E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. NGL Plant Output Set Record in 2017 and More Growth to Come, EIA Says

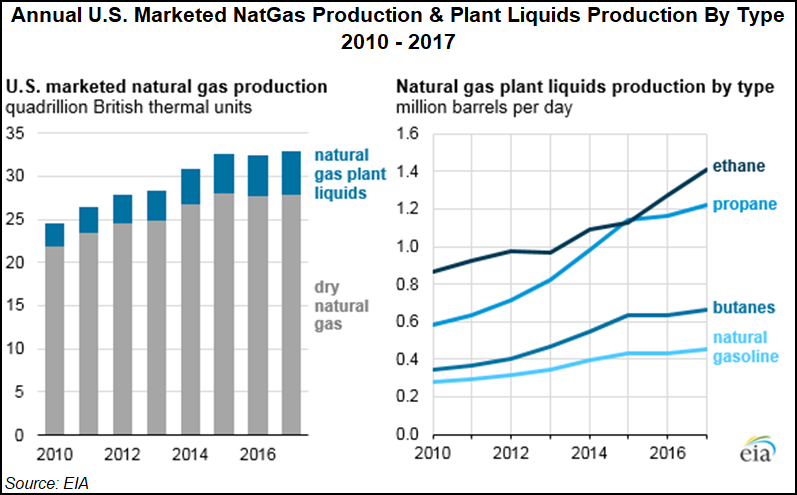

U.S. natural gas liquids (NGL) production from plants set a record in 2017, averaging 3.7 million b/d and has nearly doubled since 2010, the Energy Information Administration (EIA) said in a research note Tuesday.

The growth in NGL output has accompanied a rise in marketed gas production driven by unconventional development, particularly from the Appalachian Basin and also from of associated gas from crude-focused plays, EIA noted.

As capacity to produce, transport and consume related products has increased, NGLs have made up a larger share of total marketed production since 2010, when it was 11%, to 15% in 2017 in energy content terms.

Increases in NGL plant production “pushed two measures of total natural gas production — gross withdrawals and marketed production — to record highs in 2017,” EIA said.

The output of from NGL plants that include ethane, propane, isobutane/normal butane and natural gasoline has fluctuated with commodity prices over the years, especially ethane, as operators determine whether to leave it in the gas stream based on economics, EIA said.

Ethane rejection because of low prices drove down ethane’s share of U.S. liquids output from 2012-2015, before demand and prices increased after two U.S. export terminals opened in 2016, followed by two domestic petrochemical plants opening in 2017, according to EIA.

U.S. NGL plant production increased on average every year by “nearly 400,000 b/d between 2015 and 2017, and about 175,000 b/d of this increase resulted from growth in ethane production,” EIA wrote.

The recent growth in ethane output is poised to continue, according to the agency.

“Several more petrochemical plants are expected to come online in the United States in 2018 and 2019, further driving increases in ethane demand and prices,” EIA said. “First quarter 2018 ethane production was 260,000 b/d higher than the first quarter 2017 level. Ethane production will increase by another 440,000 b/d between the first quarter of 2018 and the fourth quarter of 2019,” representing 86% of growth in NGL plant output, based on data from EIA’s Short-Term Energy Outlook.

EIA has previously noted the critical role processing and fractionation capacity has played in pacing gas production growth from the Marcellus and Utica shales. The expectations for higher NGL output come as Sunoco Pipeline LP’s Mariner East projects, offering a critical takeaway path for Appalachian ethane, butane and propane to reach the Marcus Industrial Complex near Philadelphia, have faced significant pushback and regulatory scrutiny. Speakers at an industry conference near Pittsburgh recently pointed to a need for underground NGL storage in Appalachia.

Meanwhile, an executive with Shell Chemical Appalachia LLC said the multi-billion dollar ethane cracker planned in western Pennsylvania remains on track, with nearly all of the foundations completed for the 200 structures that will form the self-contained site and major equipment arriving regularly.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |