E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Rig Decline Said Near Bottom, with ‘Slow, Methodical Recovery’ to Year’s End

The decline in the U.S. oil and natural gas rig count may be close to a bottom, and the current commodity strip could allow activity to grind higher, according to Raymond James & Associates Inc.

Analysts Praveen Narra and Kirk Presley Sr. in a note to clients said most of the pain of the downturn related to Covid-19 and slumping prices “has already been felt, with the current commodity strip allowing for activity to bottom and start to grind higher.” The soon-to-come bump, however, likely would be weighted to completions as exploration and production (E&P) operators draw down their drilled but uncompleted wells, aka DUCs.

“However, we should not be expecting any significant near-term jump in activity as E&P budgets are likely set for the second half of 2020, with focus on free cash flow generation,” Narra and Presley said. “As such, a slow, methodical recovery is likely.”

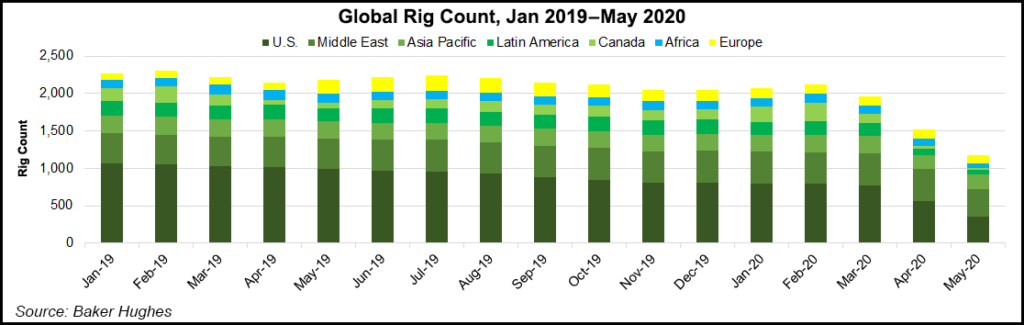

As of last Friday (July 10), the U.S. rig count stood at 258, according to Baker Hughes Co., down 700 units from 958 at this time a year ago. The U.S. tally has tumbled 535 rigs since mid-March.

The incremental gains in activity should be more evident in 2021, according to Raymond James. Longer term, analysts are forecasting a global oil shortage, “particularly in 2022. This will mean that U.S. oilfield activity can return to 2019 levels eventually.”

Strip prices are more supportive today than two months ago, but U.S. upstream capital spend for 2020 still is down more than 50% year/year, they noted. That means the rig count recovery is unlikely to recover as quickly as it has in previous downturns.

“We expect the U.S. rig count can recover from a bottom near 250 before averaging 420 in 2021,” Narra and Presley said.

On average, the United States could see the rig count rise to around 270 by year’s end, they said. To rebalance the oil market by 2022, the domestic rig count “would need to average 475 rigs in 2021 and an even larger 900 rigs in 2022.”

The Raymond James commodity outlook sees global oil inventories tightening, which should send oil prices higher in the second half of 2021, breaking $60/bbl for West Texas Intermediate crude.

“Under this scenario, we expect E&Ps will react to this price signal, and increase activity to grow oil production in 2022,” the analysts said. “In this forecast, the rig count will accelerate, allowing for 475 rigs in 2021, a 12% increase over 2020, and a fiscal year 2022 average of 900, or a 90% increase in 2022.”

The DUC backlog built this year could give E&Ps “an abnormally large backlog to complete in 2021 and 2022,” allowing oil production to grow “without an additional rig being sent into the field (or at least E&Ps could stem production declines).”

There are valid arguments to be made about future U.S. oilfield services activity, according to the Raymond James team. Some predict the rig count may never reach 2019 levels again, and it could be slower if E&Ps commit to actual capital discipline. In addition, there could be a “lack of infrastructure, labor and capital” for oilfield services.

However, the global oil market still is expected to be 2.5 million b/d undersupplied in 2022, with the Organization of the Petroleum Exporting Countries holding “zero spare production capacity,” analysts noted.

Raymond James is modeling that demand would slowly recover from Covid-19 and return to 2019 levels by 2022, thereby achieving modest growth.

“Thus, with this level of undersupply, and while E&Ps will certainly react slower to price signals than in the past, we do believe that the U.S. oilfield will remain a critical component of incremental oil supply.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |