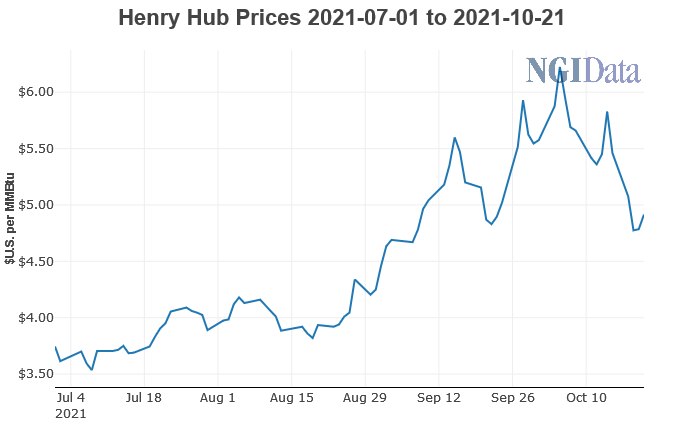

The U.S. natural gas markets are going to see big swings for at least the next year and a half, with production volumes exiting this year at about the same rate as when the year began, according to an IHS Markit expert.

IHS Markit’s Jack Weixel, senior director of the Gas, Power and Energy Futures practice, offered his take about the swings in the global market, as well as the outlook for U.S. pipeline infrastructure growth, at the recent LDC Natural Gas Forums conference in New Orleans.

“I think that volatility is here to stay for a minimum of 18 months,” he told the audience. Domestic gas production this year has been “stagnant…We’re going to basically exit 2021 at the same volumes that we entered it…It takes producers some time to ramp,” and activity has remained...