Markets | LNG | NGI All News Access

UK’s Rough Natural Gas Storage Closure Likely Positive for LNG Imports

Centrica plc said this week it plans to shutter permanently its Rough natural gas storage facility off the east coast of England after concluding it could not be returned safely to operation. The closure of the largest gas storage site in the UK could lead to more reliance on liquefied natural gas (LNG) imports, analysts said.

The 3.4 billion cubic meter (bcm) storage facility had been shuttered until next spring following concerns about the integrity of wells at the site. Following a battery of tests, Centrica concluded that the facility, now more than 30-years-old, need to be closed permanently.

The shutdown, while not a surprise, could result in a 70% reduction in UK gas storage.

Closing the plant “leaves a big hole in the UK’s security of supply in the future and will no doubt lead to a UK government review of its position,” especially as it negotiates to exit the European Union, aka Brexit, said Wood Mackenzie researchers.

Rough’s main driver every year has been the winter-summer price spread at the UK National Balancing Point. With spreads languishing for several years, “it has become increasingly difficult for Centrica and many other storage operators to even cover their annual operating costs.”

Rough’s age and technical issues also have made it a more expensive facility on average to operate.

Centrica intends to produce all recoverable cushion volumes from Rough, which are estimated at 183 Bcf. But that may take several years.

“Furthermore, the 5.2 bcm (183 Bcf) of cushion gas, which sits in Rough, enabling it to operate at a high pressure, also has significant residual value,” Wood Mackenzie’s team noted. “At today’s prices this has a value of $750 million-plus in the UK market, which on a discounted cash flow calculation will return much higher income than maintaining the facility in place.

“Whilst we would not expect this all to be delivered to the market in one winter, we would expect it to operate like any other depleting gas field reducing production year on year until fully depleted.”

Depending on Centrica gaining full regulatory approval in time, Rough may deliver gas to the UK market for the next few winters as if it were operating as a normal storage facility, but clearly in depleting mode, researchers said.

“From a security of supply perspective, this will give the UK government cause for concern,” said the Wood Mackenzie team. “Historically the UK was self-sufficient in gas and had enough flexibility in its supply to meet all winter requirements. As a result, this left the country with limited storage of only 24 days cover, compared to 105 in France and 100 in Germany.

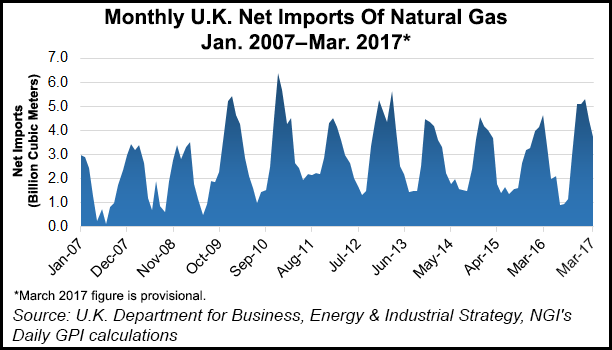

“With Rough closing, this reduces UK storage cover to just 10 days, making it almost totally reliant on winter flows from the continent and LNG imports to balance daily markets.”

Tudor, Pickering, Holt & Co. Inc. (TPH) analysts said because recovering the gas volumes will take time, “this will be negative for gas prices in the short-term since stored gas will be drained and create more volatility in gas prices over the long term (lower summer gas prices and higher winter)…

“We are already seeing increased imports to the UK,” including LNG volumes from Qatar and pipeline gas from Russia and Norway. Those supplies “will likely increase to balance out seasonal winter demand. Britain has seven smaller gas storage sites.”

Wood Mackenzie noted that the closure may not be all bad news for gas supply.

“There are a number of projects that have received their planning permissions and completed designs, but have been frustrated by poor market conditions, plus the reluctance of the UK government to support new investments. With Brexit issues high on the agenda and a perceived threat to UK energy supply security, this may be a good time for a change in policy direction.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |