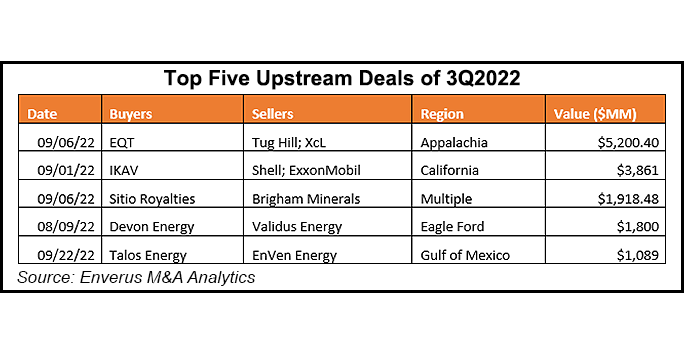

Upstream mergers and acquisitions (M&A) among U.S. oil and gas companies totaled more than $16 billion in transacted value during the third quarter, the highest quarterly tally so far this year, according to Enverus Intelligence Research (EIR).

Overall though, M&A activity has been sluggish, particularly in the Permian Basin, amid price volatility and undervaluation of exploration and production (E&P) company stocks, said EIR, a subsidiary of Enverus.

“While the business environment for E&Ps has been mostly great in 2022, that hasn’t translated to a bonanza of dealmaking,” said EIR director Andrew Dittmar. “Companies are using the cash generated by high commodity prices to pay down debt and reward shareholders rather than seeking out acquisitions. And when companies do...