NGI The Weekly Gas Market Report | E&P | NGI All News Access

U.S. Offshore Dealmaking ‘Virtually Stalled,’ Says IHS Markit

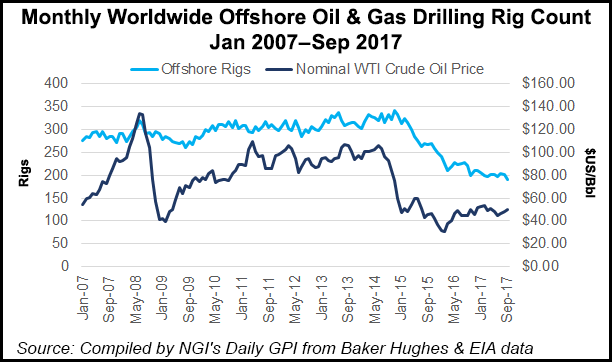

As operators use their capital for faster-to-market onshore prospecting, offshore exploration has declined and with it dealmaking, according to IHS Markit.

The lack of deepwater assets available for merger and acquisition (M&A) has challenged exploration and production (E&P) operators that need to secure development funds or de-risk their portfolios, the researcher said in a new report.

“Low oil prices have significantly reduced operator spending on exploration, particularly in the deepwater, which is very costly,” said IHS Markit’s Cindy Giglio, senior principal energy M&A analyst who authored a paper on offshore dynamics.

“This means fewer deepwater discoveries are made, and even fewer world-class assets become available for sale or acquisition,” she said. “As a result, those quality deepwater assets that do become available are commanding premium prices.”

According to the researcher, most of the recoverable upstream resources discovered offshore since the beginning of 2006 have been found in four key areas: the United States, Africa/Middle East, Brazil and Europe.

Offshore discoveries accounted for 69% of oil and gas volumes discovered between 2006 to 2017 year-to-date, but over that period, the offshore represented only 16%, or $300 billion, of global upstream M&A transaction value.

“Offshore M&A activity in the U.S. has virtually stalled,” including in the venerable Gulf of Mexico (GOM), Giglio said. “In the Gulf of Mexico, this reflects the stronger interest in onshore unconventionals; more stringent regulations in the post-Macondo era; and low oil and gas prices that have reduced the number of potential M&A participants.”

However, the deepwater GOM still accounts for $3.2 billion, or 17% of the global deepwater assets on the market.

Meanwhile, in Alaska, weak commodity prices and fiscal-tax uncertainty have slowed development of the state’s oil and gas, and hence, upstream M&A.

Over the last 10 years, global offshore upstream deal values were split roughly 50:50 between deepwater and shallow-water activity, even though there were three times as many (less expensive) shallow-water deals. In the past five years, even shallow-water deal activity has steadily declined.

Since the start of 2006, the average size of deepwater deals at $775 million has been more than twice that of shallow-water deals, which have averaged $325 million. The deepwater has accounted for fewer deals overall, but deal flow has represented a “more consistent percentage” of annual global upstream deal count.

“Deepwater M&A has typically involved undeveloped assets driven by significant deepwater oil and gas discoveries, with deal activity centered on owners selling down asset stakes to lock in returns and to share or de-risk development costs,” Giglio said. “Shallow-water M&A has typically involved producing assets, and often buyers of shallow-water assets are seeking to de-risk their upstream asset portfolios and generate lower-risk cash flow.”

The independent, publicly traded E&Ps have been the most active buyers and sellers of offshore assets for the last decade, with most of the activity in shallow water where they have been net-sellers.

National oil companies (NOC), both wholly government-owned or partially government-owned, have been net-buyers, especially in deepwater, IHS Markit said. Partially owned NOCs include Brazil’s Petroleo Brasileiro, Russia’s OAO Rosneft and Norway’s Statoil ASA.

Major integrated producers, including BP plc, Chevron Corp., ExxonMobil Corp. and Royal Dutch Shell plc, “have been less active in the offshore M&A market in terms of transaction value than NOCs/partial NOCs,” Giglio said. “On a net basis, these IOCs have been divesting both deepwater and shallow-water assets.”

The smaller integrated operators have been divesting deepwater assets and buying shallow-water assets, she said.

“Shallow-water M&A faces a dwindling number of pure-play companies, as well as competition from onshore unconventionals. The shallow-water regions have seen a decline in deals during the past five years, but interest from new buyer types is triggering a rebound in activity in certain regions.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |