Weekly Natgas Cash Slides But Futures Gain Ahead Of Holiday Weekend

Natural gas sellers got their Christmas presents early when weekly prices reached $3.92 for the week ending Dec. 16, but a week later the grinch emerged to take some of those gains back. The NGI Weekly National Spot Gas Averaged fell 40 cents to $3.52, and only a handful of points traded unchanged or in the black.

The week’s best gainer was gas traded at the PG&E Citygate with a rise of just a nickel to $3.73. The week’s biggest loser was the perennially volatile Transco Zone 6 New York with a drop of $3.87 to average $3.98.

Regionally producing zones and California showed the most resilience with losses of just a few cents, and the Northeast market zone suffered the greatest indignity giving up nearly $2. South Texas and South Louisiana lost just 3 cents to $3.38, and $3.43, respectively and the Northeast plunged $1.98 to $4.79.

California and East Texas both shed 6 cents to $3.56 and $3.37, respectively, and the Rocky Mountains gave up 17 cents to $3.37.

The Midwest was off 19 cents to $3.52, Appalachia retreated 21 cents to $3.03, and the Midcontinent fell 23 cents to $3.36. The Southeast was lower by 53 cents to average $3.49.

January futures, however, gained a stout 24.7 cents for the week to $3.662.

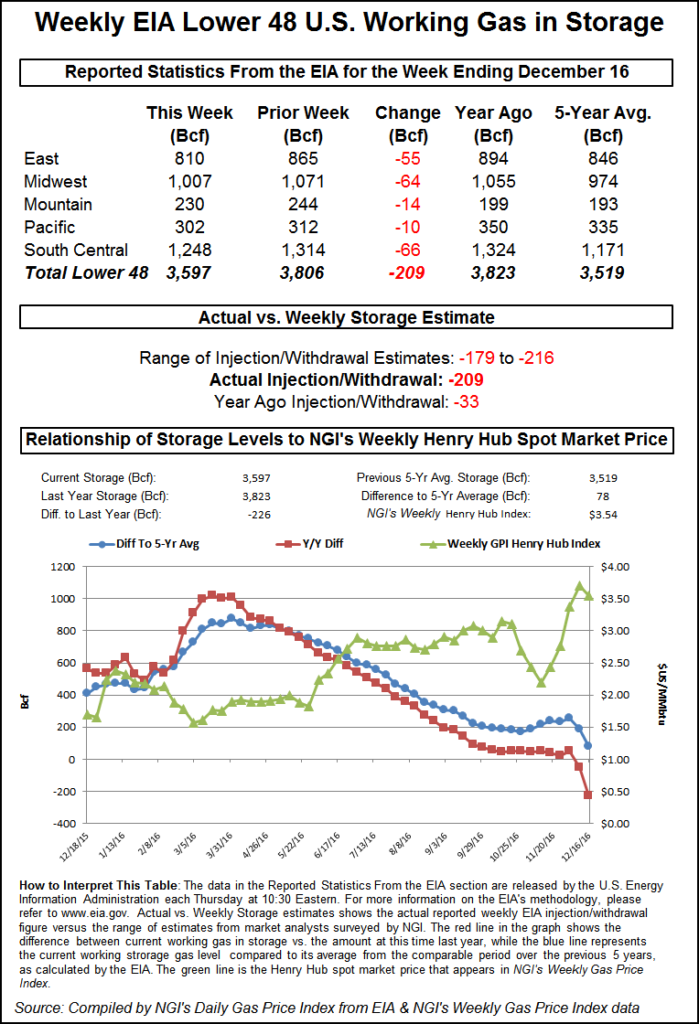

In Thursday’s market action futures struggled despite a monster withdrawal from inventories that put the year-on-year storage surplus into a deficit. The Energy Information Administration (EIA) reported a withdrawal of 209 Bcf for the week ending Dec. 16, about 8 Bcf more than what the market was expecting. Prices traded modestly higher initially, but at the end of Thursday January had slipped four-tenths of a cent to $3.538, and February had eased four-tenths as well to $3.563.

Initial market reaction was positive, as January futures reached a high of $3.626 immediately after the figures were released, and by 10:45 a.m. January was trading at $3.560, up 1.8 cents from Wednesday’s settlement.

“It looked like the market moved high enough to give some traders a chance to take money off the table ahead of the long weekend,” said a New York floor trader

“This drawdown was 9 Bcf below our estimate of -200 Bcf and on the lower side of most analyst estimates as well,” said Harrison, NY-based Bespoke Weather Services. “However, the recent market rally has seemed to have priced in an even more bullish miss in today’s number, and the number falling generally within expectations has helped prices fall back a bit today as weather remains neutral. Still, this market remains tight with some upside risk left.”

“The 209 Bcf versus 203 Bcf is pretty neutral, and the market should slip on it,” said Mike DeVooght, president of DEVO Capital, a Colorado trading and risk management firm.

“If we were at $3, it could have been bullish, but we’re at $3.60 and this is the third time we have been up here, and the reality is that there has been a tremendous amount of optimism built into the natural gas market. The funds have pretty much liquidated all their short positions, and that along with all the optimism about re-inflation has given the market a nice boost.”

DeVooght said these were times for producers to initiate short hedges to manage price risk. “It’s not that we are negative on natural gas, but I look at $3, $4 collars [selling $4 call options against the purchase of $3 put options to hedge downside price exposure] as making a lot of sense. We have had clients that have had stuff shut in and are now turning it back on. They have put hedges in place so that gas will show up later.

“The $3, $4 collar traded today at 1.2 cents [credit], so you could have executed that trade this morning. I like those. Just a few weeks ago prices were at $2.65.

“We are not terribly bearish, but it makes sense to do some forward sales in the form of collars with a $3 floor.”

Citi Futures Perspective analyst Tim Evans called the report “bullish,” adding that it was likely the result of stronger-than-anticipated heating demand. “The data implies a somewhat tighter balance in the market for the reports to follow as well,” he said.

The 209 Bcf draw dwarfed last year’s 33 Bcf pull for the week, as well as the 101 Bcf five-year average draw for the week.

Inventories now stand at 3,597 Bcf and are 226 Bcf less than last year but still 78 Bcf more than the five-year average. In the East Region 55 Bcf was withdrawn and the Midwest Region saw inventories decrease by 64 Bcf. Stocks in the Mountain Region fell 14 Bcf, and the Pacific Region was down 10 Bcf. The South Central Region declined 66 Bcf.

In Friday’s trading physical natural gas for delivery over the extended holiday weekend eased as multi-dollar weather-driven losses in New England skewed the overall average lower.

Gains in Texas, Louisiana, and the Midcontinent for the weekend through Tuesday were offset by setbacks in the Northeast and Midwest, and the NGI National Spot Gas Average fell 4 cents to $3.51.

Futures continued to build on Tuesday’s 28-cent gain, and at the close on Friday January had added 12.4 cents to $3.662 and February was higher by 11.5 cents to $3.678.

New England points took the day’s biggest hits on Friday, dropping close to $4 at some points as weather forecasts called for a round of mild temperatures leading into the weekend. Wunderground.com forecast that Boston’s Friday high of 45 degrees would ease to 44 by Saturday before easing to 39 by Monday, the seasonal norm. New York City’s Friday peak of 46 was anticipated to slide to all of 45 Saturday before rising back to 48 on Monday, 7 degrees above normal.

Futures traders saw the day’s gains as weather-driven. “This is a weather rally,” a New York floor trader told NGI. “I look for the market to trade up to $3.72 and then back off.”

Others saw a cornucopia of factors in play. “The natural gas market is pushing higher in Friday trade to levels not seen since Dec. 9, supported by a somewhat colder 11-15 day temperature forecast,” said Tim Evans of Citi Futures Perspective. “Book-squaring ahead of the holiday weekend, options expiration on Tuesday, and the January futures expiration on Wednesday are additional features in today’s trade.”

More deferred weather forecasts called for cooling directed primarily to the West. In its 11-15 day Friday morning outlook, MDA Weather Services said, “The forecast trends colder in this period, with these changes focused from the West to the Midwest. This comes with model support, as well as the background MJO [Madden Julian Oscillation] tracking toward colder correlating phase seven. The forecast, however, remains slower than models with the evolution of cold air, keeping belows limited to the western half while promoting continued above normal coverage downstream in the South and East.

“Ridging near Alaska is a feature worth monitoring going forward as a cold signal, but models keep troughing focused over the West during this period.”

Traders see a treacherous environment with the possibility of extended cold placing risk to the upside. “[W]e still view this week’s dramatic two-day price spike as a possible exaggeration relative to the forecasts for another Arctic blast at around the New Year holiday,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients. “Models continue to differ, and until a consensus develops in favor of a pronounced and lengthy broad-based cold spell, this market is apt to spend more time digesting the early week price pop. But we will also note that the market’s sensitivity to any shifts in the forecasts toward abnormally cold trends will be heightened going forward now that a supply deficit against average levels is developing.

“Back-to-back large storage draws in excess of 200 Bcf have been efficiently discounted. But going forward into the heart of the heavy-usage period, a deficit supply situation could easily push nearby futures back to above this month’s highs. This market has seen four distinct major price swings evenly divided between the up and the down side across this fourth quarter. As a result, this has provided a treacherous environment for position-type traders. We have, instead, focused on ‘spreading’ opportunities as an alternative strategy. After accepting profits out of bear spreads at the start of this week, we are now awaiting a significant reaction as an opportunity to establish bull spreads, such as long April-short December 2017.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |