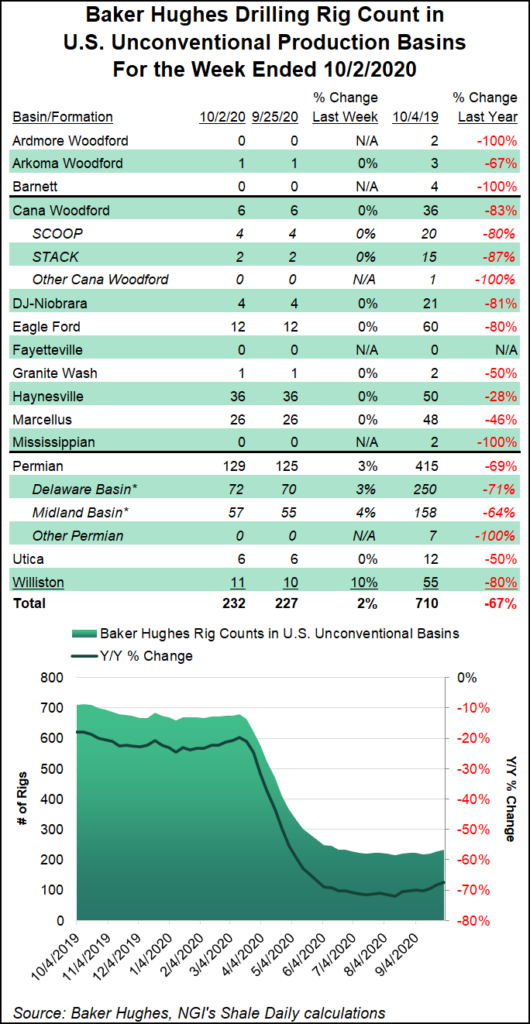

A bump in oil drilling raised the domestic rig count five units to 266 for the week ending Friday (Oct. 2), according to Baker Hughes Co. (BKR), marking the third straight weekly net increase in activity for a beleaguered U.S. exploration and production industry.

A six-rig increase in oil rigs offset a one-rig decline in natural gas-directed drilling for the week. That left the overall U.S. count sitting 589 rigs behind the 855 units active at the same time a year earlier.

All of the gains occurred on land, with the Gulf of Mexico finishing the week unchanged at 14 rigs. Five horizontal rigs returned to action during the week, while the total number of directional and vertical units remained unchanged.

Canada added four rigs overall for the week, all of them oil-directed. The...