U.S. Pricing Dominates Physical Natural Gas Market Transactions in Mexico, MGPI Survey Says — Bonus Coverage

The first survey of buyers and sellers of natural gas in Mexico conducted by NGI’s Mexico GPI shows that U.S. price indexes are involved in the majority of transactions in Mexico.

The survey received 29 responses from natural gas buyers and sellers in Mexico, one short of the 30-sample size generally considered by statistical theory as needed to approach the population mean, and so a fairly good measure of current realities in the market.

There was also ample representation of both buyers and sellers in the survey. Ten respondents were marketers, eight represented industrial end-users in Mexico, and five were gas producers.

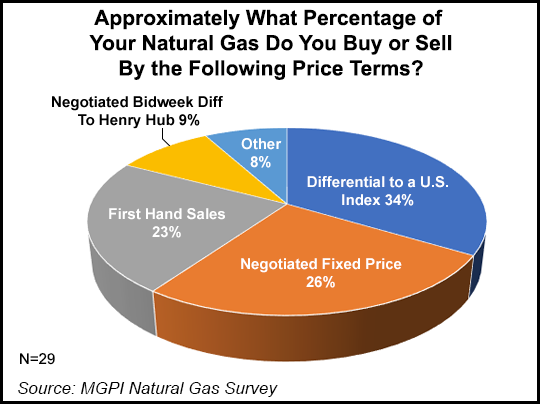

Respondents said on average 34% of the gas they buy or sell within Mexico and/or at the U.S.-Mexico border is based on a differential to a U.S. index. Meanwhile, 23% of natural gas transactions within Mexico and/or at the U.S.-Mexico border were tied to the Petróleos Mexicanos First Hand Sales pricing mechanism VPM, which is derived from various Texas indexes.

“That certainly makes sense, considering how liquid U.S. indexes are,” said NGI‘s Patrick Rau, director of strategy & research. “In the absence of liquid natural gas spot market indexes in Mexico, U.S. indexes do provide a good starting point, but they aren’t a perfect substitute for the Mexico market.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |