NGI The Weekly Gas Market Report | Coronavirus | LNG | LNG Insight | Markets | NGI All News Access

Uncertainty Reigns in Global LNG Market as Coronavirus Lockdowns Persist

Uncertainty continues to mount across the global natural gas market with key buyers from Europe to South Asia sidelined by measures to slow the coronavirus, raising questions about how suppliers across the world will respond to the possibility of an extended downturn in demand as inventories fill.

“While the collapse of liquefied natural gas (LNG) prices towards U.S. production breakevens was foreseeable, the narrative for the rest of 2020 could not be more unpredictable,” said Wood Mackenzie Research Director Robert Sims.

The global market was already oversupplied and has dealt with lackluster demand and falling prices during a mild winter in the Northern Hemisphere. The pandemic has created an unprecedented situation that’s made matters worse. And while analysts expect cargoes to be loaded at near normal levels in the coming months, global inventories could be maxed out by early fall.

Europe had been taking excess cargoes from China earlier in the year, when the virus first broke out in North Asia, but demand has crumbled on the continent since mid-March when the outbreak spread westward. India had been buying opportunistically, but the government shut down the country for 21 days last week, exacerbating the LNG market’s woes.

“Another thing hurting the market is that India tends to be very price sensitive and takes a lot of LNG when prices get low,” said Poten & Partners’ Kristen Holmquist, business intelligence forecasting manager. “And unfortunately, when demand in India isn’t there, that sink for LNG tends to go away.”

India’s LNG imports hit a record high of 2.75 million tons in February, as a number of cargoes were redirected there from the Far East, according to data intelligence firm Kpler. Natural gas demand in India had been growing rapidly, driven primarily by growth in the residential and commercial sectors. Holmquist said during a recent webinar that LNG makes up more than 50% of the country’s gas supplies. She added that the largest number of contracts in India are served by LNG producers in Qatar and the United States.

Poten projects that India’s gas demand will decline by one million tons if the current lockdown lasts only three weeks. If it extends beyond that, the ship broker has forecasted a drop in demand of more than 3 million tons.

“One of the things we try to think about is will three weeks be enough to quell the spread of the disease,” Holmquist said. “In most places, that’s not enough.”

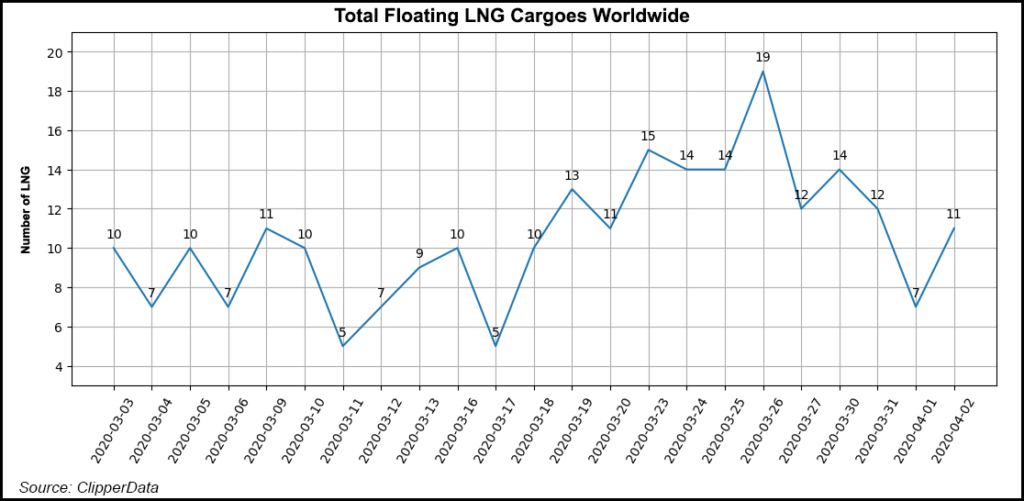

The number of vessels floating with LNG aboard worldwide has again increased as it did in mid-February when China was battling the outbreak. The number of ships on the water is an indication of global demand as vessels slow-steam to find a buyer or wait for rates to pick up.

Key buyers in India declared force majeure last week as they lost the manpower to unload vessels and faced declining demand due to the country’s shutdown. Holmquist said those force majeures were declined.

“What we’ve seen is instead of accepting force majeures, suppliers are working with countries to defer or delay cargoes and to kind of work out a solution in the short-term.”

Kpler said Thursday that 14 vessels were floating worldwide, with three ships still offshore India. That’s down from a peak of 17 vessels at the same time in the prior week, when most were concentrated along Western India. ClipperData also said Thursday that eight vessels were able to discharge in India over the previous seven-day period as delays were worked out. But the situation might get worse.

“An influx of surplus cargoes were sent to Europe in the past months when the virus outbreak was still centered in Asia,” Kpler analysts said late Thursday in a research note. “With the lockdown now taking a big toll on” European gas demand “coupled with high arrivals accumulated over the past months, inventory levels are due to reach tank-top situation and the floating storage situation will likely persist over the next few months.”

Other key buyers in South Asia, such as Bangladesh and Pakistan, have also cut deals to take fewer cargoes in the coming months, namely with Qatar, according to Poten.

Chinese buyers have reemerged as some of the market’s most active buyers in recent weeks as economic activity has started to recover and they look to take advantage of record low spot prices in the region. But some of the country’s largest buyers are still dealing with excess supplies. Moreover, for U.S. LNG exporters, increasing oil and gas demand in China might not matter all that much due to a “transportation cost disadvantage” compared to Middle East suppliers and “ongoing trade tensions,” said ClearView Energy Partners LLC.

The outbreak has continued to push prices in Europe and Asia lower. Since the beginning of the year, the Dutch Title Transfer Facility and Japan Korea Marker have dropped 44% and 57%, respectively, said analysts at Goldman Sachs, adding that “we now see U.S. LNG exports uneconomic to flow for virtually all summer.”

While U.S. LNG shut-ins have been a possibility since European storage began to fill late last year, a more robust supply response might be needed from elsewhere by fall if the market continues to deteriorate.

“At that point, it’s likely that we’ll start to see more extreme needs for shut-downs in locations where we haven’t seen shut-ins before,” Holmquist said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |