Infrastructure | E&P | NGI All News Access

Utica Activity Slows in Latest BHGE Tally; Overall Rig Count Down 11

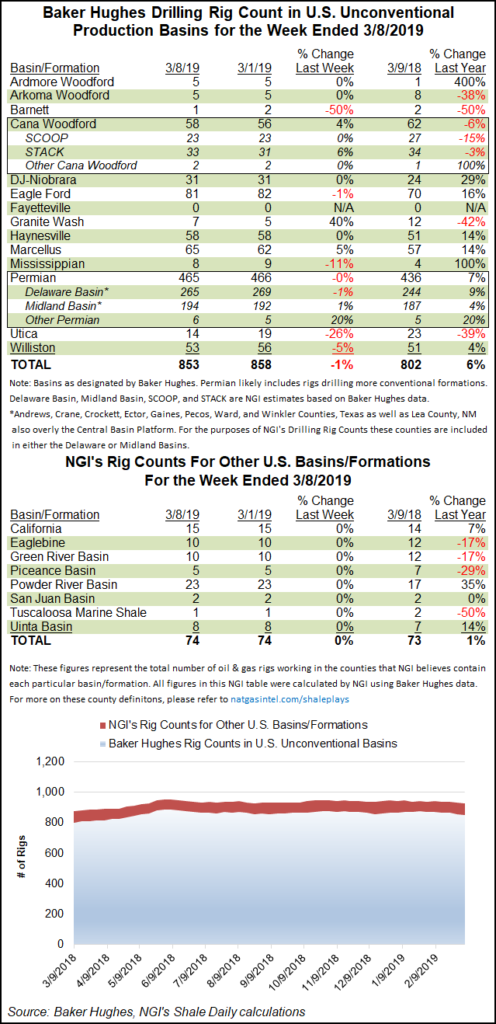

The U.S. rig count fell by 11 to 1,027 units for the week ended Friday (March 8), including a slowdown in Ohio’s Utica Shale, according to data from Baker Hughes, a GE Company (BHGE).

Nine oil-directed rigs packed up shop for the week, along with two natural gas-directed units, leaving the domestic tally 43 units ahead of its year-ago total of 984 rigs.

Directional rigs held flat for the week, while seven horizontal units and four vertical units exited the patch. All of the week’s declines were land-based rigs, with the Gulf of Mexico holding flat at 22, up from 13 a year ago, according to BHGE.

The Canadian rig count dropped 22 units, all oil-directed, to finish at 118, down from 196 in the year-ago period. The combined North American rig count finished the week at 1,216, lagging the year-ago total of 1,257, BHGE data showed.

Among plays, the largest net decline for the week occurred in the Utica, where five units packed up to leave the gassy Ohio play at 14 rigs, versus 23 a year ago. The neighboring Marcellus Shale, meanwhile, added three rigs to grow its count to 65, ahead of the 57 rigs running in the year-ago period.

Also among plays, the Williston Basin dropped three units, while the Barnett Shale, Eagle Ford Shale, Mississippian Lime and Permian Basin each saw one unit pack up for the week. The Cana Woodford and Granite Wash each added two rigs to their respective tallies.

Among states, Ohio unsurprisingly posted the largest decline on the week at five. Alaska saw four rigs exit the patch, while North Dakota, home to the Williston Basin, dropped three and New Mexico dropped two. Pennsylvania gained three rigs, coinciding with the uptick in Marcellus activity.

Also among states, Louisiana and Oklahoma netted one rig each, while Texas dropped one from its overall count.

Unconventional natural gas production in Pennsylvania increased 14.2% in 2018 year/year, exceeding 6 Tcf for the first time and notching the largest annual increase since 2014, according to the state’s Independent Fiscal Office (IFO).

Based on data collected by the Pennsylvania Department of Environmental Protection, unconventional operators produced 6.1 Tcf last year. In the fourth quarter, statewide production was 1.651 Tcf, up 17.7% from the year-ago period and 5% higher than in 3Q2018, when production rose sharply as the second half of the year got underway.

Meanwhile, the West Texas housing market is tight and wages are at their highest level in 12 years, as production continues to rise from the Permian, the hottest play in the world, according to the Federal Reserve Bank of Dallas.

The Dallas Fed, as it is known, in its latest monthly installment of the Permian Basin Economic Indicators said production from the basin is growing while the rig count remains steady. Wages were well above the Texas average in December, and the tight housing market has led to strong home price appreciation, economists said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |