Vaca Muerta Showing Signs of Life as Argentina Considers Oil, Gas Incentive Bill

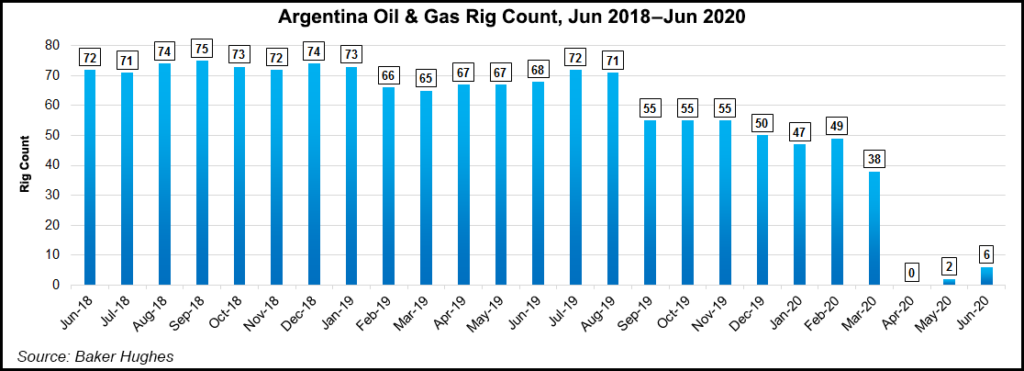

Oil and gas producers working in Argentina continued to increase activity in June, adding four rigs during the month, according to information from Baker Hughes Co.

Argentina had a total of six rigs running in June, compared to two in May and zero in April as the country had strict lockdown measures from the coronavirus pandemic, which has seriously impacted energy demand.

Activity also picked up in unconventional plays in the Vaca Muerta shale formation in western Argentina last month, according to press reports based on information from services company NCS Multistage. There were 196 hydraulic fracturing (fracking) stages completed in Argentina in June, compared to 28 in May and zero in April. By comparison, the country in 2019 saw an average of 700 frack stages per month.

Meanwhile, a bill to spur natural gas drilling in Argentina is “very advanced,” Production Minister Matias Kulfas said in an interview.

After freezing utility rates paid by end users through the end of the year, Argentina is also planning a price floor for natural gas production, similar to the $45/bbl floor established for oil producers.

“Gas prices in Argentina as reflected by tenders to the power generation sector have continued to be close to US$ 2.50/MMBtu, which is not attractive for upstream producers,” Wood Mackenzie analyst Ignacio Rooney, who covers Argentina, told NGI’s Mexico GPI. “Discussions have begun for a scheme for gas set at $3.50/MMBtu to incentivize drilling activity, but nothing has been made official yet.”

Rooney said while activity has picked up “mildly” in gas-rich areas such as Vaca Muerta and Santa Cruz, gas drilling may not return to pre-pandemic levels until the economy comes back.

“Demand needs to recover, and producers need to understand how they will be remunerated when compared to import parity prices,” he said. “The potential new price scheme is intended to begin addressing this last point.”

As a sign of how quickly Argentina’s gas boom has unraveled, Belgian shipping company Exmar said at the end of June it had received a force majeure notice from Argentine state oil company YPF SA for the Tango floating export project, which it chartered last year as a first step toward sending out liquefied natural gas to export markets.

Exmar called the notice unlawful.

“YPF claims that effects of the coronavirus (Covid-19) pandemic both worldwide and in Argentina have hindered YPF’s ability to perform its obligations under the agreements, including but not limited to its ability to pay the invoices due for services performed for the period starting the second half of March 2020,” Exmar said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |