NGI Mexico GPI | E&P | NGI All News Access

Unconventional Development Said to be Future of Mexico Hydrocarbons Industry

If Mexico’s goal is to increase crude and natural gas production, unconventional exploration and development will be required to play a key part, according to a presentation last week by the National Hydrocarbons Commission (CNH).

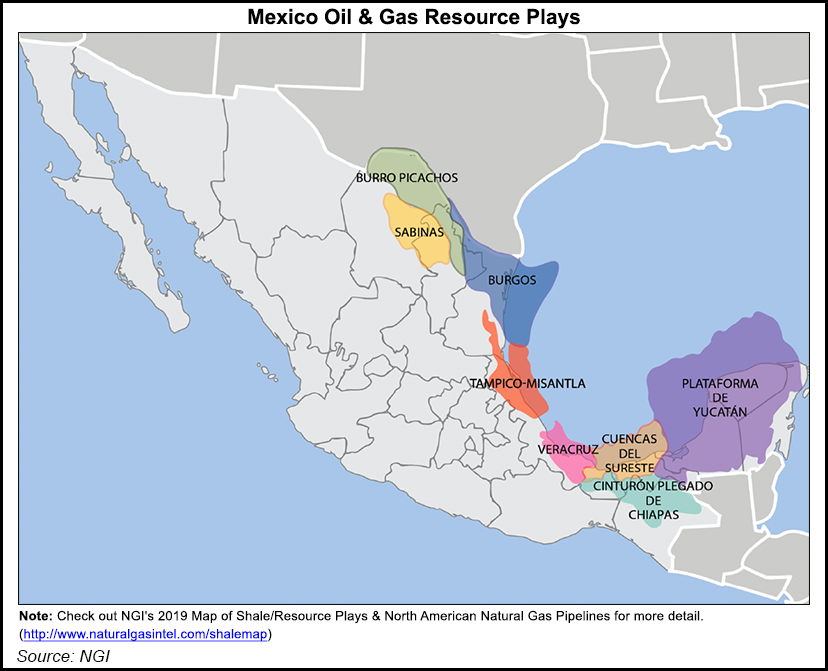

Following a study to update estimates for the country’s prospective hydrocarbon reserves, the CNH concluded that approximately 57% of Mexico’s prospective hydrocarbon reserves are located in unconventional plays, specifically the Burgos, Tampico-Misantla and Sabinas-Burro Picachos areas. Only 43% of Mexico’s prospective reserves are found in conventional plays, down from around 50% as recently as a few years ago, according to CNH Commissioner Alma América Porres.

“Unconventional prospective resources are increasing and are now around 57%, which is relevant for the future of Mexico,” said Porres during the presentation of the study. “A large part of the potential resources that we have in exploration in Mexico are focused in unconventional resources. The message that we are always giving is that they are the future of the hydrocarbons industry in Mexico.”

Porres made her statements following a presentation by Christian Uriel Moya, general director of oil potential evaluation at the CNH, who announced that following an extensive study it was determined that Mexico contains 112.9 billion barrels of crude equivalent in prospective resources, an increase of 100 million barrels compared to a previous assessment. The CNH evaluation found that Mexico contains 48.7 billion barrels of crude equivalent in conventional resources, predominantly in deep water areas in the Gulf of Mexico such as the Perdido belt and Salina basin, with 64.2 billion barrels of crude equivalent in unconventional resources.

“Prospective resources, if we had to define it, means riches that are yet to be discovered,” Sergio Pimentel, CNH Commissioner, said. He added that the study provides “valuable and important information” that can be used to guide to Mexico’s future plans for oil and natural gas in the country.

On Oct. 28, Pemex, Mexico’s state hydrocarbon producer, reported that natural gas output in the third quarter was 3.685 bcf/d, a 131 MMcf/d decrease, or 3.4% decline, from a year earlier.

“This is the result of the natural decline in mature fields and increased fractional water inflow in North, South and Marine regions,” the company said in a statement.

Pemex’s natural gas production did increase slightly by 1.3% compared to the second quarter, the company reported.

The slight increase in prospective reserves is positive for Mexico’s hydrocarbons industry, which has seen significant oil and natural gas production declines in recent years. The country’s natural gas output has fallen each year since 2009, while crude production has declined annually since 2004.

In April, the CNH announced that proven oil reserves fell around 7% as of Jan.1, 2019 compared to a year earlier, down to 7.9 billion barrels of crude equivalent. Proven reserves of natural gas, during the same time period, declined 3.7% from a year earlier to 9.65 Tcf as of Jan. 1.

But the first bidding round to auction off fields for unconventional oil and natural gas development by private companies, which was scheduled for this year, was canceled by the government of Andrés Manuel López Obrador, who has said his administration will not permit hydraulic fracturing (fracking) in Mexico.

“There has been a lot of buzz” around fracking, and it is not clear if the current administration will support it or not, but “most of Mexico’s prospective gas resources require use of this technology to be extracted,” Verónica Irastorza, an industry expert and Associate Director at NERA Economic Consulting told NGI’s Mexico’s GPI. “Furthermore, the bidding round for natural gas exploration and production was cancelled this year, which creates a very unlikely scenario for the development of domestic natural gas production in the near future.”

CNH’s Porres said it is “obligatory to recognize the presence of Mexico’s unconventional resources” in order to recover production losses seen in recent years. She said that horizontal drilling is a reliable technology that has been proven to boost output and provide consistent results in a short timeframe.

According to the CNH, Mexico has more than 32 Tcf of possible (3P) natural gas reserves.

“To put (that) figure into context, there are enough reserves to satisfy 12 years of national consumption and there are still many areas that haven’t been explored,” Irastorza said. Eventual development of these resources “would place Mexico as one of the top countries in terms of natural gas reserves.”

López Obrador reiterated earlier this month that fracking won’t be allowed during his administration and that the possibility has been “dismissed” as it is considered damaging to the environment. With increasing national consumption of natural gas and lowered production, Mexico will continue to lean on U.S. supply to meet local demand.

“It is expected that natural gas demand will keep increasing in the upcoming years” in Mexico, Irastorza said. She cited a study by Mexico’s Centro Nacional de Control del Gas Natural (Cenagas) this year that forecast gas consumption could reach a value of 14.5 Bcf/d by 2024, a dramatic increase compared to current levels.

“What is certain is that gas consumption will have a significant increase in the coming years,” she wrote.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |