As U.S. natural gas demand improves, Vine Energy Inc. expects its production in Northwest Louisiana to increasingly be sourced for overseas exports, the company’s CEO said Monday.

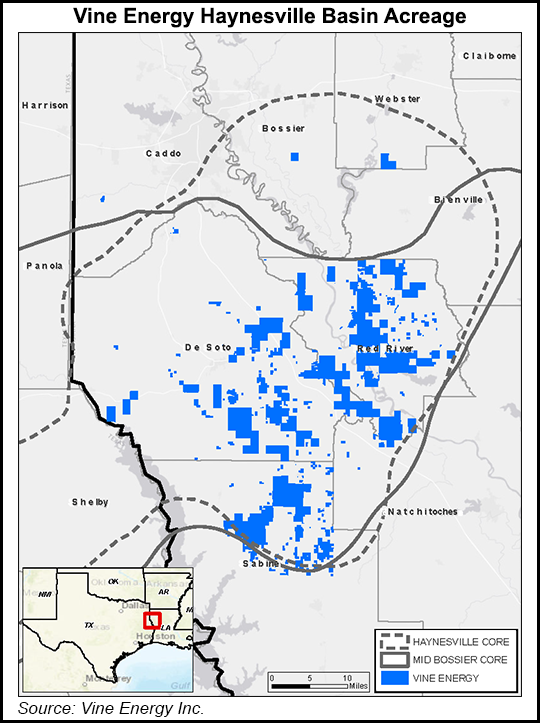

The Plano, TX-based independent in the spring of 2021 took the company public to secure more investor interest in its 227,000 net acre stronghold in the Haynesville and Mid-Bossier shales. Sponsor Blackstone Group LP remains the biggest shareholder.

During a conference call to discuss first quarter performance and the outlook, CEO Eric Marsh, who has led the company since it was formed seven years ago, said the company is looking to be a player in the race to move liquefied natural gas (LNG) overseas.

“Natural gas fundamentals are improving as expected, building a tailwind that will supplement...