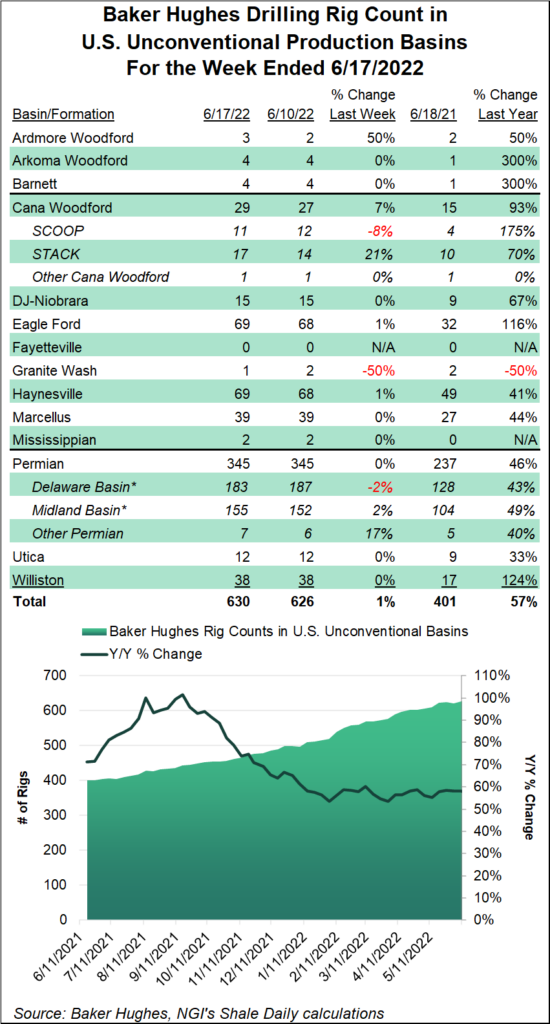

The U.S. rig count climbed seven units to 740 during the week ended Friday (June 17) on a combination of gains in both oil- and natural gas-directed drilling, according to the latest numbers from Baker Hughes Co. (BKR).

Four oil-directed rigs and three natural gas-directed rigs were added in the United States for the week, putting the combined domestic count 270 units ahead of its year-earlier total of 470.

Six rigs were added on land, while the Gulf of Mexico count increased by one to end at 15 for the period. Domestic drilling gains included six horizontal rigs and one directional rig, according to the BKR numbers, which are partly based on data from Enverus.

The Canadian rig count, meanwhile, rose 15 units to end the week at 156, up from 117 in the year-ago period. Gains...