NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

Volatility Still Abounds, but Natural Gas Futures Start May on Steadier Foot

Despite erratic swings throughout the week, natural gas forward prices eventually stabilized as the calendar flipped to May as states across the country started to reopen amid the coronavirus pandemic. Despite ongoing uncertainty about continued economic recovery as well as liquefied natural gas (LNG) demand, June natural gas prices averaged only a penny lower for the April 30-May 6 period, according to NGI’s Forward Look.

Similar losses extended through the balance of the summer (June-October), while prices for the upcoming winter (November-March) and next summer (April-October) averaged about 3 cents lower, Forward Look data show.

The moves mirrored the direction of Nymex futures, which, despite the small overall change for the April 30-May 6 period, experienced quite a bit of volatility from a chillier weather forecast for the next couple of weeks, a precipitous fall in production and an explosion on one of the Lower 48’s oldest gas systems.

The June Nymex gas contract even surged well above $2.00 on Tuesday as traders assessed the implications of the blast on the Texas Eastern Transmission (Tetco) system, the second in less than a year. However, as quickly as prices rose, they fell.

On Wednesday, the front of the curve plunged nearly 20 cents as production following the Tetco blast was largely rerouted, leaving the June Nymex contract back under $2 at $1.944. July also fell sharply down to around $2.17, while the balance of summer dropped to around $2.21.

Despite the rerouting of Tetco supplies, total U.S. production remained well off late-November highs and was sitting at around 86 Bcf midweek. In fact, the recent pullback in overall production appears to be tracking EBW Analytics Group’s “steep declines” scenario, with the seven-day moving average of 4.3 Bcf/d from late February levels. Furthermore, with no major revisions to recent production data, dry gas production likely should continue to sink in the near term, with the average closer to 7 Bcf/d.

“As supply continues to drop — and recent production levels appear more likely to decline further than rebound higher — the market may continue to add to recent gains in the near term,” EBW said. Although volatility has been prevalent in the gas market over the past month, a “move higher may appear decisive to algorithms and carry prices higher than fundamentally justified at this time.”

EBW pointed out that the large net short position from two months ago has been largely unwound, but further short-covering and establishment of new long positions by traders foreseeing a sustained move higher could carry Nymex natural gas prices as high as $2.20-$2.32 by later this month.

LNG demand remains a looming concern and stands to limit any upside for near-term prices. More than 30 U.S. cargoes likely have been canceled for June, and some analysts see ongoing cancellations through October as the cost of delivering U.S. supplies overseas is no longer economic.

Poten & Partners’ Jason Feer, head of Business Intelligence, told NGI that the shipbroker has learned of cancellations from those scheduled to lift the cargoes or from those with knowledge of operations at the liquefaction terminals. In all, Poten expects 13 cargoes to be canceled at Corpus Christi, eight at Freeport, six at Sabine Pass and another six at Cameron — all in June — with the potential for more throughout the summer and into fall. There could also be some cancellations at Dominion Energy Inc.’s Cove Point terminal in Maryland.

Other analysts shared similarly bearish views on the global appetite for U.S. cargoes. Goldman Sachs said in a recent research note that domestic feed gas demand has so far trended 800 MMcf/d below expectations for May. The potential for cargo cancellations in June, Goldman said, could reach up to 3 Bcf/d. Tudor, Pickering, Holt & Co. expects up to 4 Bcf/d of cancellations in June.

Meanwhile, Rystad Energy recently noted that global LNG supply is forecast to reach 380 million metric tons (mmt) this year, or 17 mmt higher than in 2019. Demand, on the other hand, is expected to rise only 6 mmt from 2019 to 359 mmt, which is likely to impact suppliers.

“Traders, desperate for information on LNG loadings due to its centrality to Nymex pricing, are focused on LNG cancellation notices,” said EBW. “Given that the 31-cent Dutch Title Transfer Facility premium to Nymex Henry Hub futures for July-September has flipped to a 45-cent deficit over the past month, LNG cargo cancellations may soar.”

In addition, EBW noted that European storage is having difficulties shaving the nearly 800 Bcf year/year surplus, threatening a physical lack of storage capacity to take cargoes. “If announced cancellations pick up as expected, Nymex futures may come under downward pressure.”

With up to 4 Bcf/d of LNG demand potentially remaining in the United States in the coming months, traders also have been mindful of the growing surplus in Lower 48 storage inventories. Coming off an unusually mild winter and robust production growth through the first quarter of this year, stocks are far above historical levels, with a string of hefty injections expected throughout May.

On Thursday, the Energy Information Administration (EIA) reported a 109 Bcf build for the week ending May 1, which compares with the 96 Bcf increase in storage recorded in the same week last year and the five-year average build of 74 Bcf for that week. Broken down by region, the South Central region led with a 48 Bcf build, which included a 31 Bcf injection into nonsalt facilities and a 17 Bcf build in salts.

On The Desk’s social media platform Enelyst.com, Managing Director Het Shah noted the rapid pace in which salt inventories have risen, with stocks now sitting not far below the peak at 331 Bcf. However, with the gas flows being redirected to Midwest and East storage locations following the Tetco blast, Shah expects the salt storage build to be lower.

Elsewhere, the Midwest added 24 Bcf into storage, and the East added 19 Bcf. Pacific inventories grew by 10 Bcf, while Mountain region stocks rose by 8 Bcf.

Total working gas in storage as of May 1 was 2,319 Bcf, 796 Bcf above year-ago levels and 395 Bcf above the five-year average, EIA said.

Permian Basin pricing continued to improve despite other markets across the country seeing two consecutive weeks in the red.

Waha June gas prices climbed 8.0 cents from April 30-May 6 to reach $1.690, a mere 25-cent discount to benchmark Henry Hub, according to Forward Look. The balance of summer at Waha averaged 6.0 cents higher at $1.910, while the winter strip moved up 5.0 cents to $2.530. Waha’s Calendar (Cal) Year 2021 strip also posted a notable gain of 6.0 cents to average $2.280, while Cal 2022 picked up only 1.0 cent to reach $2.01.

Although Waha forward pricing, particularly for 2021, started to rise earlier this year as traders priced in the startup of two planned Permian takeaway projects, improvement picked up steam as oil prices crumbled. The collapse in West Texas Intermediate crude in April that sent prices into negative territory lit a fire under Permian gas prices since any reduction in drilling would inevitably lead to lower associated gas production. Prices have continued to improve ever since.

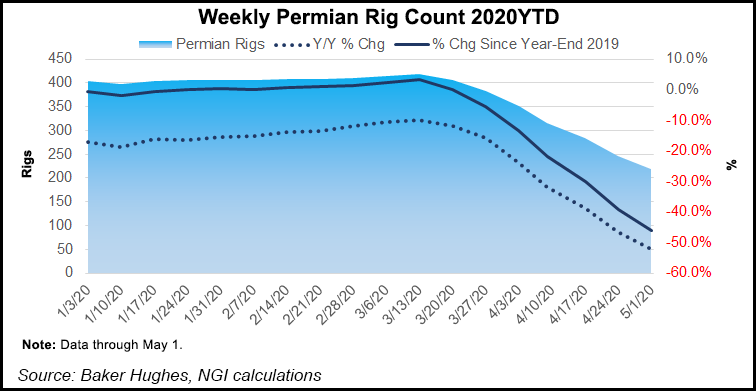

Producers have quickly moved to reduce activity in light of the oil downturn. Enverus shows 13 rigs exiting the Permian during the April 30-May 6 period, with the number of units in the West Texas play now under 200. Baker Hughes Co., which issues weekly reports for every basin, has reported a sharp decline in the Permian rig count. The company’s report on May 1 showed that rigs were down by more than half from a year ago.

With earnings season in full swing, energy operators have painted a sobering picture of what lies ahead for an industry hammered by the double whammy of the oil downturn and the coronavirus.

Occidental Petroleum Corp. joined other Permian-heavy operators in reducing activity in reaction to plummeting demand. Management indicated that second quarter shut-ins are likely to average 45,000 boe/d, with a peak in June of around 75,000 boe/d. Diamondback Energy Inc. said 14 rigs are running today, but by the start of June, the count should be down by four, with more declines thereafter. Only seven rigs are scheduled to be working in 4Q2020.

Parsley Energy Inc. voluntarily shut in about 400 wells in mid-March, mostly verticals, that had oil production of around 1,000-2,000 b/d and expects to curtail up to 23,000 b/d net in May. The company also has suspended all new drilling and completion activity. Meanwhile, Centennial Resource Development Inc. plans to curtail about 40% of its oil volumes this month.

However, CEO Sean Smith was optimistic about the outlook later this year. “Given the potential for near-term shut-in volumes and declining drilling activity by both U.S. and international producers, we believe there is a good chance that oil prices will be higher toward the end of this year.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |