Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Rig Count ‘Inflection Point’ Possible as Permits Near Pre-Downturn Levels, Says Evercore

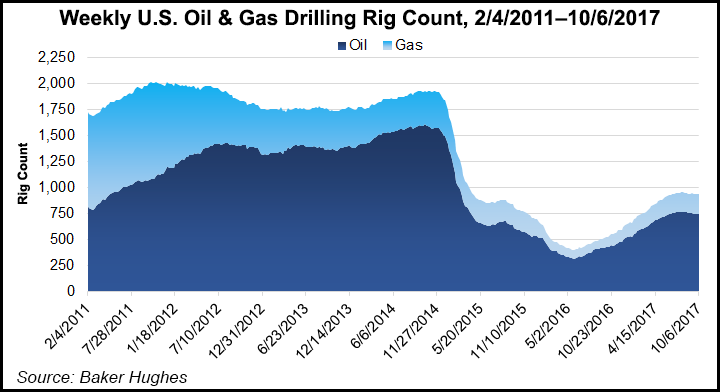

The domestic rig count could be nearing an inflection point as the current tally of weekly average drilling permits approaches 2014 levels, driven by higher commodity prices and “a strengthening macro outlook” for the industry, according to analysts with Evercore ISI.

In its monthly tally of U.S. drilling permits, Evercore counted 4,728 total permits in September, a 42% sequential increase and a 66% increase over year-ago levels. Year-to-date, 2017 drilling permits have already exceeded full-year 2016, driven by year/year increases in Texas (63%), Oklahoma (56%), North Dakota (35%) and Louisiana (21%), the analyst team, led by James West, wrote in its monthly report.

At 1,001, the four-week trailing average “has eclipsed the 1,000-permit mark for the first and only time since we began aggregating weekly data in January 2015. The recent momentum is warranted by improving commodity prices and strengthening macro outlook.” That the average is now approaching 2014 levels “means a sharp rig count inflection could be in the cards,” Evercore said.

There’s still some wariness surrounding the strengthening outlook, however, based on a number of high-profile exploration and production (E&P) companies guiding for a pullback in fourth quarter drilling capital expenditures, according to Evercore.

“Perhaps prior fears of a considerable rig count pullback are still influencing the way the market is reading the discrepancy between communicated rig releases and a permit count that continues to march toward pre-downturn highs,” Evercore said. “Marrying the two through a more conservative lens, we believe that recent permitting strength will serve to at least stabilize the rig count, with continued commodity strength driving incremental rig count growth through year end.

“Combined with what is anticipated to be a strong winter drilling season in Canada, this makes for perhaps the best fundamental setup that” the North American oilfield services industry “has seen in three years.”

Month-to-date activity in October points to continued momentum for U.S. onshore activity, with 1,069 permits filed through last week (Oct. 6). The current pace would see domestic onshore permitting total more than 4,200 for October, which with September, would make the first back-to-back months of 4,000-plus permits since 4Q2014, the analyst team said.

“With commodity prices stabilizing at or above $50/bbl, we continue to believe that even if the large public E&Ps dial back drilling in 4Q2017, permit trends suggest that the rig count will continue to grind higher as smaller players beef up their drilling programs. In recent weeks, we have also begun to hear rumblings of perhaps more severe shale execution challenges than previously purported. In our view, what this would imply for services (and what has been reflected in the permit counts) is that aggregate growth targets cannot be met with the current rig count” even assuming a drawdown in drilled uncompleted wells.

A complete tally of 3Q2017 drilling permit activity is now on record, and gas-focused shale basins, along with the Bakken Shale and Niobrara formation, drove a 10.6% quarterly increase in U.S. drilling permits. U.S. shale/unconventional permitting grew 12.1% sequentially, while “conventional/other” permitting activity declined 2.3%, Evercore said.

By play, sequential permit growth was seen in the Haynesville (6.6%), Marcellus (11.6%) and Utica (14.4%) shales, while gains in the Bakken (26.4%) and Niobrara (44.1%) were enough to offset “quarterly weakness” in the Eagle Ford Shale and Permian Basin.

Among states, declines were seen in September by Oklahoma (down 4%), Alaska (down 50%) and Michigan (down 10%), offset by gains in California (111%) and Pennsylvania (113%).

However, the drilling permit numbers continue to show Texas at the center of onshore activity.

“Texas permitting exhibited a 9% sequential increase on the back of a 19% increase the month before,” analysts said. “With over half of the working U.S. oil rigs, Texas continues to be the single most important state in terms of evaluating the magnitude and direction of U.S. permitting trends.”

In the Gulf of Mexico, Evercore counted 15 permits for September, up from eight in August and a 50% year/year increase, driven by shallow water (five) and midwater (six) permits. Four deepwater permits were filed in September.

“The sharpest decline from the 2014 peak has come from shallow water permitting, down 94% in 2017 from year-to-date 2014,” said analysts. “We believe that offshore drilling (and specifically jackup utilization) is starting to turn the corner, but continued attrition/consolidation will be critical in supporting slowly-improving permit and drilling activity.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |