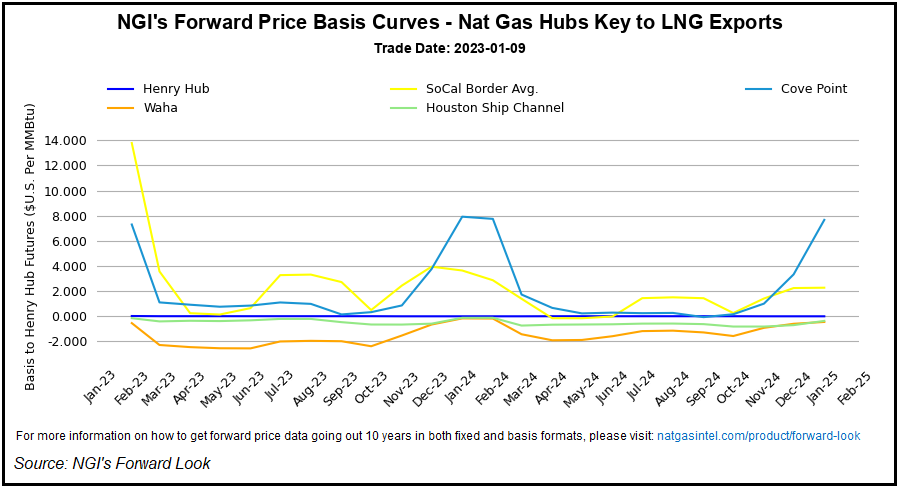

U.S. natural gas prices are off to a rocky start in 2023, and analysts are braced for a choppy ride ahead amid expectations for strong production levels, infrastructure constraints and forecasts for relatively mild weather during the heart of winter.

Limits on American exporters’ collective ability to meet global needs add another layer of uncertainty – given both the protracted Freeport LNG outage and a dearth of new liquefied natural gas facilities this year.

“It’s looking really volatile here to start the year, obviously,” Marex North America LLC’s Steve Blair, senior account executive, told NGI. “We have a lot of factors at play – production, LNG – but ultimately weather will rule, as it almost always does.

“It’s early in the winter. If we get more...