Global commodity trader Vitol said Tuesday its activity in the energy markets declined last year along with demand as the Covid-19 pandemic raged on.

The world’s top oil trader, and a dominant force in the still-developing liquefied natural gas (LNG) markets, saw both oil and LNG trading fall.

“The extraordinary market conditions in the initial stages of lockdown and sudden drop in demand resulted in huge logistical challenges and market opportunities,” said CEO Russell Hardy of crude activity, which was one of the hardest hit sectors of the global economy last year.

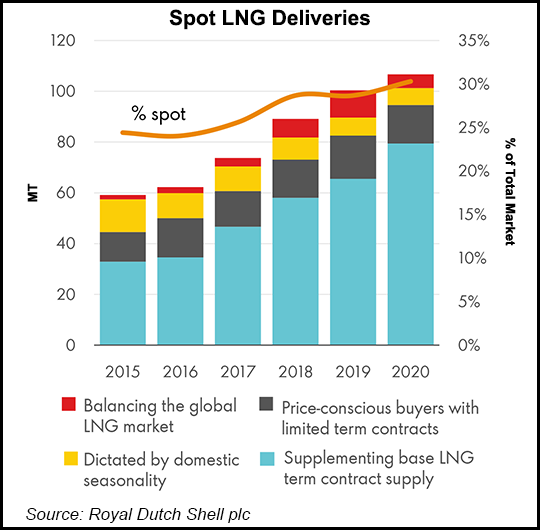

He said the firm anticipates a longer-term shift in energy demand away from liquid hydrocarbons toward power. However, in the medium-term, demand for hydrocarbons such as LNG, natural gas and propane...