U.S. Onshore Business Improves Slightly in June, Says Basic Energy CEO

Well site services in the U.S. onshore stabilized a bit during the second quarter from early this year, but pricing still remains cutthroat as operators compete for a smaller share of business, the chief of Basic Energy Services Inc. said Friday.

The well servicing rig count remained unchanged month/month in June at 421, the Fort Worth, TX-based oilfield services operator reported. Well servicing rig hours for June were 55,800, producing a rig utilization rate of 55%. That compares to a rig utilization rate of 50% in May and 74% in June 2014.

“The results from our operating segments in June were consistent with the previous two months of the second quarter,” CEO Roe Patterson said. “Our well servicing utilization improved by 500 basis points and our trucking hours improved by 2% sequentially, recovering slightly after the significant rainy weather conditions we experienced in May,” (see Shale Daily, June 12).

A “slight” recovery in June “was partially offset by the mid-June tropical storm that impacted our Gulf Coast, Ark-La-Tex and Midcontinent operating areas, particularly well servicing and stimulation services.”

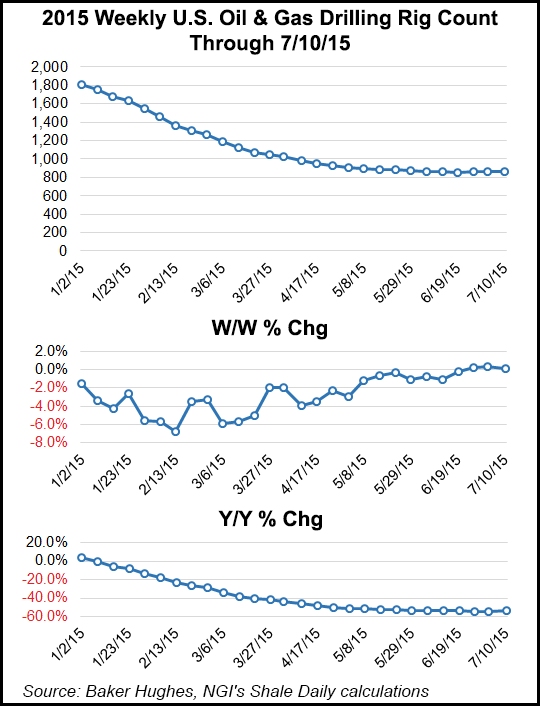

Drilling and completion business lines “remain the most competitive,” because of the “lower drilling rig count and the amount of excess equipment in most markets,” said the CEO. “Pricing continues to be competitive in all lines of business.” However, activity “stabilized somewhat as of the end of the second quarter.”

Based on the operating performance in June, Basic still expects to see second quarter revenue decline 22-24% sequentially, as it forecast last month.

In June, Basic’s fluid service truck count increased by six to 1,012. Fluid service truck hours for the month were 193,200, compared to 189,900 in May and 205,300 in June 2014. Drilling rig days for June totaled 60, producing a rig utilization of 17%. That compares to 36% in May and with 88% a year ago.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |