View more information about the North American Pipeline Map

Background Information about the Upper Devonian/Huron Shales

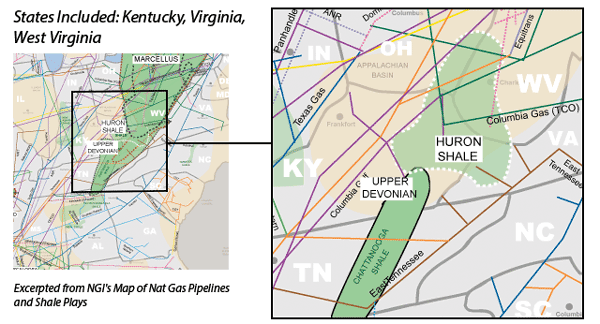

The Upper Devonian Shale (UD) is a stacked interval that is roughly three times as thick as the Marcellus Shale, which sits just below it (the Marcellus is part of the Middle Devonian formation). Intervals within the Upper Devonian include the Cleveland, Dunkirk, Geneseo/Burket, Middlesex, Pipe Creek, and Rhinestreet shales. Most of the early unconventional drilling within the formation has thus far targeted the Geneseo/Burket shales. The UD does not overlie the entire Marcellus. It is situated in Western New York, Western Pennsylvania, Northeast Pennsylvania, Western West Virginia, Eastern Ohio and Eastern Kentucky, with a little overlap in Southwest Virginia and Northeast Tennessee. Furthermore, each of the six major zones do not necessarily appear across the entire UD fairway.

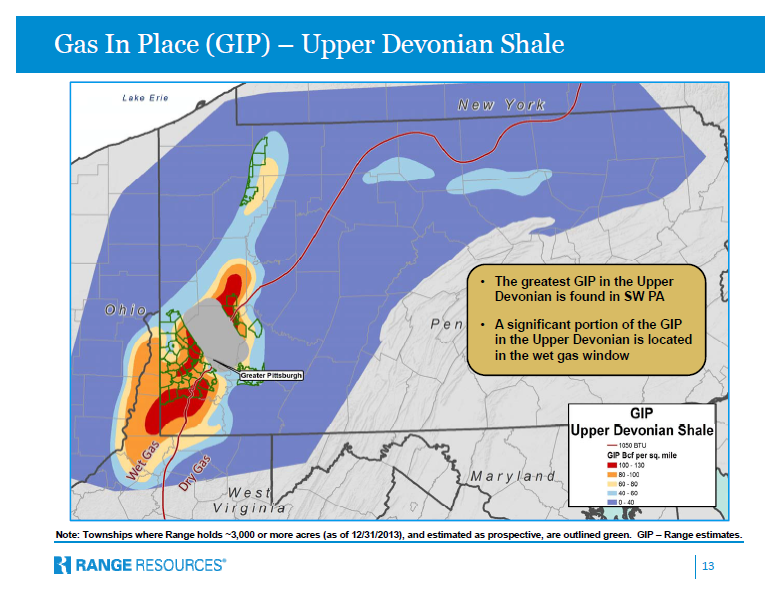

The group of shales within the Upper Devonian have substantial potential. An executive with Range Resources raised some eyebrows in the fall of 2011 when he hypothesized that the UD may hold as much gas as the Marcellus Shale. It will take plenty of drilling to prove that theory, however.

Upper Devonian

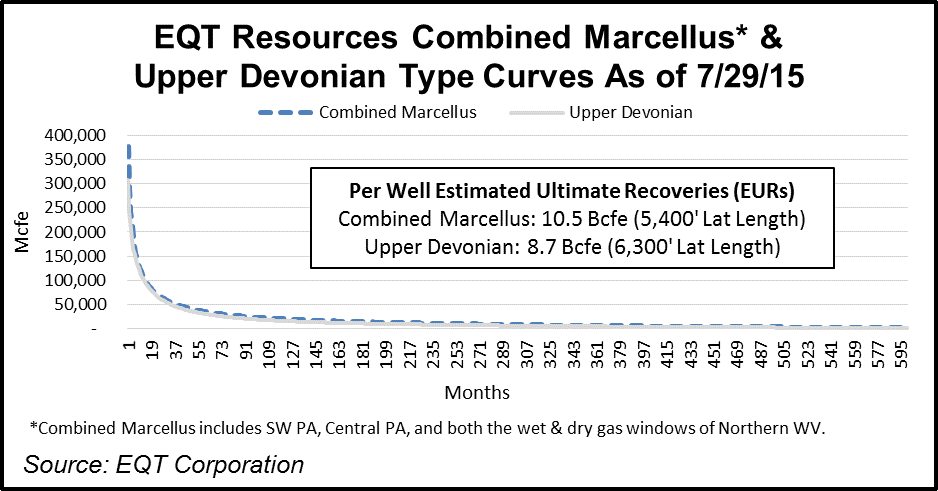

At mid-year 2015, there were about 85 producing UD wells in Pennsylvania, with another 100 or so that were drilled or in the process of completion, according to Gregory Wrightstone of Wrightstone Energy Consulting, who gave an update on the status of the play at an industry conference in Pittsburgh in June 2015 (see Shale Daily, June 29, 2015). That number was up from the 28 unconventional Upper Devonian wells that the Pennsylvania Department of Environmental Protection said were drilled at the end of 2013, when the unconventional industry began to explore the intervals in earnest. Wrightstone added that the average six-month cumulative production of an Upper Devonian well in Northeast Pennsylvania at the time of his presentation was about 530 MMcfe — nearly half the 1.02 Bcfe that a Marcellus well in the same area has been known to produce. Taken together, current well economics, competing supply from the prolific Marcellus and Utica shales, a lack of takeaway capacity and UD acreage that is largely held by production, currently finds Appalachian operators referencing the UD as a thing of the future.

While the industry has worked to identify its ultimate potential — thought to hold roughly 30 Tcf of natural gas — the formation is still a one off, a part of the Appalachian Basin’s stacked pay potential that producers could eventually develop as their operations continue to unfold in the coming years and possibly decades. The formation is more important to some operators than others, and its leading driller to date has been EQT Corp. But the commodity downturn that began in Summer 2014 and showed no signs of abating heading into 2016, has forced operators to look more closely at their portfolios and their capital spending plans.

Entering 2015, EQT had outlined a plan to drill up to 40 Upper Devonian wells. But following a mid-year test of the company’s Scotts Run Utica well in Greene County, PA, that showed an initial 24-hour rate of 72.9 MMcf/d, the company said in August 2015 that it would suspend its UD program (see Shale Daily, Aug. 3, 2015). As of July 2015, EQT had 36 UD wells online and said it would drill 24 more through the remainder of the year before phasing-out the program in early 2016.

“Given the extraordinary results of our first dry Utica well, we are accelerating our efforts in Greene County,” said EQT President of Exploration and Production Steven Schlotterbeck. “Our focus is on creating a capital efficient, dry Utica development plan that leverages existing pads, existing gathering infrastructure and takeaway capacity. Consequently, we have reevaluated our competing investment opportunities and made a strategic decision to phase-out our Upper Devonian drilling program.”

Other leading UD drillers have shared similar views since delineation in the deep dry Utica of Southwest Pennsylvania and West Virginia began in 2014. Consol Energy Inc. tested a deep Utica well in Westmoreland County, PA, in 2015 at more than 60 MMcf/d (see Shale Daily, July 29, 2015). Range Resources Corp. had similar results in nearby Washington County, but that company continues to maintain that neither the Utica nor the UD can compete with its low-risk, high-quality Marcellus Shale assets (see Shale Daily, Oct. 29, 2015).

“We run economics on every pad and they really all compete for capital. We certainly, in the last month, have received information that tells us the deep dry Utica is now a higher rate of return than what we have anticipated,” said Consol Vice President of Gas Operations Craig Neal in an interview with NGI shortly after the company announced its deep Utica test results (see Shale Daily, Aug. 25, 2015). “We have to get the costs down, but we expect to do that, and I think you will see dry Utica displace both the Marcellus and Upper Devonian drilling. But we have some attractive prospects in the Marcellus and Upper Devonian, as long as we are combining them with Marcellus or a recomplete. I don’t want you to think those are not attractive. It’s just that these [Utica wells] are likely better.”

Early results have demonstrated that the UD’s hydrocarbon content mirrors that in the underlying Marcellus, according to industry interviews in 2014 after more wells started coming online (see Shale Daily, April 28, 2014). “We have four wells tested so far around our [Washington County, PA] acreage with that dry and wet gas showing itself, and we’re encouraged by the tests we’ve conducted through the years,” Range’s Vice President of Engineering Technology Joe Frantz told NGI. “One of the things is that we have so much Marcellus acreage to develop and we know the Upper Devonian is there. Once we’re ready to go after it, it’ll be one of those things we co-develop down the road.” The UD tends to be gassy where the Marcellus is gassy, and more liquids-rich in those areas where the Marcellus features higher btu gas. For example, Rex Energy Corp. has said its horizontal Upper Devonian (Burket Shale) and Marcellus wells in Butler County, PA both contain 40% liquids in western Pennsylvania where the Marcellus has tended to be wetter.

The economics of future UD wells will no doubt improve somewhat as operators ascend the learning curve, and by the fact that many UD wells can be drilled from existing Marcellus well bores. That will save money on things like site preparation and water management. “It’s true that companies have been evaluating the Upper Devonian and looking at the intervals for a while now; it’s a shallow, easy target. Here’s the difference where people sometimes get confused: when you talk about multi-play stacked laterals, we’re talking about economies of scale,” said Consol Energy Inc.’s Director of Engineering for Gas Operations Andrea Passman in a 2014 interview with NGI about the UD’s long-term potential and its link to Marcellus wells. “You’re adding something that wouldn’t have worked previously on its own. The economics have changed, there’s no separate factors and you’re not incurring the additional costs associated with construction of all those different pieces that burden a well.”

HURON

We have included the Huron Shale for completeness, but this formation has not been much of a priority for many of the large-, mid- and small-cap producers that have come to characterize the nation’s shale boom in recent years. In 2012, for example, EQT, which was once a leading operator in the Huron, announced it was suspending its drilling in the play indefinitely because of low natural gas prices. EQT drilled 236 horizontal Huron Shale wells in 2010, 115 in 2011, and only 7 in 2012. It resumed drilling in the Huron in 2014, with plans to drill 120 wells. It has since suspended those operations again.

According to the U.S. Energy Information Administration, the Huron Shale, which it calls the Devonian Big Sandy Shale Gas Play, includes the Huron, Cleveland, and Rhinestreet formations within Eastern Kentucky, Western West Virginia, and Southwest Virginia. It is a mixture of shale, tight sands, and coalbed methane gas. Most of the Huron wells lie at depths between 2500’ – 6500’. Given those depths, drilling the formation requires far less water and additives, said Kentucky Oil and Gas Association Executive Director Andrew McNeill in a July 2015 interview about other emerging horizons in the state, such as the Rogersville Shale. He added, however, that the Huron still accounts for a significant portion of his state’s oil and gas development, saying it remains the bread and butter target for many smaller operators in the region.

Huron Counties

Kentucky: Boyd, Breathitt, Carter, Clay, Elliott, Estill, Floyd, Greenup, Harlan, Jackson, Johnson, Knott, Knox, Laurel, Lawrence, Lee, Letcher, Lewis, Leslie, Magoffin, Menifee, Martin, McCreary, Morgan, Owsley, Perry, Pike, Powell, Pulaski, Rockcastle, Rowan, Wayne, Whitley, Wolfe

West Virginia: Boone, Cabell, Calhoun, Clay, Fayette, Jackson, Kanawha, Lincoln, Logan, Mason, McDowell, Mingo, Putnam, Raleigh, Ritchie, Roane, Wayne, Wirt, Wood, Wyoming

Virginia: Buchanan, Dickenson, Lee, Scott, Wise

Local Major Pipelines

Natural Gas: Columbia Gas Transmission, Dominion Transmission, Empire Pipeline, Equitrans, Leidy Hub, Millennium, National Fuel Gas, Tennessee, Texas Eastern Transmission, Transco

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily