E&P | NGI All News Access | NGI The Weekly Gas Market Report

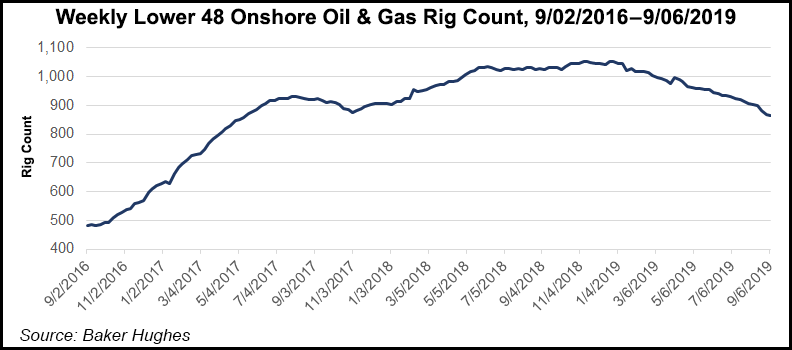

U.S. Onshore Oil, Natural Gas Permitting Up Slightly as Rig Count Declines

Permitting to develop oil formations in the Lower 48 recovered slightly in August month/month, and natural gas permitting remained healthy even with commodity price volatility, according to a compilation of state and federal data by Evercore ISI.

In its monthly permit roundup, Evercore analysts led by James West said permits for gas formations climbed 16% from July to 395, with improvement in the Marcellus and Haynesville shales.

“The Marcellus rose to 185,” or 24 higher than in July, “as operators implemented more permits in Pennsylvania (up by 10) and West Virginia (up by 18),” West said. Most of the increase in the Marcellus was driven by more permits for horizontal wells, up by 20 from July, and directional gas wells, which climbed by three.

“The Haynesville bounced back to 172,” 23 higher month/month, with unconventional gas wells permits climbing by 15, according to analysts. The Utica Shale inched up to 38, driven by permit applications for unconventional drilling, with nine more permits than in July.

“Gas permitting is lower year-to-date at 2,923,” off 13% year/year, with applications for Haynesville and Marcellus development softening by 13% overall.

Haynesville permits year-to-date were down 25% through August at 1,212, while Marcellus permitting was down 3% to 1,418. The declines were partially offset by “modest growth in the Utica,” with permits at 293 year-to-date, or 5% higher than for the same period of 2018.

For oil permitting, the monthly analysis reported a modest recovery from July, climbing by 7% to 4,248. The gains were driven by Texas permitting, which rose by 14%, and in Wyoming, up by 13%.

The oil permit count in the Texas portion of the Permian Basin increased 17% from July at 856, but it was partially offset by declines in the Permian portion of New Mexico, down by 90 month/month.

Permitting for oil wells also improved in the Eagle Ford Shale to 230, or by 34, while there was a slowdown in the Barnett Shale by two to 44.

In the Denver-Julesburg (DJ)/Niobrara formation of Colorado, a 229 month/month increase was reported, mainly driven by permits for unconventional oil wells, which represented 86% of the count, Evercore noted.

“On a year-to-date basis, onshore permits are higher at 41,761,” up 18% from the same period of 2018. The strongest activity through August was in the DJ/Niobrara, where permitting was up 67%, and in the Bakken Shale, up 8%.

Declines through August were seen in the Eagle Ford, off 18% year/year, and in the Permian, down 8%, according to Evercore.

Evercore also noted that ExxonMobil, Occidental Petroleum Corp. (Oxy) and Pioneer Natural Resources Co. dominate Permian permitting.

“The top 10 operators in August represented 32% of permit applications,” driven by ExxonMobil, at 10%, followed by Pioneer at 5% and Oxy at 2%. Private operators represented 4% of the total permits filed.

ExxonMobil’s permitting was targeting horizontal drilling in New Mexico, with 52% for oil wells, Evercore noted.

On a year-to-date basis, the top five Permian operators have been ExxonMobil (9%), Oxy (5%), EOG Resources Inc. (4%), Pioneer (4%) and Diamondback Energy Co. (3%).

As for early September, Evercore’s team said onshore permits jumped to 967 in the first week of the month, mainly on a sharp uptick in the DJ/Niobrara, with 172 permits more week/week, and in the Eagle Ford, which saw a gain of 32.

Natural gas drilling permits during the first week of September “declined modestly” from the final week of August to 62, down by 17. The reductions were in the Marcellus (down 43), partially offset by an uptick in the Haynesville, where there were 24 more permits, and in the Utica, which had two more permits.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |