Shale Daily | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

U.S. NGL Supply Glut May Weigh on Prices, E&Ps through 2023, Says Moody’s

Without more pipeline and fractionation capacity, natural gas liquids (NGLs) pricing could remain under pressure for the next three-to-four years, hindering what should otherwise be a boon to U.S. oil and gas producers, said analysts with Moody’s Investors Service in a research note.

Targa Resources Corp., for example, reported profit headwinds in its first-quarter earnings call thanks in part to weak NGL pricing.

Lower 48 exploration and production (E&P) companies have grown their NGL production over the past decade by an estimated 175% as a by-product of growing crude production, similar to the growth in natural gas output. Unlike gas, however, there is already significant export infrastructure in place to take advantage of growing demand for liquified petroleum gases (LPG) in emerging economies like India, China and Nigeria.

Insufficient U.S. fractionation capacity, which separates NGLs into purity components like ethane and propane, and a lack of Y-grade NGL pipelines that can ferry the NGLs to the fractionation facilities, are maintaining the gap between NGL production and better margins for producers via exports.

More Y-grade pipelines, like Oneok Partners’ Elk Creek project set to come online by the end of this year, are needed, Moody’s said. The Elk Creek NGL line would bring roughly 240,000 b/d of unfractionated NGLs from near Oneok’s Riverview terminal in eastern Montana to its fractionation plant in Bushton, KS, the company has said.

The lack of processing and shipping capacity has been well cited as a culprit in the flaring challenges faced by Bakken producers, among others, and the Elk Creek pipeline is seen as essential to alleviating the burden of those challenges.

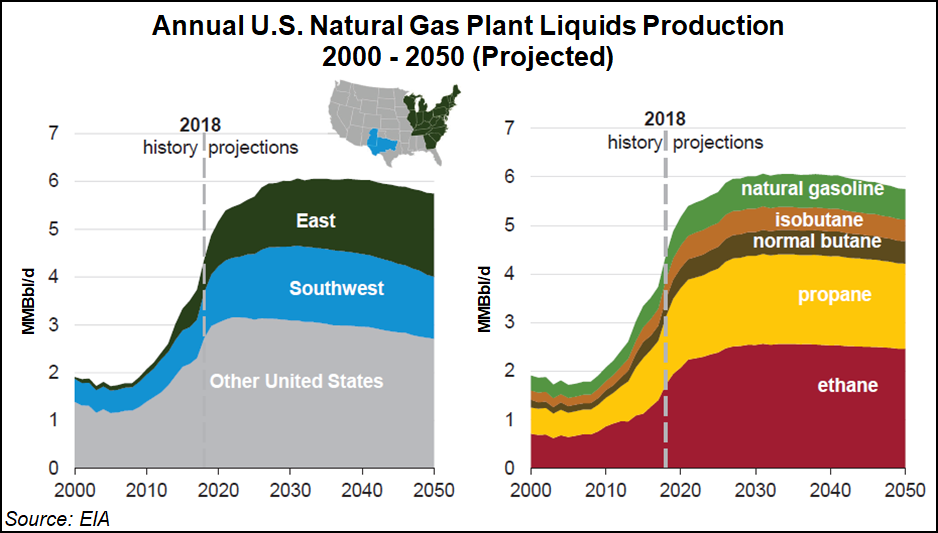

The Energy Information Administration (EIA) has predicted that NGL production in the United States will rise by roughly 40% to 6 million b/d through 2030, thanks primarily to growth in the Appalachian and Permian basins, according to its 2019 Annual Energy Outlook. Production should flatten out after 2030, the EIA added.

Under such growth conditions, NGL and LPG exports become increasingly important to E&P companies, Moody’s noted.

The United States has been a net exporter of NGLs since 2014, with roughly one-third of all NGL production exported in 2018. The EIA expects that one-half of NGLs produced in the United States will be exported by 2024 as domestic supply continues to outstrip domestic demand.

“Demand for LPG, including propane, is picking up in emerging countries…which increasingly view propane as a fuel of choice,” said Moody’s. “India, Nigeria and China have instituted social programs to increase LPG demand, relying mostly on imports and offering U.S. propane favorable demand dynamics outside of the U.S.”

NGL export growth is not without vulnerability, however. Pipeline delays and competition from lower-priced naphtha in export markets offer a muddy look on near-term export growth, BofA Merrill Lynch researchers said in January.

Phillips 66, Enterprise Products Partners LP and Targa together will bring an additional 4.1 million b/d of fractionation capacity online in the Mont Belvieu, TX, and Gulf Coast areas through early 2021. The need for increased NGL transportation capacity to the Coast is not only key for producers but also presents opportunities for midstream companies, Moody’s said.

Before 2021, however, a need to store ample NGL production will boost inventories and draw out the downward price pressure on NGLs as late as 2023, Moody’s said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |