northeast quadrant has yet to show a potential return of arctic air that will be required to jump start another price advance.

“[T]he further that this winter wears on, the less the price impact when another cold spell does show up on the radar. While some occasional bullish storage reports can briefly spike values, the trade of the past 24 hours is strongly suggesting that some cold weather will be required to spark a significant price rally. As is the case in the petroleum, we have been forced to lower our price expectation and we believe that our $3.55 upside target in March futures may well represent the high for that particular contract during the next five to six weeks.”

Gas buyers for power generation across PJM Interconnection over the weekend were not expected to have much in the way of wind generation to work with if the forecast of WSI Corp. turned out to be correct. “Much above average temperatures and below average heating demand are expected during the forecast period [Friday through Tuesday]. A weak frontal system will continue to spread a dissipating swath of rain/drizzle across the power pool today. Max temps will range in the mid 40s, 50s to near 60 in spots. Mostly cloudy skies and a slight chance of a shower will linger into Saturday. It will be unseasonably warm with max temps in the upper 40s, 50s to low 60s.

“A robust storm system will develop over the southern U.S. this weekend and track a track north up the East Coast early next week. The exact track and details still need to be resolved, but this will likely bring primarily rain and gusty winds into the region during Sunday into early Tuesday. Temperatures will vary in the 40s and 50s.

“Relatively light wind generation is expected through Saturday. The expected storm system will likely bolster wind gen during Sunday into Monday, with output in excess of 3 GW.”

Moderating temperatures in major East Coast markets pulled the plug on any hope for stronger weekend and Monday physical prices. AccuWeather.com forcast that Boston’s Friday high of 43 degrees would reach 51 on Saturday before easing to 38 on Monday, 3 degrees above normal. New York City’s Friday high of 45 was seen climbing to 52 Saturday and retreating to 45 by Monday, 7 degrees above its seasonal norm.

Gas on Texas Eastern M-3, Delivery fell 12 cents to $2.95, and deliveries to New York City on Transco Zone 6 shed 9 cents to $3.02.

Deliveries to major trading hubs were mixed. Gas at the Chicago Citygates added a nickel to $3.18, and packages at the Henry Hub were quoted flat at $3.21. Gas on El Paso Permian fell 4 cents to $3.00, and packages on Kern Receipt fell a penny to $3.05. Gas at the PG&E Citygate changed hands a penny higher at $3.56.

New England took the biggest hits. Deliveries to the Algonquin Citygate dropped 50 cents to $3.24, and gas on Iroquois, Waddington fell 4 cents to $3.43. Gas on Tenn Zone 6 200L shed 33 cents to $3.38.

Both futures and physical traders could be looking at greater supplies and, by extension, lower prices down the road if the trend in rig deployments continues.

In its weekly rig count tally Baker Hughes Inc. reported that the U.S. natural gas rig count has been climbing and at 142 is well past its year-ago level of 127. But the oil-rich Permian Basin casts a long shadow and once again has put gas-directed drilling increases in the shade.

The weekly rig count tallied by Baker Hughes Inc. again packed a Permian punch on Friday as 13 rigs returned to the oil-rich West Texas and New Mexico play.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 |