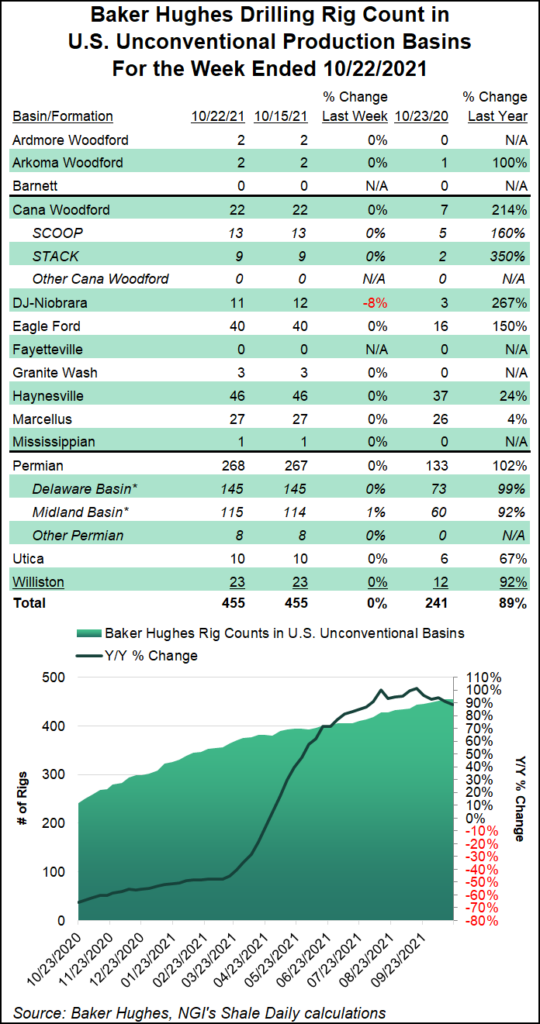

Pausing what has been a steady upward trend going back to last year, the U.S. rig count dipped one unit to 542 for the week ended Friday, driven by a small decline in onshore oil-directed activity, the latest data from Baker Hughes Co. (BKR) show.

A net decline of two oil-directed rigs was partially offset by a one-rig increase in natural gas-directed drilling in the United States for the week. Even with the week/week decline, the combined 542 active U.S. rigs as of Friday far surpasses the year-ago count of 287, according to the BKR figures, which are based partly on data from Enverus.

The Gulf of Mexico count increased by one week/week to 13, while U.S. land drilling fell by two units. Two vertical units packed up shop for the week, with one horizontal rig joining the...