Markets | LNG | Mexico | NGI All News Access | NGI Mexico GPI

Understanding LNG’s Complex Role in Mexico’s Natural Gas Market — Bonus Coverage

Editor’s Note: NGI’s Mexico Gas Price Index, a leader tracking Mexico natural gas market reform, is offering the following column as part of a regular series on understanding this process, written by Eduardo Prud’homme. This is the second in the series.

Prud’homme was central to the development of Cenagas, the nation’s natural gas pipeline operator, an entity formed in 2015 as part of the energy reform process. He began his career at national oil company Petróleos Mexicanos (Pemex), worked for 14 years at the Energy Regulatory Commission (CRE), rising to be chief economist, and from July 2015 through February served as the ISO Chief Officer for Cenagas, where he oversaw the technical, commercial and economic management of the nascent Natural Gas Integrated System (Sistrangas).

The opinions and positions expressed by Prud’homme do not necessarily reflect the views of NGI’s Mexico Gas Price Index.

Starting with the first liquefied natural gas (LNG) cargo at Altamira, an LNG import facility near Tampico, Tamaulipas, on the northeast coast in August 2006, the supply has taken on a strategic role in Mexico’s energy security.

In an effort to underpin natural gas for power generation in Mexico, state power company Comisión Federal de Electricidad (CFE) anchored the development of the LNG infrastructure and drew up supply contracts at Altamira. Shortly thereafter, the Manzanillo LNG import terminal on Mexico’s Pacific Coast was built, enabling power plants in the area to switch from fuel oil to natural gas-fueled power generation.

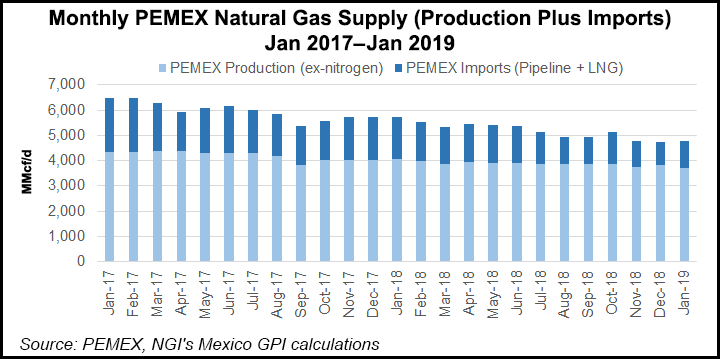

With the Altamira and Manzanillo regasification facilities, LNG imports to both the Gulf and Pacific Coasts of Mexico became an everyday occurrence. By 2011, the dramatic decrease in Petroleos Mexicanos (Pemex) production caused natural gas shortages across Mexico and a series of “critical alerts” were declared. The only viable solution to the shortage was to use regasified LNG as an auxiliary source to ensure consistent supply across the entire natural gas system.

The Altamira LNG import facility’s location on the Sistrangas network, Mexico’s main pipeline system, also made regas injections a powerful tool to improve system pressure conditions in the event of disturbances in gas production along the Gulf Coast.

However, the price differential between the U.S. pricing hub, Henry Hub, and LNG was significant. Consequently, for the Mexican market there were now two types of gas available: a cheap option produced by Pemex or imported from the United States by pipeline, and another more expensive LNG option. Both were needed to maintain supply.

To rectify the situation, regulators defined a way to allocate the cost of the expensive regasified LNG. A “Balancing Adjustment” was created to distribute the cost of the LNG used when production was insufficient — operated by Pemex, regulated by the Energy Regulatory Commission (CRE) and aided by CFE as the largest gas importer into Mexico.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 |