Weekly Natgas Cash Posts 4th Double-Digit Weekly Gain; More Seen Coming

Oh what a week it was, but the half-dollar weekly natural gas cash gains shouldn’t have come as much of a surprise to those who noted that January futures bounded higher by a stout 40 cents during the previous week. With chilly winter temps now on hand for much of the country, further strengthening is likely in the forecast.

The gains in the prior week futures have been a solid prognosticator of weekly gains ahead for some time now. For the week ended Dec. 9 the NGI Weekly Spot Gas Average jumped 52 cents to $3.75 and all points followed by NGI were solidly in the black.

The week’s laggard proved to be PG&E Citygate with a rise of 15 cents to average $3.79, and the points showing the greatest gain were Tennessee Zone 6 200 L with a rise of $3.90 to $7.68 followed closely by deliveries to the Algonquin Citygate advancing $3.58 to average $7.21.

Regionally no one could touch the Northeast with it jumping $1.48 to average $4.82. California brought up the rear with an average gain of 29 cents to $3.70.

South Texas added 32 cents to $3.58 and both South Louisiana and East Texas added 33 cents to $3.62 and $3.58, respectively.

The Midcontinent was up by 38 cents to average $3.61 and the Midwest and Rocky Mountains gained 41 cents to $3.78 and $3.58, respectively.

The Southeast rose 44 cents to $3.77 and Appalachia gained 66 cents to $3.32.

The move higher of 31 cents in the January futures to $3.746 augured well for next week’s weekly cash quotes.

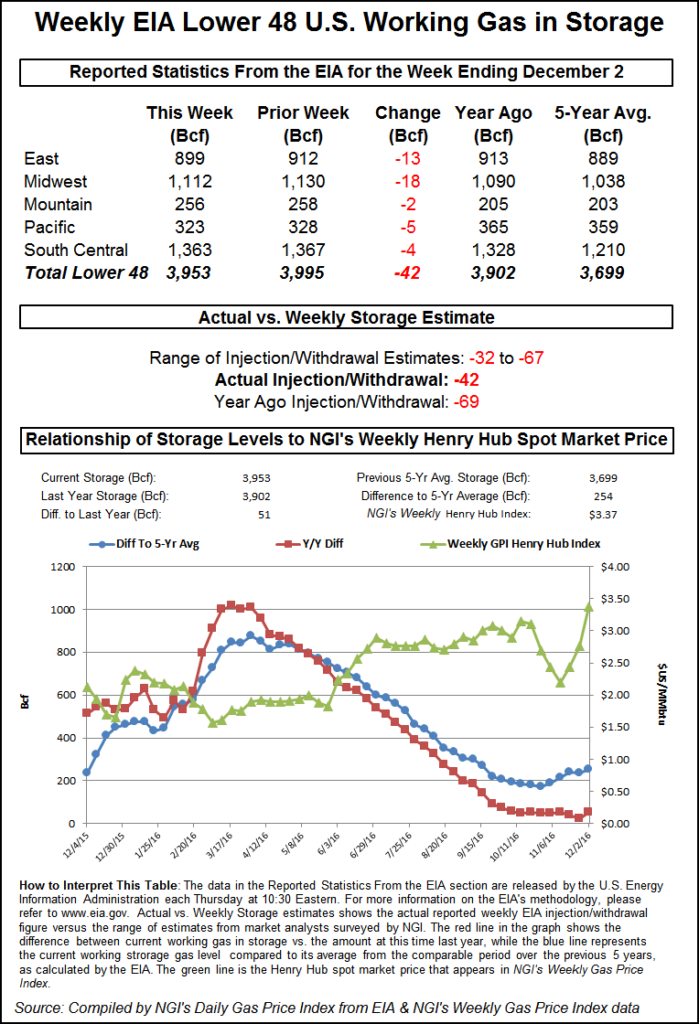

Thursday’s primary price driver was the Energy Information Administration (EIA) report of a storage withdrawal of 42 Bcf, about what the market was expecting, but prices advanced and closed at the high end of the day’s range. At the close on Thursday, January had gained 9.2 cents to $3.695 and February was up 8.7 cents to $3.676.

Futures lost no time working higher after the report.

EIA reported a 42 Bcf storage withdrawal for the week ending Dec. 2 in its 10:30 a.m. EST release on Thursday, whereas traders were expecting a pull about 1 Bcf greater. January futures reached a high of $3.680 immediately after the figures were released, and by 10:45 a.m. January was trading at $3.628, up 2.5 cents from Wednesday’s settlement.

“You see the way this market goes regardless of the number,” a New York floor trader told NGI. “If it goes down 7 cents, it comes back basically to where we were before, and if it goes up 7 cents we go back down to where it was 15 minutes before. You’ve got to pick your point right at the onset and then get out. Then you are in good shape. It’s a little scary to have your position on before the number comes out.

“I think we have to look at $3.75 as resistance and $3.50 as support,” he said.

“The 42 Bcf net withdrawal for last week was in line with revised consensus expectations for 42-43 Bcf but moderately bearish relative to the 61 Bcf five-year average for the date,” said Tim Evans of Citi Futures Perspective. “However, we fully expect the market to focus more on the upcoming cold than only last week’s details.”

Inventories now stand at 3,953 Bcf and are 51 Bcf greater than last year and 254 Bcf more than the five-year average. In the East Region 13 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 18 Bcf. Stocks in the Mountain Region fell 2 Bcf, and the Pacific Region was down by 5 Bcf. The South Central Region shed 4 Bcf.

Technical traders Thursday saw trading at something of a watershed and suggested the groundwork was coming together for significantly higher prices. “The last two days were looking a little toppy, but Thursday took back all those losses, and I take that as a pretty dramatic confirmation that the trend is still up,” said Walter Zimmermann, vice president at United ICAP.

“My critical pivot was $3.68, and if natural gas doesn’t stop there, that opens the door to $4.30 and $4.96. If we get a weekly close over $3.68, and it’s kind of teetering there now, but any further gains Friday we could get that. In my book I am struggling to find any candidates for resistance until that $4.30 to $4.96 area.”

Zimmermann added that Thursday’s advance as well as recent price action is “pretty conclusive evidence that $1.611 back in March was the 15-year commodity cycle low. 2016 was the year we were looking for the next 15-year low.

“We’ve had bigger rallies previously such as the $1.902 to $6.493 and others but they were counted as bear market corrections within the 15-year cycle decline. This is more than that. Assuming Thursday’s gains are not given back Friday, let see what happens up to the $4.30 to $4.96 zone,” he said.

In Friday’s trading both weekend and Monday natural gas cash and futures capped off the week with gains of about a nickel, but if predictions of the coming weather/storage dynamic prove correct, gas markets could be on the cusp of still greater changes.

In the physical market, gains at points in New England, the Rockies and California more than offset a weak Marcellus and Southeast, and the NGI National Spot Gas Average added 4 cents to $3.85. Not to be outdone, futures managed to hold on to opening gains, and January closed up 5.1 cents to $3.746 and February added 6.5 cents to $3.741. January crude oil gained 66 cents to $51.50/bbl.

Market observers were calling for a slight lull in the weather action over the weekend before market turbulence resumes the following week. “It has been a wild week with the coldest weather of the season lifting demand; freeze-offs in Alberta and risk of such in the U.S.; and a slew of forces majeure and operational flow orders coast-to-coast,” said industry consultant Genscape in a Friday report to clients.

“The wood-paneled station wagon of warm weather will trundle right through the game Sunday through Tuesday, but after that it is game back on.”

The weekend and first half of the week was expected to see big swings in heating load as Saturday was expected to see Lower 48 HDDs at 243, about 44 more than normal, but Monday HDDs were expected to drop to 170, or 35 warmer than normal, Genscape said. Tuesday is normal, but by Thursday it’s off to the races, with 289 HDDs, or 76 colder than normal.

“As with this week past, the cold is expected to be widespread, coast-to-coast, north-to-south. The exception will be in SoCal and the Desert Southwest, which will both run warm,” Genscape said.

Weekend and Monday gas at eastern locations reflected that kind of variation. Gas at the Algonquin Citygate rose 27 cents to $9.84, and deliveries to Iroquois, Waddington added 24 cents to $5.25. However, gas on Tenn Zone 6 200L slipped 9 cents to $9.94.

Gas on Texas Eastern M-3, Delivery fell 39 cents to $3.59, and parcels headed to New York City on Transco Zone 6 skidded 16 cents to $4.04.

A mixed pricing picture in the Northeast notwithstanding, several points along the Eastern Seaboard and elsewhere hit new one-year highs. The $9.84 posted at the Algonquin Citygate surpassed its one-year high of $9.57, which was recorded on Thursday. Gas on Tennessee Zone 5 200 L hit $5.77, easily surpassing its one-year high of $5.61, which was also recorded on Thursday.

In the Midcontinent ANR SW changed hands at $3.62, up 13 cents and a penny above its one-year high. Texas Eastern E Tx came in at $3.58, up 9 cents and beating its one-year high of $3.56.

Western points hit new highs as well. Northwest Sumas deliveries surged $1.01 to $4.55, well past its one-year max of $3.65, and Stanfield traded at $3.74, up 24 cents and far above its one-year high of $3.66.

Weather forecasts continue to provide a solid market foundation for both physical and financial natural gas.

Weather models overnight continued with the pattern of upcoming frigid temperatures up to Christmas, but honing the details of focused temperature forecasts remained difficult.

“The two things we know is that (1) there is an impressive supply of very cold air affecting North America over the next two weeks and (2) the models historically can struggle a lot with details of the boundaries of these air masses,” said Matt Rogers, president of Commodity Weather Group, in a Friday morning report to clients.

“Slight trajectory and timing differences can lead to large swings in temperature expectations. From a large-scale natural gas perspective, this is an impressive cold pattern with national demand continuing to run above normal over the next two weeks, but from a localized power perspective, this seems to continue to deliver headaches.

“[Friday’s] changes are much colder in the West overall with demand gains even into California. The East Coast is a bit colder in the six-10 day but then warmer in the 11-15.”

For some perspective, the normal high in Chicago during December is about 36 degrees, according to AccuWeather.com. Friday’s high was expected to be 26 degrees, and next Friday’s high is forecast to be 21. Friday, Dec. 23’s high is anticipated to reach 32. Only one day during the next two weeks is the high forecast expected to dip into the single digits.

According to analysts, natural gas pricing is all about near-term weather and less about longer-term macro impacts. “This market continues to push higher to levels not seen in about two years, with cold weather forecasts continuing to offer primary bullish impetus by a wide margin,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients.

“Although some bullish discussion could be had regarding this year’s downsized production, strong export activity, coal to gas displacement, etc., this market will be almost entirely focused on daily updates to the one- to two-week temperature views. Occasionally, some models will hint at some moderation a couple of weeks out but, for now, consensus of expectations remain heavily skewed in favor of polar conditions that will be broadly spread across the nation’s midsection, especially next week when Chicago could see subzero conditions.

“These colder weather trends have already been developing in force this week to the extent that next week’s EIA release could be posting a contraction in the storage surplus against five-year averages of as much as 50 Bcf that would more than offset yesterday’s reported expansion.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |