NGI Archives | NGI All News Access

Unconventional Gas to Remain U.S.-Dominated, Says Shell Exec

The development and growth of unconventional natural gas supplies should remain an exclusive domain of the United States, according to a top executive with the energy trading arm of Royal Dutch Shell plc.

Senior Vice President Beth Bowman of Shell Energy North America made the prediction as part of a keynote address Tuesday at the LDC Gas Forum Mid-Continent in Chicago. Global dominance will remain U.S.-based, she said, because it’s unlikely that Mexico’s shale gas resources will be developed anytime soon.

Bowman stressed the U.S. advantage in terms of what she called the “Three A’s” — abundance, acceptability and affordability of domestic unconventional gas supplies. There are more liquid U.S. energy markets and a geologic profile that generally is more accessible than unconventional plays in other parts of the world that tend to be deeper and thinner, said Bowman.

The wide differences in global oil and natural gas prices are likely to remain, she said.

“Don’t expect oil and gas prices to come together anytime soon,” Bowman told the audience. She said technology unlocking tight, coalbed methane and shale gas has more than doubled the supplies now found in the United States from 1,000 Tcf in 1990 and 2,384 Tcf. “At current consumption levels we now have a hundred years worth of natural gas.”

Mexico also has considerable unconventional gas supplies, but political, economic and topographical reasons probably would keep them undeveloped for a long time.

“You will not see the Mexicans developing these resources, and the reasons are both political and regulatory,” Bowman said. “The Mexican government has prohibitions against developing its unconventional gas resources. In addition, the shale is located in arid areas with no water readily available and the supplies are not close to any market centers.

“So, from Mexico’s perspective, it is much better off bringing in low-priced added supplies from the United States,” while it continues to export some natural gas.

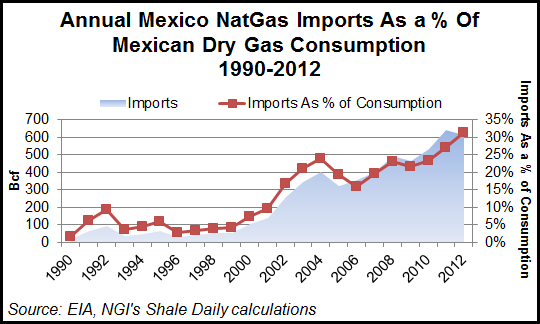

Mexico’s level of gas imports has grown by leaps and bounds over the last 20 years. According to Energy Information Administration data, the country’s annual gas imports grew from 16 Bcf in 1990 to 609 Bcf in 2012.

The situation in Mexico is one example of how the “shale gas revolution” has created a competitive advantage for the United States in global energy markets, Bowman said. “It is one that we will probably enjoy for quite a few years before it catches on elsewhere in the world.”

Bowman thinks the nation needs to take advantage of this competitive edge in every possible economic sector. “It can help get us out of the economic slump we have been in, and our economy will benefit from this from a number of perspectives, including jobs and attract more energy intensive industries back to the U.S.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |