Utica Shale | E&P | Infrastructure | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

UGI’s $1B-Plus Deal for TC’s Columbia Midstream Expands Service for Appalachia E&Ps

A UGI Corp. subsidiary has agreed to pay TC Energy Corp. $1.275 billion to acquire Columbia Midstream Group LLC (CMG), which provides natural gas gathering services in the Marcellus and Utica shales.

UGI, headquartered in Valley Forge, PA, said subsidiary UGI Energy Services, LLC signed a definitive agreement to acquire the equity interests of CMG from the Calgary-based pipeline giant.

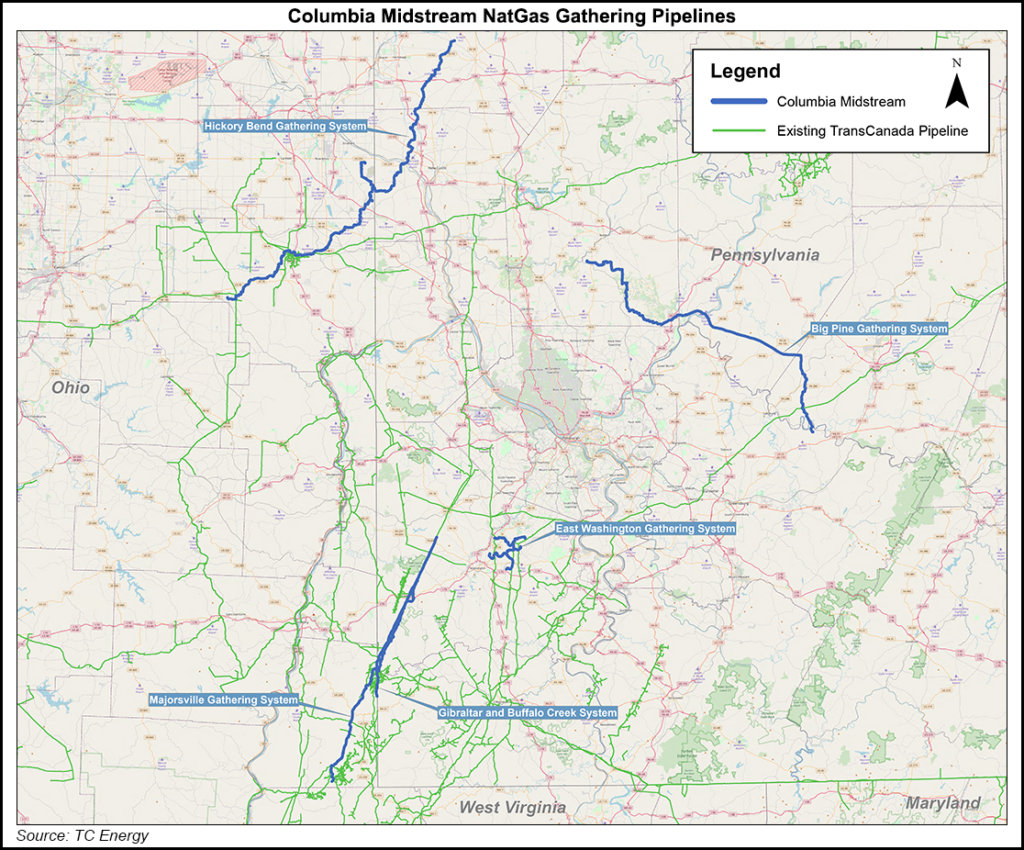

CMG has five gathering systems with capacity of roughly 2,675,000 MMBtu/d and 240 miles of pipeline in the southwestern core of the Appalachian Basin. The acquisition would significantly expand UGI’s midstream portfolio, which it said offers an opportunity to invest an additional $300-500 million over the next five years at attractive returns.

UGI expects the transaction to be neutral to earnings in fiscal 2020 and accretive beginning in fiscal 2021.

“This transaction expands our midstream capabilities in the prolific gas producing region of the southwest Appalachian Basin and provides an initial investment into both wet gas gathering and processing,” UGI CEO John L. Walsh said. “The CMG assets fit nicely into our strategy and further support our long-term commitments to shareholders of 6-10% adjusted earnings per share growth and 4% dividend growth.”

CMG has a “solid portfolio of strategic assets that enhance and build upon our existing business,” UGI’s Robert F. Beard, executive vice president of natural gas said. “We believe this acquisition is a great fit strategically, operationally and culturally, and are excited to welcome the CMG employees to the UGI family of companies.”

The transaction would position UGI Energy Services with assets from northeastern through western Pennsylvania, eastern Ohio, and the panhandle of West Virginia. It would give the unit access to wet gas gathering and processing, and offer procurement opportunities for AmeriGas.

The sale does not include any interest in Columbia Energy Ventures Co., TC’s minerals business in the Appalachian Basin.

“The sale of Columbia Midstream Group advances our ongoing efforts to prudently fund our industry leading portfolio of high-quality natural gas pipeline, liquids pipelines and power generation projects, while maximizing value for our shareholders,” said TC CEO Russ Girling.

With other recent portfolio sales to date this 2019, including the Coolidge assets and partial monetization of Northern Courier oilsands properties, TC expects to realize C$3.4 billion in proceeds.

“When combined with our significant and growing cash flow, access to capital markets and potential additional portfolio management activities, we are well positioned to fund our C$30 billion secured capital program in a manner consistent with achieving targeted credit metrics in 2019 and thereafter,” Girling said.

TC continues to own and operate a network of interstate pipelines in the Appalachian Basin with its Columbia Gas Transmission system, which transports natural gas supply from the production region to markets in the U.S., including liquefied natural gas export facilities.

The transaction is expected to be completed in 3Q2019. Credit Suisse is serving as UGI’s financial adviser and Latham & Watkins LLP is serving as legal counsel. TC retained Wells Fargo Securities to serve as its financial adviser in connection with the sale.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

UGI, headquartered in Valley Forge, PA, said subsidiary UGI Energy Services, LLC signed a definitive agreement to acquire the equity interests of CMG from the Calgary-based pipeline giant.

CMG has five gathering systems with capacity of roughly 2,675,000 MMBtu/d and 240 miles of pipeline in the southwestern core of the Appalachian Basin. The acquisition would significantly expand UGI’s midstream portfolio, which it said offers an opportunity to invest an additional $300-500 million over the next five years at attractive returns.

UGI expects the transaction to be neutral to earnings in fiscal 2020 and accretive beginning in fiscal 2021.

“This transaction expands our midstream capabilities in the prolific gas producing region of the southwest Appalachian Basin and provides an initial investment into both wet gas gathering and processing,” UGI CEO John L. Walsh said. “The CMG assets fit nicely into our strategy and further support our long-term commitments to shareholders of 6-10% adjusted earnings per share growth and 4% dividend growth.”

CMG has a “solid portfolio of strategic assets that enhance and build upon our existing business,” UGI’s Robert F. Beard, executive vice president of natural gas said. “We believe this acquisition is a great fit strategically, operationally and culturally, and are excited to welcome the CMG employees to the UGI family of companies.”

The transaction would position UGI Energy Services with assets from northeastern through western Pennsylvania, eastern Ohio, and the panhandle of West Virginia. It would give the unit access to wet gas gathering and processing, and offer procurement opportunities for AmeriGas.

The sale does not include any interest in Columbia Energy Ventures Co., TC’s minerals business in the Appalachian Basin.

“The sale of Columbia Midstream Group advances our ongoing efforts to prudently fund our industry leading portfolio of high-quality natural gas pipeline, liquids pipelines and power generation projects, while maximizing value for our shareholders,” said TC CEO Russ Girling.

With other recent portfolio sales to date this 2019, including the Coolidge assets and partial monetization of Northern Courier oilsands properties, TC expects to realize C$3.4 billion in proceeds.

“When combined with our significant and growing cash flow, access to capital markets and potential additional portfolio management activities, we are well positioned to fund our C$30 billion secured capital program in a manner consistent with achieving targeted credit metrics in 2019 and thereafter,” Girling said.

TC continues to own and operate a network of interstate pipelines in the Appalachian Basin with its Columbia Gas Transmission system, which transports natural gas supply from the production region to markets in the U.S., including liquefied natural gas export facilities.

The transaction is expected to be completed in 3Q2019. Credit Suisse is serving as UGI’s financial adviser and Latham & Watkins LLP is serving as legal counsel. TC retained Wells Fargo Securities to serve as its financial adviser in connection with the sale.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

CMG has five gathering systems with capacity of roughly 2,675,000 MMBtu/d and 240 miles of pipeline in the southwestern core of the Appalachian Basin. The acquisition would significantly expand UGI’s midstream portfolio, which it said offers an opportunity to invest an additional $300-500 million over the next five years at attractive returns.

UGI expects the transaction to be neutral to earnings in fiscal 2020 and accretive beginning in fiscal 2021.

“This transaction expands our midstream capabilities in the prolific gas producing region of the southwest Appalachian Basin and provides an initial investment into both wet gas gathering and processing,” UGI CEO John L. Walsh said. “The CMG assets fit nicely into our strategy and further support our long-term commitments to shareholders of 6-10% adjusted earnings per share growth and 4% dividend growth.”

CMG has a “solid portfolio of strategic assets that enhance and build upon our existing business,” UGI’s Robert F. Beard, executive vice president of natural gas said. “We believe this acquisition is a great fit strategically, operationally and culturally, and are excited to welcome the CMG employees to the UGI family of companies.”

The transaction would position UGI Energy Services with assets from northeastern through western Pennsylvania, eastern Ohio, and the panhandle of West Virginia. It would give the unit access to wet gas gathering and processing, and offer procurement opportunities for AmeriGas.

The sale does not include any interest in Columbia Energy Ventures Co., TC’s minerals business in the Appalachian Basin.

“The sale of Columbia Midstream Group advances our ongoing efforts to prudently fund our industry leading portfolio of high-quality natural gas pipeline, liquids pipelines and power generation projects, while maximizing value for our shareholders,” said TC CEO Russ Girling.

With other recent portfolio sales to date this 2019, including the Coolidge assets and partial monetization of Northern Courier oilsands properties, TC expects to realize C$3.4 billion in proceeds.

“When combined with our significant and growing cash flow, access to capital markets and potential additional portfolio management activities, we are well positioned to fund our C$30 billion secured capital program in a manner consistent with achieving targeted credit metrics in 2019 and thereafter,” Girling said.

TC continues to own and operate a network of interstate pipelines in the Appalachian Basin with its Columbia Gas Transmission system, which transports natural gas supply from the production region to markets in the U.S., including liquefied natural gas export facilities.

The transaction is expected to be completed in 3Q2019. Credit Suisse is serving as UGI’s financial adviser and Latham & Watkins LLP is serving as legal counsel. TC retained Wells Fargo Securities to serve as its financial adviser in connection with the sale.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

UGI expects the transaction to be neutral to earnings in fiscal 2020 and accretive beginning in fiscal 2021.

“This transaction expands our midstream capabilities in the prolific gas producing region of the southwest Appalachian Basin and provides an initial investment into both wet gas gathering and processing,” UGI CEO John L. Walsh said. “The CMG assets fit nicely into our strategy and further support our long-term commitments to shareholders of 6-10% adjusted earnings per share growth and 4% dividend growth.”

CMG has a “solid portfolio of strategic assets that enhance and build upon our existing business,” UGI’s Robert F. Beard, executive vice president of natural gas said. “We believe this acquisition is a great fit strategically, operationally and culturally, and are excited to welcome the CMG employees to the UGI family of companies.”

The transaction would position UGI Energy Services with assets from northeastern through western Pennsylvania, eastern Ohio, and the panhandle of West Virginia. It would give the unit access to wet gas gathering and processing, and offer procurement opportunities for AmeriGas.

The sale does not include any interest in Columbia Energy Ventures Co., TC’s minerals business in the Appalachian Basin.

“The sale of Columbia Midstream Group advances our ongoing efforts to prudently fund our industry leading portfolio of high-quality natural gas pipeline, liquids pipelines and power generation projects, while maximizing value for our shareholders,” said TC CEO Russ Girling.

With other recent portfolio sales to date this 2019, including the Coolidge assets and partial monetization of Northern Courier oilsands properties, TC expects to realize C$3.4 billion in proceeds.

“When combined with our significant and growing cash flow, access to capital markets and potential additional portfolio management activities, we are well positioned to fund our C$30 billion secured capital program in a manner consistent with achieving targeted credit metrics in 2019 and thereafter,” Girling said.

TC continues to own and operate a network of interstate pipelines in the Appalachian Basin with its Columbia Gas Transmission system, which transports natural gas supply from the production region to markets in the U.S., including liquefied natural gas export facilities.

The transaction is expected to be completed in 3Q2019. Credit Suisse is serving as UGI’s financial adviser and Latham & Watkins LLP is serving as legal counsel. TC retained Wells Fargo Securities to serve as its financial adviser in connection with the sale.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

“This transaction expands our midstream capabilities in the prolific gas producing region of the southwest Appalachian Basin and provides an initial investment into both wet gas gathering and processing,” UGI CEO John L. Walsh said. “The CMG assets fit nicely into our strategy and further support our long-term commitments to shareholders of 6-10% adjusted earnings per share growth and 4% dividend growth.”

CMG has a “solid portfolio of strategic assets that enhance and build upon our existing business,” UGI’s Robert F. Beard, executive vice president of natural gas said. “We believe this acquisition is a great fit strategically, operationally and culturally, and are excited to welcome the CMG employees to the UGI family of companies.”

The transaction would position UGI Energy Services with assets from northeastern through western Pennsylvania, eastern Ohio, and the panhandle of West Virginia. It would give the unit access to wet gas gathering and processing, and offer procurement opportunities for AmeriGas.

The sale does not include any interest in Columbia Energy Ventures Co., TC’s minerals business in the Appalachian Basin.

“The sale of Columbia Midstream Group advances our ongoing efforts to prudently fund our industry leading portfolio of high-quality natural gas pipeline, liquids pipelines and power generation projects, while maximizing value for our shareholders,” said TC CEO Russ Girling.

With other recent portfolio sales to date this 2019, including the Coolidge assets and partial monetization of Northern Courier oilsands properties, TC expects to realize C$3.4 billion in proceeds.

“When combined with our significant and growing cash flow, access to capital markets and potential additional portfolio management activities, we are well positioned to fund our C$30 billion secured capital program in a manner consistent with achieving targeted credit metrics in 2019 and thereafter,” Girling said.

TC continues to own and operate a network of interstate pipelines in the Appalachian Basin with its Columbia Gas Transmission system, which transports natural gas supply from the production region to markets in the U.S., including liquefied natural gas export facilities.

The transaction is expected to be completed in 3Q2019. Credit Suisse is serving as UGI’s financial adviser and Latham & Watkins LLP is serving as legal counsel. TC retained Wells Fargo Securities to serve as its financial adviser in connection with the sale.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

CMG has a “solid portfolio of strategic assets that enhance and build upon our existing business,” UGI’s Robert F. Beard, executive vice president of natural gas said. “We believe this acquisition is a great fit strategically, operationally and culturally, and are excited to welcome the CMG employees to the UGI family of companies.”

The transaction would position UGI Energy Services with assets from northeastern through western Pennsylvania, eastern Ohio, and the panhandle of West Virginia. It would give the unit access to wet gas gathering and processing, and offer procurement opportunities for AmeriGas.

The sale does not include any interest in Columbia Energy Ventures Co., TC’s minerals business in the Appalachian Basin.

“The sale of Columbia Midstream Group advances our ongoing efforts to prudently fund our industry leading portfolio of high-quality natural gas pipeline, liquids pipelines and power generation projects, while maximizing value for our shareholders,” said TC CEO Russ Girling.

With other recent portfolio sales to date this 2019, including the Coolidge assets and partial monetization of Northern Courier oilsands properties, TC expects to realize C$3.4 billion in proceeds.

“When combined with our significant and growing cash flow, access to capital markets and potential additional portfolio management activities, we are well positioned to fund our C$30 billion secured capital program in a manner consistent with achieving targeted credit metrics in 2019 and thereafter,” Girling said.

TC continues to own and operate a network of interstate pipelines in the Appalachian Basin with its Columbia Gas Transmission system, which transports natural gas supply from the production region to markets in the U.S., including liquefied natural gas export facilities.

The transaction is expected to be completed in 3Q2019. Credit Suisse is serving as UGI’s financial adviser and Latham & Watkins LLP is serving as legal counsel. TC retained Wells Fargo Securities to serve as its financial adviser in connection with the sale.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

The transaction would position UGI Energy Services with assets from northeastern through western Pennsylvania, eastern Ohio, and the panhandle of West Virginia. It would give the unit access to wet gas gathering and processing, and offer procurement opportunities for AmeriGas.

The sale does not include any interest in Columbia Energy Ventures Co., TC’s minerals business in the Appalachian Basin.

“The sale of Columbia Midstream Group advances our ongoing efforts to prudently fund our industry leading portfolio of high-quality natural gas pipeline, liquids pipelines and power generation projects, while maximizing value for our shareholders,” said TC CEO Russ Girling.

With other recent portfolio sales to date this 2019, including the Coolidge assets and partial monetization of Northern Courier oilsands properties, TC expects to realize C$3.4 billion in proceeds.

“When combined with our significant and growing cash flow, access to capital markets and potential additional portfolio management activities, we are well positioned to fund our C$30 billion secured capital program in a manner consistent with achieving targeted credit metrics in 2019 and thereafter,” Girling said.

TC continues to own and operate a network of interstate pipelines in the Appalachian Basin with its Columbia Gas Transmission system, which transports natural gas supply from the production region to markets in the U.S., including liquefied natural gas export facilities.

The transaction is expected to be completed in 3Q2019. Credit Suisse is serving as UGI’s financial adviser and Latham & Watkins LLP is serving as legal counsel. TC retained Wells Fargo Securities to serve as its financial adviser in connection with the sale.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

The sale does not include any interest in Columbia Energy Ventures Co., TC’s minerals business in the Appalachian Basin.

“The sale of Columbia Midstream Group advances our ongoing efforts to prudently fund our industry leading portfolio of high-quality natural gas pipeline, liquids pipelines and power generation projects, while maximizing value for our shareholders,” said TC CEO Russ Girling.

With other recent portfolio sales to date this 2019, including the Coolidge assets and partial monetization of Northern Courier oilsands properties, TC expects to realize C$3.4 billion in proceeds.

“When combined with our significant and growing cash flow, access to capital markets and potential additional portfolio management activities, we are well positioned to fund our C$30 billion secured capital program in a manner consistent with achieving targeted credit metrics in 2019 and thereafter,” Girling said.

TC continues to own and operate a network of interstate pipelines in the Appalachian Basin with its Columbia Gas Transmission system, which transports natural gas supply from the production region to markets in the U.S., including liquefied natural gas export facilities.

The transaction is expected to be completed in 3Q2019. Credit Suisse is serving as UGI’s financial adviser and Latham & Watkins LLP is serving as legal counsel. TC retained Wells Fargo Securities to serve as its financial adviser in connection with the sale.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

“The sale of Columbia Midstream Group advances our ongoing efforts to prudently fund our industry leading portfolio of high-quality natural gas pipeline, liquids pipelines and power generation projects, while maximizing value for our shareholders,” said TC CEO Russ Girling.

With other recent portfolio sales to date this 2019, including the Coolidge assets and partial monetization of Northern Courier oilsands properties, TC expects to realize C$3.4 billion in proceeds.

“When combined with our significant and growing cash flow, access to capital markets and potential additional portfolio management activities, we are well positioned to fund our C$30 billion secured capital program in a manner consistent with achieving targeted credit metrics in 2019 and thereafter,” Girling said.

TC continues to own and operate a network of interstate pipelines in the Appalachian Basin with its Columbia Gas Transmission system, which transports natural gas supply from the production region to markets in the U.S., including liquefied natural gas export facilities.

The transaction is expected to be completed in 3Q2019. Credit Suisse is serving as UGI’s financial adviser and Latham & Watkins LLP is serving as legal counsel. TC retained Wells Fargo Securities to serve as its financial adviser in connection with the sale.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

With other recent portfolio sales to date this 2019, including the Coolidge assets and partial monetization of Northern Courier oilsands properties, TC expects to realize C$3.4 billion in proceeds.

“When combined with our significant and growing cash flow, access to capital markets and potential additional portfolio management activities, we are well positioned to fund our C$30 billion secured capital program in a manner consistent with achieving targeted credit metrics in 2019 and thereafter,” Girling said.

TC continues to own and operate a network of interstate pipelines in the Appalachian Basin with its Columbia Gas Transmission system, which transports natural gas supply from the production region to markets in the U.S., including liquefied natural gas export facilities.

The transaction is expected to be completed in 3Q2019. Credit Suisse is serving as UGI’s financial adviser and Latham & Watkins LLP is serving as legal counsel. TC retained Wells Fargo Securities to serve as its financial adviser in connection with the sale.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

“When combined with our significant and growing cash flow, access to capital markets and potential additional portfolio management activities, we are well positioned to fund our C$30 billion secured capital program in a manner consistent with achieving targeted credit metrics in 2019 and thereafter,” Girling said.

TC continues to own and operate a network of interstate pipelines in the Appalachian Basin with its Columbia Gas Transmission system, which transports natural gas supply from the production region to markets in the U.S., including liquefied natural gas export facilities.

The transaction is expected to be completed in 3Q2019. Credit Suisse is serving as UGI’s financial adviser and Latham & Watkins LLP is serving as legal counsel. TC retained Wells Fargo Securities to serve as its financial adviser in connection with the sale.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

TC continues to own and operate a network of interstate pipelines in the Appalachian Basin with its Columbia Gas Transmission system, which transports natural gas supply from the production region to markets in the U.S., including liquefied natural gas export facilities.

The transaction is expected to be completed in 3Q2019. Credit Suisse is serving as UGI’s financial adviser and Latham & Watkins LLP is serving as legal counsel. TC retained Wells Fargo Securities to serve as its financial adviser in connection with the sale.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

The transaction is expected to be completed in 3Q2019. Credit Suisse is serving as UGI’s financial adviser and Latham & Watkins LLP is serving as legal counsel. TC retained Wells Fargo Securities to serve as its financial adviser in connection with the sale.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

Through subsidiaries, UGI operates natural gas and electric utilities in Pennsylvania, distributes propane both domestically and internationally, manages midstream energy and electric generation assets in Pennsylvania, and engages in energy marketing in 10 states, the District of Columbia and internationally in France, Belgium, the Netherlands and the UK.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

UGI, through subsidiaries, also is the sole general partner and owns 26% of retail propane distributor AmeriGas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |