U.S. Rig Count Drops Two NatGas, Two Oil to End at 936

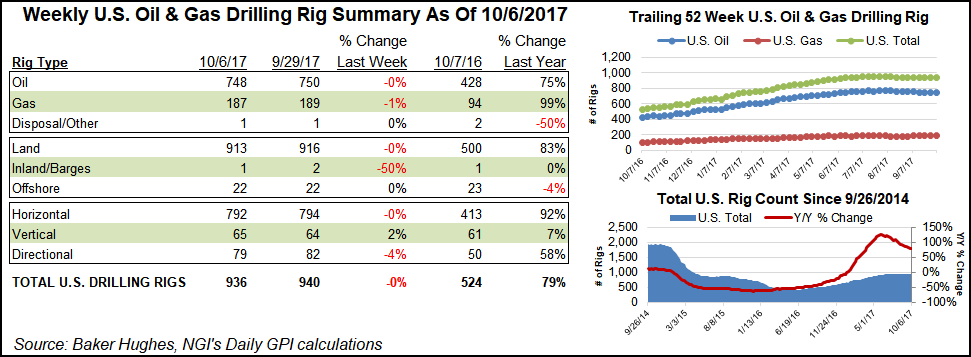

Giving up gains from the previous week, the U.S. rig count fell by four, including two natural gas-directed units, according to the latest tally from Baker Hughes Inc. (BHI).

Along with the two gas rigs, two oil-directed units also left the patch in the United States, where the week’s declines included three rigs on land and one on inland waters, according to BHI. Three directional units and two horizontal units packed up, while one vertical unit was added.

The U.S. rig count ended the week at 936, versus 524 in the year-ago period.

Canada also saw four rigs pack up for the week, three gas-directed and one oil, and the Canadian rig count finished at 209 versus 165 a year ago.

The combined North American rig count finished the week at 1,145, up from 689 a year ago, according to BHI.

Among states, Oklahoma (up three) and Colorado (up one) were the only net gainers for the week, while Texas (down three), Pennsylvania (down two), Wyoming (down two) and Louisiana (down one) all saw declines.

Among plays, the legacy natural gas Barnett Shale added a rig during the week to finish at eight, up from three running a year ago.

The Arkoma Woodford added two rigs to end at 11, and the Denver Julesburg-Niobrara and Eagle Ford shales each added a rig to round out the gains.

Meanwhile, several of the plays generally regarded as the most economic in the North American onshore saw declines, according to BHI’s breakdown. In the Midcontinent, the STACK — aka, the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties — fell by two rigs to finish at 41 (up from 27 a year ago). In the Gulf, the Permian Basin saw two rigs pack up shop and finished the week at 383 rigs (203 a year ago).

In the Northeast, the Marcellus Shale saw two rigs depart and ended the week at 45 rigs, up from 32 running in the year-ago period. Over the last week or so, Marcellus producers have been squeezed by widening shoulder season basis differentials.

Since the calendar flipped to October, Dominion South has traded at sub-$1/MMBtu prices, a roughly $2/MMBtu discount to Henry Hub. The low prices mirror similar constraint-driven pricing observed at Dominion South last October, even as new takeaway capacity has come online over the past year, including the Rockies Express Zone 3 enhancement and more recently the initial start-up of the Rover Pipeline.

Also on Friday BHI released its international rig count for September, showing the tally down 21 month/month to 931 rigs, roughly in line with 934 rigs running a year ago.

The biggest declines for the month came in Latin America (down 14), with Africa (down 5) and Asia Pacific (down 6) also losing rigs. The Middle East added four rigs during the month and now stands at 395, versus 386 rigs running a year ago.

As of September, the worldwide rig count stands at 2,081, down 35 month/month but up from 1,584 rigs in the year-ago period, according to BHI.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |