Regulatory | Coronavirus | NGI All News Access | NGI The Weekly Gas Market Report

Using Coronavirus as ‘Excuse,’ Mexico Pushes Through Power Rules Said Damaging to Private Sector

The business climate in Mexico has been hurt by new laws favoring state power company Comisión Federal de Electricidad (CFE) over private sector generators, according to industry participants and analysts.

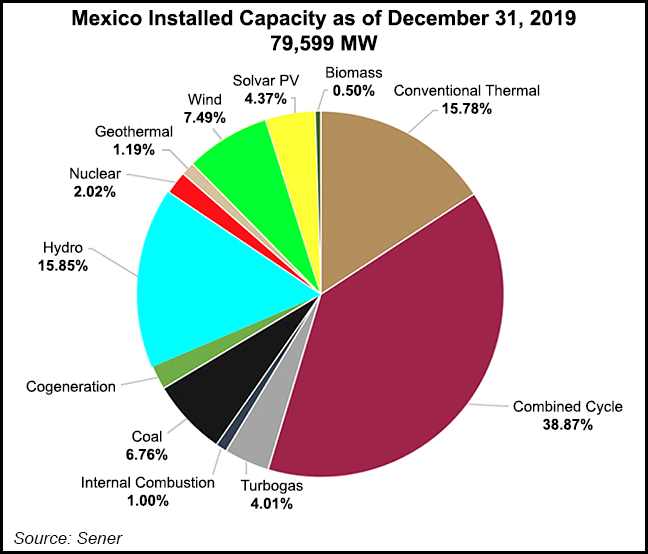

Claiming coronavirus demand destruction has made the electric power system in Mexico unstable, energy minister Rocío Nahle defended new rules published Friday in the Official Gazette that limit the entry of new renewable energy plants into operation and allow the grid operator Centro Nacional de Control de Energía (Cenace) to nominate power dispatch from plants based on reliability and not cost.

“It’s about putting structure into the electrical system,” Nahle said in an interview on Mexican radio station Radio Formula on Monday.

The new agreement guaranteeing “reliability, security, continuity and quality in the national electric system” is beneficial to the power system because it allows for “effective planning” at a time of demand uncertainty, the energy ministry (Sener) said in a statement.

Sector participants exploded against the rules.

The Canadian ambassador to Mexico, Graeme Clark, sent a letter to Nahle on Friday signaling his concern that cancelled auctions, permitting delays, along with new regulation in the energy sector put at risk $450 million in Canadian investment through companies such as Atco, Canadian Solar, Cubico Sustainable Investments and Northland Power.

Representatives from the European Union also sent a concerned letter to Nahle, in which they stated that the new rules would threaten $6.4 billion of investments in clean energy projects.

Nahle, who has prioritized refineries and the oil sector, said on Monday that she would respond to their concerns this week.

“The government is using coronavirus to illegitimately regain market share, without doubt,” Pablo Zárate of Mexico City-based FTI Consulting told NGI’s Mexico GPI.

Members of Mexican business groups Consejo Coordinador Empresarial (CCE) and the American Chamber Mexico agreed, saying in a joint statement that the rules were a violation of the legal framework and could potentially displace any kind of private sector generation project, renewable or not.

“Declaring certain plants as strategic kills competition,” Zárate said. “The electric power system in Mexico operates with an economic dispatch logic.”

Renewable power projects in Mexico won at public auctions during the previous administration were deemed to be among the most cost-competitive in the world.

“These rules, if they are allowed, and we still have to see what happens in the courts, could lead to a change in the makeup of energy in Mexico,” Zárate said. “It impacts all private sector energy in Mexico. This could lead to an important reshuffling in the sector.”

But the rules are also very much in line with changes seen under the administration of Andrés Manuel López Obrador, a firm opponent of the energy reform that opened up the sector to private participation in 2013-14.

López Obrador has blasted the previous administration for weakening CFE and state oil company Petróleos Mexicanos (Pemex). He has also turned his nose up at private investors through the cancellation of the already under-construction international airport, along with other actions in the energy sector such as ending new oil and power auctions and forcing the restructuring of natural gas pipeline contracts.

On Monday morning during his daily presser, López Obrador said that private companies in the renewable energy segment could go to the courts if they felt it necessary.

The news comes at a time of economic hardship in Mexico as the country struggles with the impacts of the coronavirus. Even before the virus, Mexico’s economy had stagnated; now analysts see gross domestic product falling by as much as 10% in 2020.

Zárate said the new rules don’t bode well for the economy in general. “When you are talking about a change that is so important in the regulatory system in a country, that goes against the law, it just generates a lot of doubt in the economy in general,” he said. “The private sector right now is thinking what does this mean for them? How risky is it to do business in Mexico?”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |