Infrastructure | E&P | NGI All News Access | Permian Basin

Weatherford’s Cash Flow Still Thorny, But Improving; Permian Constraints No Concern

Battered oilfield services (OFS) operator Weatherford International plc’s “transformation” story appears to have kicked into second gear as the company crossed one major hurdle in its efforts to trim its business while also reporting improvements in revenue and operating income.

Weatherford, which reported second quarter results last Friday, also edged closer to its $1 billion target for run-rate profitability improvements by the end of 2019 and recently signed a multitude of contracts in the United States and overseas that have the company well on its way to becoming a healthier organization. But it was not all good news for the fourth-largest OFS company in the world, as it fell short of cash flow generation expectations for the quarter.

Revenue in 2Q2018 increased 2% sequentially in the quarter to $1.45 billion from $1.42 billion and was up 6% year/year (y/y) to $1.36 billion. Revenue increased sequentially on a higher rig count and improved product mix in the United States, integrated service projects in Mexico, seasonal improvement in the North Sea and higher activity levels in Saudi Arabia and Asia, but were offset by the seasonal slowdown associated with spring breakup in Canada, the company said.

The completions work in the United States and activity in Mexico also drove y/y revenue gains and improvements in operations. Weatherford reported a net loss of $264 million (minus 26 cents/share), compared with a y/y net loss of $171 million (minus 17 cents). Operating losses for the quarter came in at $73 million. Excluding unusual charges and credits, segment operating income in the quarter was $69 million, up 73% sequentially and 195% y/y.

In addition to improvements in revenues and operating income, the company reported that total recurring cost savings during the quarter were $48 million, or $192 million on an annualized basis, representing 19% of its $1 billion target. Weatherford expects to make additional progress on these initiatives as its “transformation continues to accelerate,” CEO Mark McCollum said, adding that he expects to approach 30% of the company’s target by the end of the next quarter.

Furthermore, he said that internally, company executives “are setting our sights on bigger targets” with an ultimate goal of generating “more sustainable value for all of our stakeholders.”

“Our transformation is in full force, and we now have tangible evidence of its effect on our bottom line and back-to-back quarters,” McCollum said Friday on a call discuss second quarter earnings.

McCollum took over the reins of beleaguered Weatherford last year after serving as CFO of Halliburton Co. While Weatherford’s business appears to be improving, second quarter cash flow results proved disappointing.

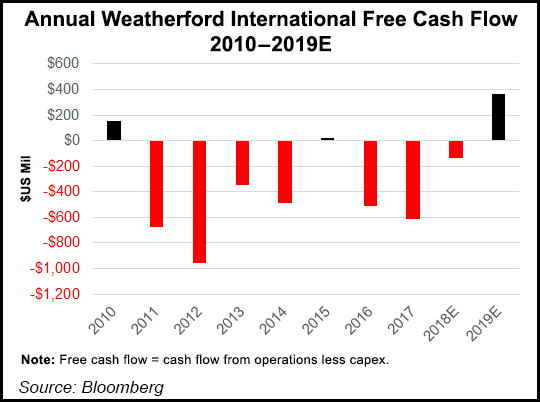

Net free cash flow in the quarter was negative $140 million, including capital expenditures (capex) of $48 million and proceeds from asset sales of $38 million.

“We recognize that we must correct this,” McCollum said. “The primary focus on both the transformation and our daily operations is generating cash. We remain committed to our target of achieving breakeven free cash flow for the year.”

The company chief noted the magnitude of that challenge, in particular as Weatherford continues to see accelerated growth, and said it is taking “aggressive, focused, remedial action where necessary to get it done. A focus on flawless service quality execution is also critical to our path to profitability.”

Second quarter capex was $48 million, including $9 million of capital investments in its drilling rigs business.

Meanwhile, Weatherford earlier this month signed a definitive agreement with ADES International Holding Ltd. to sell its land drilling rig business in Saudi Arabia, Kuwait and Algeria for cash proceeds of $287.5 million. The company had been looking to pare down its business, but McCollum said in April that he wanted to do “right by its customers” in seeking a buyer. At the time of the sale, he praised ADES as a company “that is known for providing high quality and efficient services with an extensive track record of serving leading regional and global oil and gas customers.”

The transaction — which includes 31 land drilling rigs and related drilling contracts, as well as close to 2,300 employees and contract personnel — is expected to be executed in a series of closings, most of which are expected to be “substantially completed” before the end of the year.

Weatherford also announced the sale of its 50% stake in a guar gum joint venture in India. This transaction is part of planned divestitures and “an example of a deal to refocus the company’s portfolio in line with our long-term strategy and to maximize shareholder value,” CFO Christoph Bausch said.

Other divestiture programs are underway which will account for a large portion of Weatherford’s $500 million target for non-rig divestiture proceeds. Bausch said the company would “continue to be diligent in getting these deals across the finish line as we explore various paths to maximize shareholder value. We are confident that we will reach an agreement on at least one of the planned divestitures during the third quarter.”

Transformation Initiatives Taking Off

During Friday’s call, McCollum gave a “shout out” to the company’s transformation team, which “is working relentlessly toward completing close to 1,600 different transformation initiatives.

“The results are coming fast but that doesn’t mean they’re coming easy,” he said, noting the work being done by the team to build on the organization, which has included implementing new processes, installing the systems, learning new disciplines and instilling a new culture, all while continuing to perform their day-to-day duties.

A key work stream in Weatherford’s success this quarter was sales/commercial, which reflected the most upward movement. For example, the company is now using new planning tools when pricing customized products to ensure it has accounted for the full cost to design and manufacture custom-made products it produces for specific customer needs.

“This area has a great deal of opportunity to increase profitability from the value we helped create for our customers,” McCollum said.

Sales initiatives specifically focused on the Permian Basin also positively influenced results in the sales/commercial work stream, as did its win rate and execution on integrated service products in Mexico.

Other internal improvements made significant progress this quarter, McCollum said, although admitting to being “a little behind where we wanted to be at June 30” in procurement, adding that the company is “making up ground fast.” In particular, Weatherford is bundling similar products throughout the organization into request for proposals (RFP) to its vendors to leverage its volume of spend.

“This approach will enable us to better align with our vendor base and maximize our savings as we purchase parts and materials more efficiently,” McCollum said. In addition it “opens up opportunities for our primary vendors who can handle larger volumes to benefit from the scale of our purchasing.”

Weatherford has already released RFPs representing about $750 million of annual spend that “are in the queue to deliver value in the second half of the year,” he said.

As for manufacturing, several decisions were made during the quarter to rationalize the company’s footprint, including consolidating facilities in Canada and closing a plant in Vietnam, as well accounting for a large amount of related implementation costs. Results for the manufacturing work stream are expected to accelerate toward the end of this year and into early 2019, McCollum said.

In the logistics and distribution work stream, Weatherford posted savings on freight costs in the second quarter and will continue working to develop more efficient ways to distribute its products, including piloting several cross docking initiatives that yielded positive early results.

Permian Constraints Not Big Concern

Looking ahead, McCollum said the industry’s supply-driven recovery continues to demonstrate “wavelike patterns” with specific areas of rapid acceleration suddenly seeming to lose momentum just as quickly. He pointed to the Permian Basin, where the development of plentiful resources has run into headwinds as takeaway constraints have created price fluctuations and uncertainties surrounding drilling and completion activity in the coming quarters.

“We’re watching the situation carefully but as you’ve heard from our peers, we neither see a substantial pullback in activity nor are our Permian customers telling us they plan to. Most of the noise seems to be related to frac capacity and pricing, which doesn’t really impact us today,” McCollum said.

Even if operators in the Permian Basin delay completions decrease rig counts, there will be a continued emphasis on maintaining current production, he added. “This trend plays right into our wheelhouse. Artificial lift is a core competency of Weatherford.”

Weatherford in May announced a memorandum of understanding with Valiant Artificial Lift Solutions to jointly commercialize, market and service electrictrical submersible pumps.

Outside the United States, a major operator in Argentina awarded Weatherford a five-year contract worth $300 million for fracturing, coil tubing, wireline completions and testing services. Another operator in Columbia awarded Weatherford a five-year contract worth $270 million for multiple product line services, including fracturing, coil tubing, wireline, fishing and re-entry, tubular running services completions and testing.

In Mexico, Weatherford utilized its new push-the-bit directional drilling system, the Magnus rotary steerable, on an oil well in Mexico, drilling 6,400 feet in one run and saving 1.2 days compared to drilling estimates.

Touting Weatherford’s operational highlights and new contracts, McCollum said the company was well on its way to “becoming a stronger healthier more integrated energy services company” and pledged to utilize its resources and assets to deliver “sustainable and profitable” growth for all of its stakeholders. “Changing the way Weatherford has historically done business will ultimately create a formidable company for the long term.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |