With its focus trained on fulfilling natural gas demand on the Gulf Coast and beyond, Haynesville Shale pure-play Vine Energy Inc. is preparing to go public.

The Blackstone Group LP-backed private on Tuesday priced an initial public offering (IPO) for 18.75 million common shares at $16-19 each. At those prices, Vine could raise $328 million in the IPO, with a midpoint market value of about $1.2 billion.

Formerly known as Vine Oil & Gas LP, the Plano, TX-based operator would trade on the New York Stock Exchange under “VEI.” Blackstone would own 73%, according to the Form S-1/A filing with the Securities and Exchange Commission.

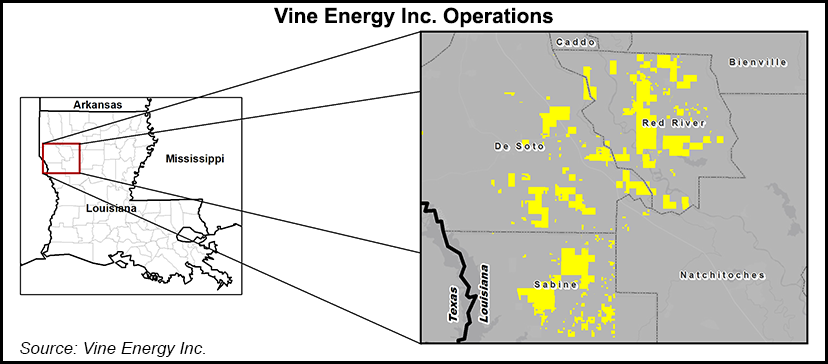

“We are an energy company focused on the development of natural gas properties in the stacked Haynesville and Mid-Bossier shale plays in the...