NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

Urgently Needed, Key Natural Gas Pipeline Projects Held Up in Mexico

Vast pipeline systems in Mexico crucial to delivering U.S. natural gas production to thirsty markets in Mexico remain stalled with little clarity as to when they might come online.

The 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline, stretching from South Texas to Veracruz in Mexico, set to start for months now, is the most visible of these projects.

The $2.1 billion underwater pipe, a TransCanada Corp. joint venture with Sempra Energy’s Mexico unit Infraestructura Energetica Nova (IEnova), stretches nearly 500 miles through the Gulf of Mexico from Brownsville, TX, to the Tuxpan port in Veracruz state, and was partially invaded by water because of storms last year. In mid-January, TransCanada’s Mexico unit President Robert Jones said that was in the past and he saw startup “in a few weeks.”

Now, Energy ministry Sener said in its latest development update the project should be online this month. But reports in Mexico this week said environmental agency Semarnat has yet to sign off on the use of coastal zones for the project, while the SecretarÃa de Communicaciones y Transportes (SCT) hasn’t rubber-stamped the construction of docking stations and piers in RÃo Tamiahua, in Veracruz.

An industry source told NGI’s Mexico GPI that June is a more likely date for operations to start, echoing the projection given this week by Miguel Reyes, the director general of CFEnergÃa, which is the fuel marketing arm of Mexican state power utility Comisión Federal de Electricidad (CFE).

“We hope that it goes into operation this quarter,” TransCanada Mexico’s Rolando MartÃnez D Meza, business development and marketing manager, told NGI’s Mexico GPI.

The good news is that the 500 MMcf/d interconnection to the main Sistrangas network is complete, which means immediate market access to receive gas imported from the United States when the pipe is up and running.

During a “consulta publica” roadshow that is still ongoing, pipeline operator Cenagas said the Cempoala compressor station had completed the initial phase of its reconfiguration, allowing for gas from the marine pipeline to reach gas-deprived Southeast Mexico, which suffers from recurring gas shortages and power outages.

The pipeline eventually is to connect to the 886 MMcf/d Tuxpan-Tula and Tula-Villa de Reyes pipelines, allowing U.S. gas to flow to industry and power generators in Central Mexico, but both projects are stalled because of community objections and ongoing consultations with government agencies; the exact startup of each remains uncertain.

Originally slated to come online in late 2017, the Sener document has Tula-Villa de Reyes and Tuxpan-Tula online by the end of the year.

The delays are particularly frustrating given absurdly cheap and at times negative natural gas prices in Texas, as well as the fact that cross-border capacity is abundant. Shippers are simply waiting on the start-up of Mexican projects to proceed.

For example, Valley Crossing Pipeline, the U.S. system that feeds the Sur de Texas-Tuxpan line, issued a nomination notice on its electronic bulletin board in early February.

Meanwhile just this week, the U.S. Federal Energy Regulatory Commission gave the go-ahead to the Kinder Morgan Inc. compression project Sierrita, which is to expand cross border capacity allowing for more Permian Basin gas to get into Northwest Mexico.

On the Mexican side of the border, another pipeline system that has seen long delays is the Wahalajara pipeline being built by privately held Mexican developer Fermaca. Once completed, Wahalajara would connect the Waha hub in West Texas to the city of Guadalajara in west-central Mexico.

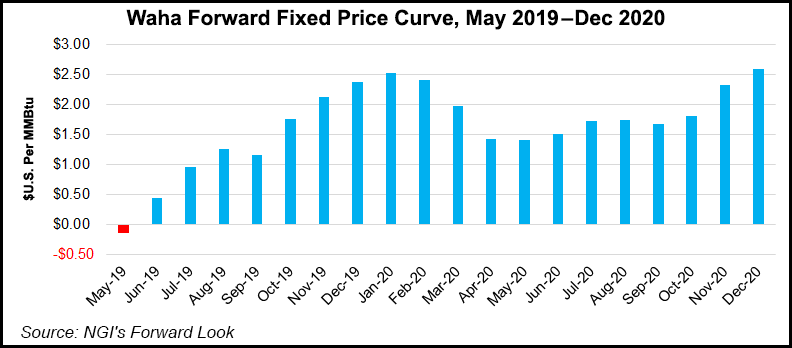

This is particularly urgent given that the Waha hub saw negative natural gas prices last week, and producers were paying consumers to offtake their gas.

“The three intrastate pipelines that were built from Waha into Mexico — Roadrunner, Comanche Trail, and TransPecos — are still underutilized, because of the underdeveloped and delayed pipelines in Mexico,” said NGI’s Patrick Rau, director of strategy and research. “There is just no excess capacity to move gas out of the region right now.”

Wahalajara is set to come online in May, according to the Sener document, though permitting issues continue to hold back progress meaning that the speed at which red-tape advances will ultimately determine the progress of this and other pipeline projects in the country.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |