Shale Daily | E&P | NGI All News Access

UK’s Highlands Signs Farm-In Agreement in Niobrara Shale

Highlands Natural Resources plc, a London-based oil and gas resources company, said it has signed a $500,000 farm-in agreement with Renegade Oil & Gas Co. LLC to drill up to six horizontal wells targeting the Niobrara Shale in Colorado.

Highlands said that under the agreement, it will have the right to drill two wells on the farm-in acreage, located in Arapahoe County, after an initial payment of $250,000 to Renegade. The UK-based company will be required to pay the remaining $250,000 when it starts drilling the third well and will be allowed to complete the remaining four wells immediately afterward.

Highlands will retain a 100% working interest and receive 80% of revenue generated from the wells, with the remaining 20% comprising royalty payments to Renegade and the State of Colorado.

The farm-in agreement is “consistent with Highlands’ opportunistic acquisition strategy,” and that the six wells would target “highly prospective geology under favorable commercial terms,” CEO Robert Price said Monday. “Having studied this opportunity for some time, Highlands’ technical team is confident in the economics of horizontal drilling in the transaction acreage.

“We are already in advanced discussions [with several industry partners] to finance the development of this acreage and I will look forward to updating shareholders in the coming months.”

Highlands said it expects to begin drilling by the end of 2016, but added that it is not obligated to drill any wells until it has secured satisfactory third party financing to fund the drilling and all associated testing, completions and other activities. The company said it would make another announcement regarding financing in the near future.

According to Highlands, the farm-in acreage is adjacent to acreage leased by ConocoPhillips that has been delineated by producing horizontal wells that rank among the most productive in the Denver-Julesburg Basin (see Shale Daily, Jan. 29, 2015). The company said it plans to use ConocoPhillips’ well designs, completion methods and decline curves as analogs for its own wells on the farm-in acreage.

“Conoco has drilled numerous productive wells in its leases north of the farm-in acreage, including wells drilled within the township of the farm-in agreement as well as adjacent townships,” Highlands said. “The majority of Conoco’s nearby horizontal wells with optimized completion techniques produced between 50,000 to 100,000 bbl of oil in their first six months of production.”

Citing data from IHS Inc. and the Colorado Oil and Gas Conservation Commission, Highlands said a well producing more than 50,000 bbl of oil in its first six months would rank among the top 12% of all horizontal wells targeting the Niobrara, based on 2,943 wells with sufficient data as of May.

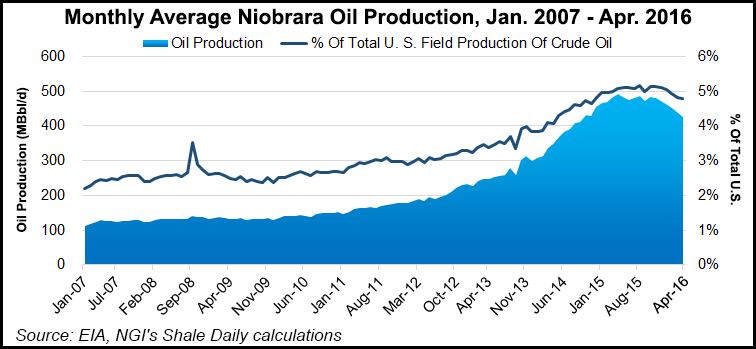

Last week, the Energy Information Administration (EIA) said oil and gas production from the seven largest unconventional plays in the U.S., including the Niobrara, is expected to decline in August (see Shale Daily, July 19). EIA forecast oil production in the Niobrara will be 371,000 b/d in August, compared to 383,000 b/d in July.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |