NGI Data | Markets | NGI All News Access

Weak NatGas Cash Outdone by Resurgent Futures; October Adds 4 Cents

Very few physical natural gas market points made it to the positive side of the trading ledger Thursday as most traders hunkered down and got their deals done before the release of the Energy Information Administration’s (EIA) storage report.

Setbacks were widespread, and the NGI National Spot Gas Average declined 11 cents to $2.57, with eastern points leading the trend lower as temperatures didn’t stray far from mild seasonal averages and power markets weakened.

Futures trading was looking a little grim after the release of EIA figures showing a build of 62 Bcf, almost exactly what the market was expecting, but by the close October had managed a gain of 3.8 cents to $2.927, and November followed suit with a rise of 3.3 cents to $3.002. October crude oil joined the march higher and added 33 cents to $43.91/bbl.

Going into the report, traders calculated that storage builds would have to equal the five-year average if storage were to match last year’s record-setting 3,954 Bcf. With seven weeks to go in the traditional injection season, 65 Bcf would be necessary to bring stocks of 3,499 up to that level.

Last year, 74 Bcf was injected, and the five-year pace is a 68 Bcf addition. When the 62 Bcf hit trading desks, the initial reaction was negative. There’s no bullish news in a number that everyone expects. October futures reached a low of $2.834 immediately after the figures were released, but by 10:45 a.m. EDT, October was trading at $2.884, down five-tenths of a cent from Wednesday’s settlement.

“We were hearing a 62 to 63 Bcf figure, and it was not much of an event,” said a New York floor trader. “The market was down, but then it jumped back. You see that almost all the time.”

“The 62 Bcf refill for last week was a match with the consensus expectations and so neutral on that account,” said Tim Evans of Citi Futures Perspective. “However, we note that that was also a step up from the 36 Bcf net injection and was also within 7 Bcf of the five-year average report. By that measure, this was the smallest, least supportive variance to the five-year average since April.”

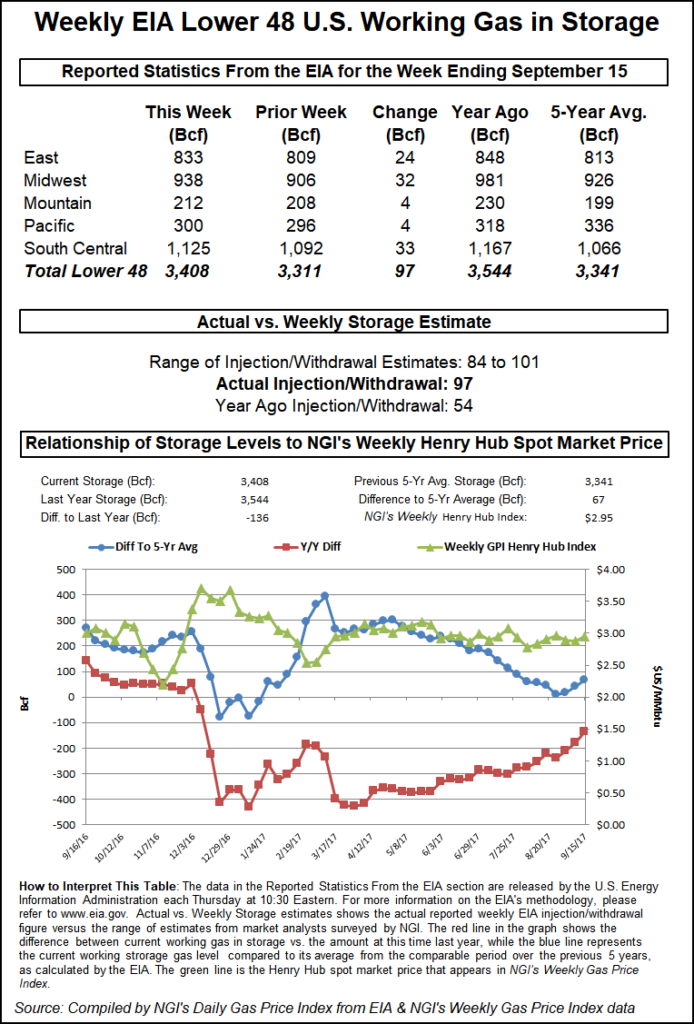

Inventories now stand at 3,499 Bcf and are 184 Bcf greater than last year and 299 Bcf more than the five-year average. In the East Region 20 Bcf was injected, and the Midwest Region saw inventories increase by 26 Bcf. Stocks in the Mountain Region rose 3 Bcf, and the Pacific Region was up by 4 Bcf. The South Central Region increased 9 Bcf.

In some cases the volatility triggered by storage reports can be enough to reach trading targets of followers of Market Profile. Tom Saal, vice president at FCStone Latin America, said to look for the market to test Wednesday’s value area at $2.912 to $2.862. Beyond that, a breakout from the Initial Balance higher at $2.940 or lower at $2.860 would set up trading targets of $2.980 for a move higher or $2.820 for a move lower.

Saal said the market is showing a neutral weak pattern, a pattern of trader indecision.

Observers are expecting an increase in SoCal and Opal basis following the shut down of Williams’ Opal processing plant in southwest Wyoming following the death of a worker. There were no reports of a rupture or explosion.

According to Genscape, “the shutdown is cutting off 870 MMcf/d of deliveries to Kern, REX and Ruby. However, the neighboring Enterprise Pioneer plant has ramped up output to offset nearly the entirety of the losses, and downstream flows on each of those lines appear unaffected.

Kern receipts from Opal are at zero after having averaged 530 MMcf/d in the prior 14 days, Ruby receipts are also at zero, down from the prior 14-day average of 235 MMcf/d, and REX receipts are down to zero after having averaged 93 MMcf/d in the last 14 days.

“We anticipate the event will lift Opal basis, and possibly that of SoCal and PG&E,” Genscape said. “SoCal basis had already seen a bump in yesterday’s trading in response to warming temperatures and supply disruptions into the market from the San Juan basin. Transwestern has been conducting planned maintenance on a line out of the San Juan, and also posted notice yesterday of underperformance from another processing plant in that area.”

For the moment, SoCal basis and PG&E basis remain unaffected. Henry Hub was quoted 9 cents lower at $2.95 but SoCal Citygate and PG&E Citygate suffered commensurate declines. SoCal Citygate shed 8 cents to $2.87 and PG&E Citygate fell 8 cents also, to $3.34.

Elsewhere, New England points skidded as near-term weather forecasts called for mild, seasonal temperatures. Forecaster Wunderground.com predicted that Boston’s Thursday high of 68 degrees would rise to 69 Friday and reach 74 on Saturday, one degree above normal. New York City’s 72 high on Thursday would reach 75 by Friday and climb further to 76 Saturday, right at the seasonal norm.

Algonquin Citygate shed 54 cents to $2.52, and gas on Iroquois Zone 2 fell 43 cents to $2.57. Deliveries to Tenn Zone 6 200L changed hands 29 cents lower at $2.41.

Major market trading centers were also in the red. Gas at the Chicago Citygate fell 8 cents to $2.84, and deliveries to El Paso Permian came in 11 cents lower at $2.69.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |