Lower 48 onshore oil and gas permit approvals fell by 10% in January versus December to 1,688, with declines seen across all of the major basins, according to the latest monthly statistics compiled by Evercore ISI.

The Permian Basin and Eagle Ford Shale combined to account for 52% of the total permit count, said the Evercore team of researchers led by James West.

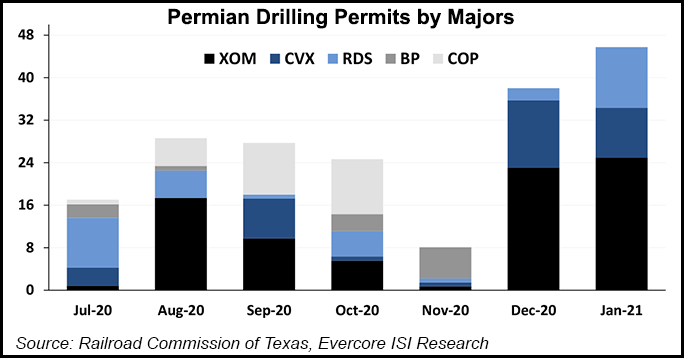

Among the oil-heavy plays, filings in the Permian fell by 99 or 12% month/month (m/m), while the Eagle Ford saw a drop of 73 or 35%.

Permits in the Denver-Julesburg (DJ)/Niobrara formation fell by 73 or 35% m/m, and the Bakken Shale saw a reduction of 29 or 43% from the prior month.

The Rockies region also included a 45% decline in the Powder River Basin (PRB) to 53 permits.

The Permian decline was driven by...