View more information about the North American Pipeline Map

Background Information about the Uinta Basin

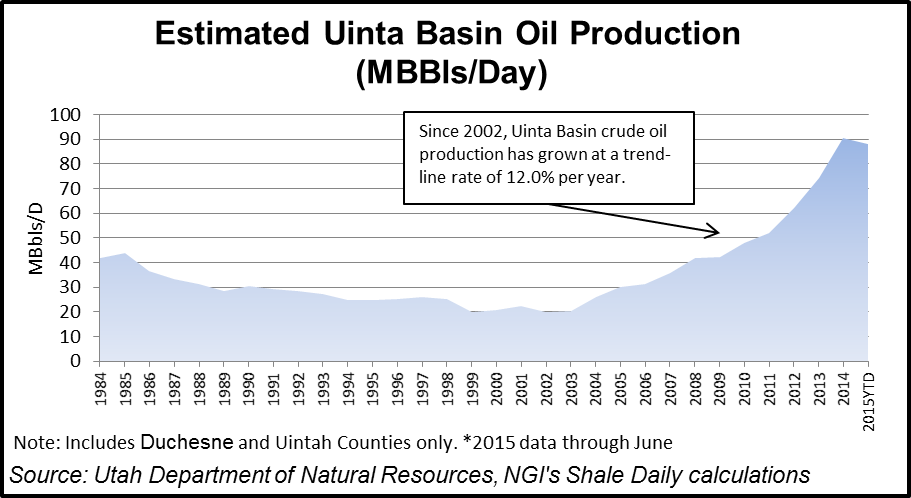

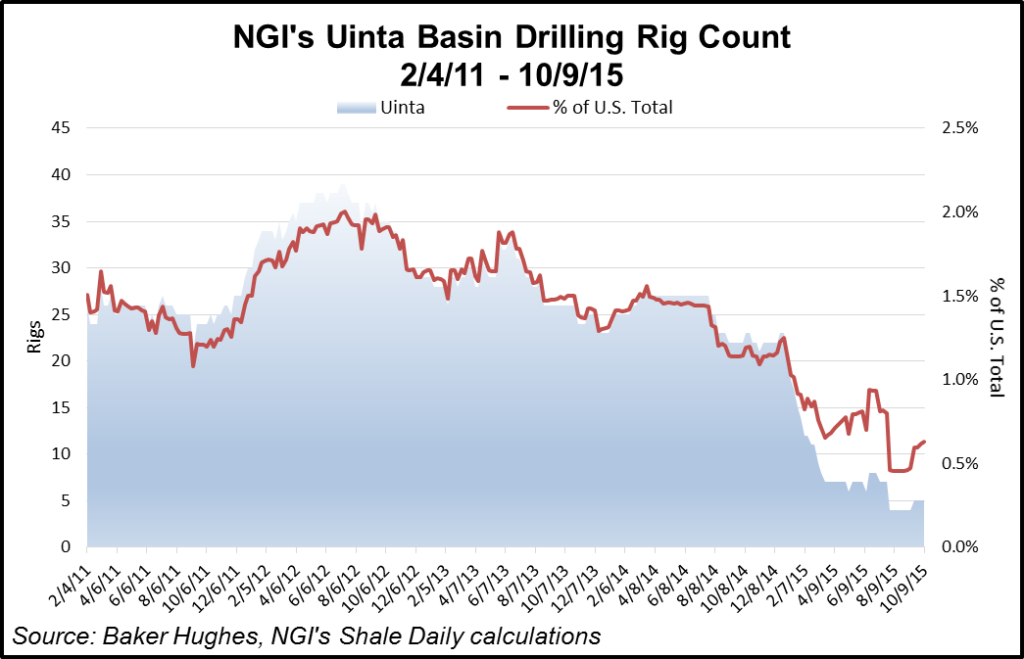

Much like the Permian Basin in West Texas, the Uinta Basin in Northeast Utah, which began producing natural gas and oil in commercial volumes in 1925 and 1949, respectively, has experienced something of a rebirth in recent years. After reaching average daily crude oil production of 44,000 b/d in 1985, annual crude oil fell by more than half, to an average 20,000 b/d in 2002. However, Uinta crude oil production has roared back to life since, rising at a trend-line growth rate of 12% per year through 2014. All this despite the fact that the drilling rig count in the basin has been in a downward trend since peaking at 39 in July 2012, falling to just five in early October 2015.

We believe a large reason for the increase in production despite lower rig activity is that operators have been drilling longer horizontal laterals in the play. For example, Newfield Exploration had drilled and completed eight super extended laterals through September 2014, and had five more that were either being drilled or awaiting completion.

The production growth in the Uinta has been led by a number of companies, including Newfield Exploration (NFX), QEP Resources, Anadarko Petroleum, Crescent Point Energy, Bill Barrett Corporation, Linn Energy, Ultra Petroleum, and Petroglyph, among others. Newfield’s 225,000 acres in the Uinta Basin comprise the company’s largest single asset. NFX’s Greater Monument Butte Unit has drilled 1,900 wells there, 1,500 of which were productive wells in 2015. That constitutes the largest federal land play in the lower 48 states. Bill Barrett at the end of 2014 had reserves totaling 48 million boe, and production for the year of 2.31 million boe. Its stake in the Uinta included 1,537 drilling locations and 199,200 net undeveloped acres. However, the company shut-in approximately 1,000 b/d of Uinta production in the 2Q15 because higher well operating costs there in the face of lower oil and gas prices rendered the area less economic for the company relative to other locations in its portfolio. BBG is currently looking to exit its position in the Uinta in order to focus on its holdings in the Niobrara-DJ Basin.

Similarly, Ultra Petroleum reported their 3Q15 Uinta production volumes were down 7% year-over-year, because of the discontinuation of its Uinta program earlier in 2015. Furthermore, the company noted during its 3Q15 earnings conference call that it would not develop its Uinta properties at then current forward prices.

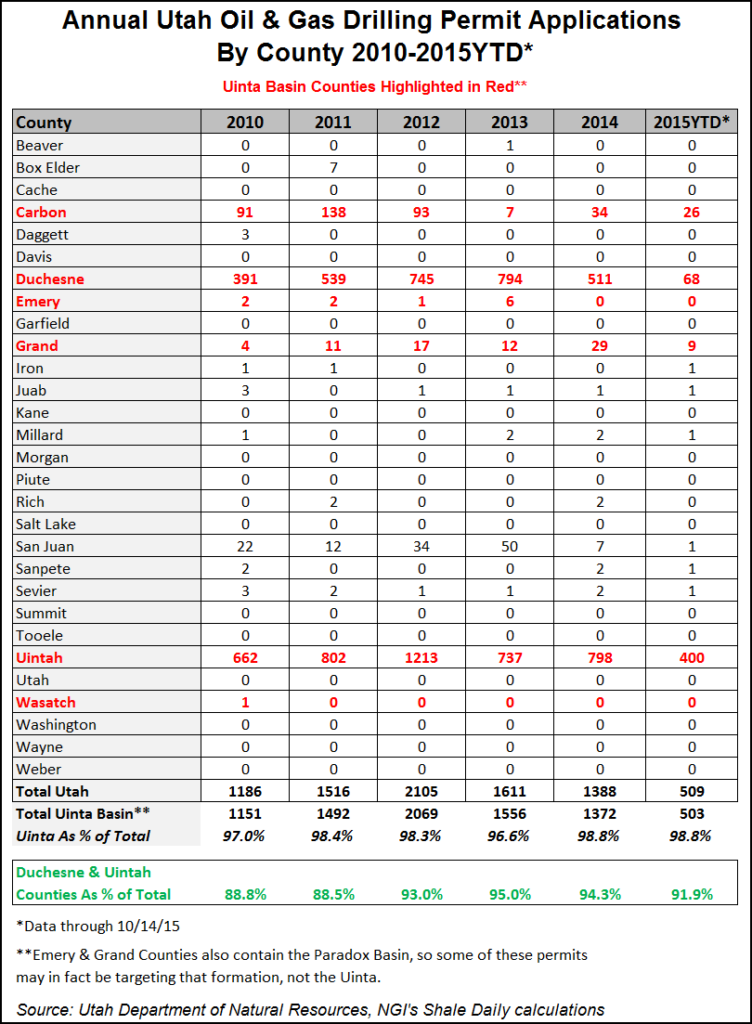

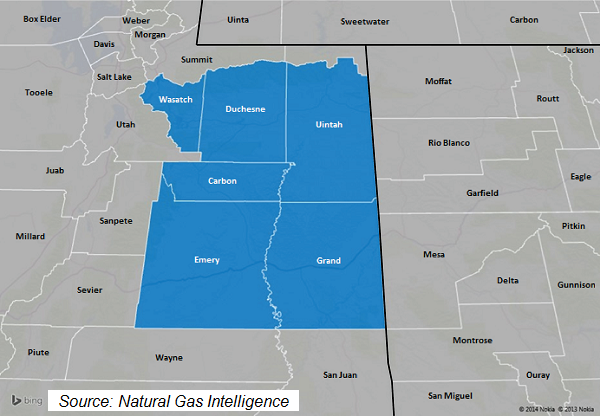

Although the Uinta touches several counties in Utah, the overwhelming majority of recent oil and gas permitting activity in the Uinta -– and in the entire state, for that matter – has been focused in Duchesne (68 through October 2015) and Uintah (400) Counties. As seen in the following table, those two counties have accounted for 89%-95% of all permits received in Utah over the last five-plus years. A few other interesting takeaways from that table:

- It appears overall permitting activity in the Uinta Basin was off somewhat through the first nine-plus months of 2015, totaling 503, compared to 1,372 and 1,556 permits, respectively, for all of 2014 and 2013. Part of the reason for the fall off may be that not all permits received have been included in the Utah Department of Natural Resources database yet, but we believe two other reasons are that operators may be delaying planned activity in the region because of a lack of takeaway capacity, and because of the recent decline in crude oil prices. In 2014, the top producing counties were Uintah (309.9 Bcf), Carbon (60.4 Bcf), and Duchesne (53 Bcf), according to the state Oil, Gas and Mining Division.

- Permitting activity in Carbon County has fallen off a cliff in recent years, moving from 138 permits in 2011, to 93 in 2012, to just 7 in 2013, before rebounding somewhat to 34 in 2014 and 26 through mid-October 2015. There was 36 Bcf of production in Carbon County through Nov. 1, 2015. While the northeastern half of Carbon County is part of the Uinta Basin, the majority of activity in the county is driven by coal bed methane gas that mostly lies outside of the Uinta. CBM in general has fallen on hard times the last few years in the United States, because of lower natural gas prices. Emery County is the other main CBM producer in Utah, and permitting activity there has been virtually non-existent since 2008.

- Grand and Wasatch Counties also contain a portion of the Uinta, but of these two, only Grand County has seen any permitting activity the last five-plus years, and that activity pales in comparison to that in Duchesne and Uintah Counties.

- San Juan County had been the only county other than Duchesne and Uintah to see growth between 2009 and 2013, but permitting activity there has been stifled in 2014-2015, with just 8 combined applications during this time. San Juan County is part of the Paradox Basin. Please see our Paradox Basin section for more information about that area.

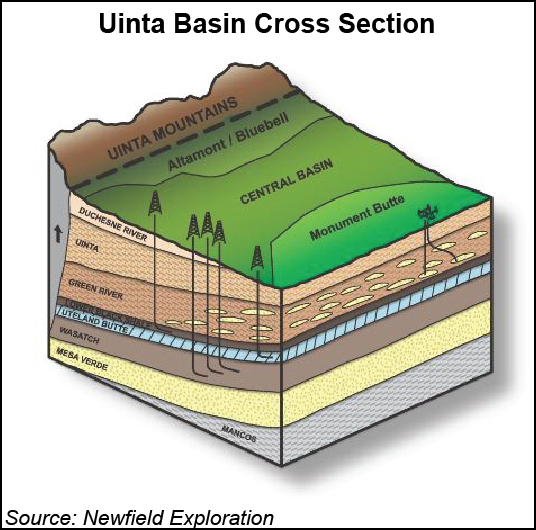

The Uinta Basin is a stacked formation that shows oil and gas pay from intervals ranging anywhere between 1,300’-18,000’, in both conventional and unconventional tight sands and shale formations. Much of the drilling in the area has been and continues to be vertical, although operators have begun drilling horizontal test wells into some of the deeper formations. For example, QEP Resources reported seeing good results from their lower Mesaverde wells during its 3Q15 earnings conference call. Ultra Petroleum agreed that these QEP wells are encouraging, and noted that the success of this formation would add “hundreds” of drilling locations for them.

Operators tend to classify their holdings differently, but current drilling activity in the Uinta can be grouped into three different regions, from North to South: The Altamont-Bluebell, Central Basin, and the Monument Butte. Furthermore, we believe the subsurface geological formations/hydrocarbon systems that drillers are targeting can be boiled down to four main groups, which we describe in the table below:

| Formation/System | Depth | Intervals | Description |

| Green River | 1300’-10000’ | Green River Oil (1300’-6000’), Mahogany Oil Shale (4500’), Douglas Creek (4150’-6000’), Black Shale (5000’-6650’), Castle Peak (5200’-6800’), Uteland Butte (4500’-10000’) | The Monument Butte is primarily a waterflood area that produces shallow Green River Oil. Green River production tends to be black wax. The Uteland Butte is being drilled horizontally. |

| Wasatch | 5800’-10000’ | Colton, Flagstaff, North Horn | Oil target. Production here is mostly yellow wax. |

| Mesaverde | 9000’-12000’ | Mesaverde | More of a gas play, and a combination of liquids rich and dry gas, depending on the field. |

| Deep | 12000’-18000’ | Blackhawk (12000’-13000’), Mancos/Dakota (13000’-18000’) | Focus is natural gas. Drilling here has been fairly limited thus far. |

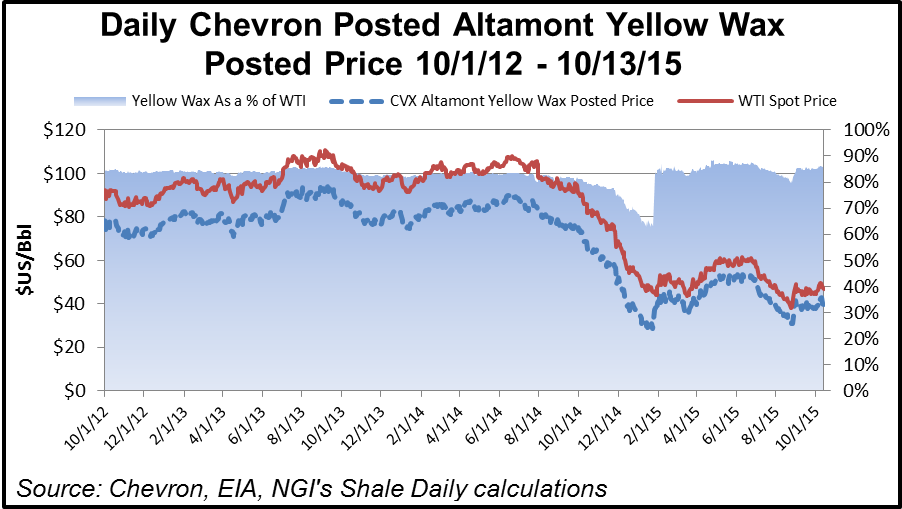

Crude oil from the Uinta tends to contain a large amount of paraffin, which creates several challenges for producers in the area. Waxy oil must remain heated in order to flow, and that tends to restrict (but not eliminate) its ability to be shipped via pipeline or rail. Much of the crude oil produced in the Uinta is transported via trucks, and because trucking is the most expensive form of oil transport, this limits the distance the oil can profitably travel to a refinery. It also affects the price of waxy crude oil. Both “black wax” (32 degrees API) and “yellow wax” (42 degrees API) that are produced in the Uinta tend to trade at a discount. For the twelve months ending October 13, 2015, both grades of wax traded at a 13%-39% discount to WTI prices.

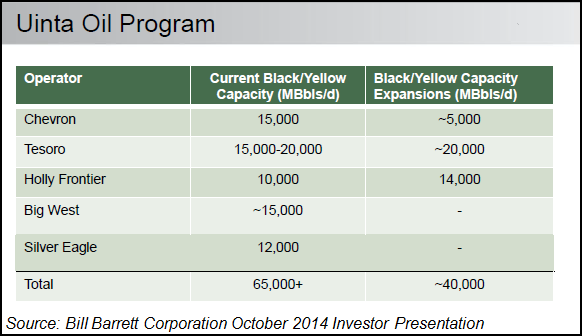

Most oil from the Uinta is refined at the five refineries that are located in the Salt Lake City area. According to Bill Barrett Corporation’s Investor Relations presentation dated October 2014, Salt Lake City refiners have the ability to handle 65+ MBPD of waxy oil, with another 40,000 b/d of planned expansions. We estimate that Uinta crude oil production averaged 83,000 b/d during the first three months of 2014, so that would suggest those Salt Lake City refineries are running at full throttle with respect to the amount of Uinta crude production they can handle. But the excess production is being handled by rail capacity. As Newfield Exploration CEO Lee Boothby noted on his company’s 3Q14 earnings conference call, “we are also encouraged with the significant rail volumes for the Uinta crudes today. For the first time, between 20,000 and 30,000 b/d are leaving the basin, and markets for this valuable product are expanding. We are confident that this will ultimately lead to improved differentials. Newfield’s growth forecast is tied to our takeaway capacity, and we expect that our production will rapidly increase through 2016, as new refining expansions are completed on our behalf.”

Prospects for added rail capacity were derailed in late 2014. Uinta Basin Rail, a proposed 100-mile rail line that would provide service between the Uinta Basin and two national freight lines 50 miles to the south, was dropped despite a coalition of seven counties in eastern Utah securing $55 million in state funding toward the possible construction of the project.

Counties

Utah: Carbon, Duchesne, Emery, Grand, Uintah, Wasatch (although the overwhelming majority of production in the Uinta Basin occurs in Duchesne and Uintah Counties)

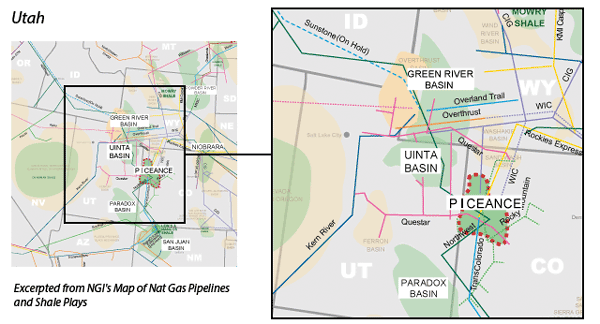

Local Major Pipelines

Natural Gas: Kern River, Northwest Pipeline, Questar, WIC

Crude Oil: Salt Lake Crude (Chevron), Uinta Express

NGLs: Rocky Mountains (Enterprise)

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | San Juan | Power River | Paradox

Shale Daily

Shale Daily